Couple hit with B.C. vacancy tax despite living in home

A Vancouver Island couple is worried about losing their home after being hit with an unexpected tax bill.

Madison and Charlotte Becerra have received letters from the B.C. government indicating that under the rules of the speculation and vacancy tax, they must pay $13,000 by July 1 on their home in Ladysmith, B.C.

The couple bought their detached home two years ago and live in it year-round, but because they are not Canadian citizens or permanent residents, they cannot apply for an exemption from the tax. This is the first year the vacancy tax has applied to Ladysmith, which is approximately 70 kilometres north of Victoria.

The couple has roughly five months to pay before the province puts a lien on their house and charges a 10 per cent late fee on the bill, as well as interest.

"Having to pay that tax would wipe us out — we just don't have the money to be able to afford it," said Madison Becerra.

The Becerras settled in Ladysmith after leaving the United States because of discrimination they say they faced as a 2SLGBTQ+ couple. They say they have no financial ties to the U.S. and both are here on valid visas — Madison on a student visa while she studies at Vancouver Island University, and Charlotte on an open worker's permit.

Both work as in-home care workers for people with developmental disabilities.

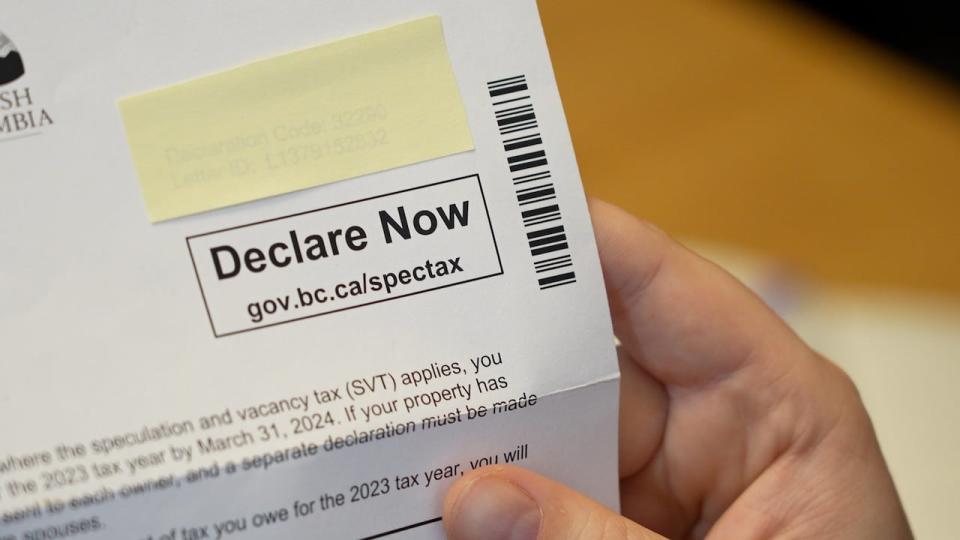

The letter the Becerras received telling them to declare their home under the vacancy tax. Everyone in an affected area must declare, and 99 per cent of homes are exempt. (Claire Palmer/CBC News )

Madison Becerra says returning to the U.S. is not an option.

"Our whole life is on Vancouver Island and everything that we have is here. If we're driven out of here for this tax, we don't really have anything. We'll have to start fresh," she said.

What is the vacancy tax?

The speculation and vacancy tax was introduced in 2018 to discourage people from leaving homes vacant, and to ensure foreign owners and those with primarily foreign income contribute fairly to B.C.'s tax system, according to the provincial government's website.

The vacancy tax rate is based on a home's assessed value, and is two per cent for people who don't pay the majority of their taxes in Canada, and 0.5 per cent for Canadian citizens or permanent residents who pay the majority of their taxes in the country. The Becerras are being taxed at the two per cent rate because they are not Canadian citizens or permanent residents.

The vacancy tax applies to areas in B.C. identified by the government as being most affected by the current housing shortage crisis. It currently applies to 59 communities.

The Becerras have lived in their home for two years and have not been able to afford to leave for even one night. They say paying the tax would wipe them out financially and put them in a precarious housing situation — the exact opposite of the goal of the tax. (Claire Palmer/CBC News)

Once an area has been identified, every homeowner in the area must file a declaration. About 99 per cent of people qualify for exemptions and don't have to pay the tax, according to the province.

As U.S. citizens, the Becerras are classified as foreign buyers, despite living and working in B.C.

Madison says they pay property tax on their home, as well as B.C. and Canadian income tax.

"We pay our taxes, we do everything we can, you know, we're trying to be the best B.C. residents that we can be," she said.

"This idea that we're not paying our fair share seems incredibly unfair."

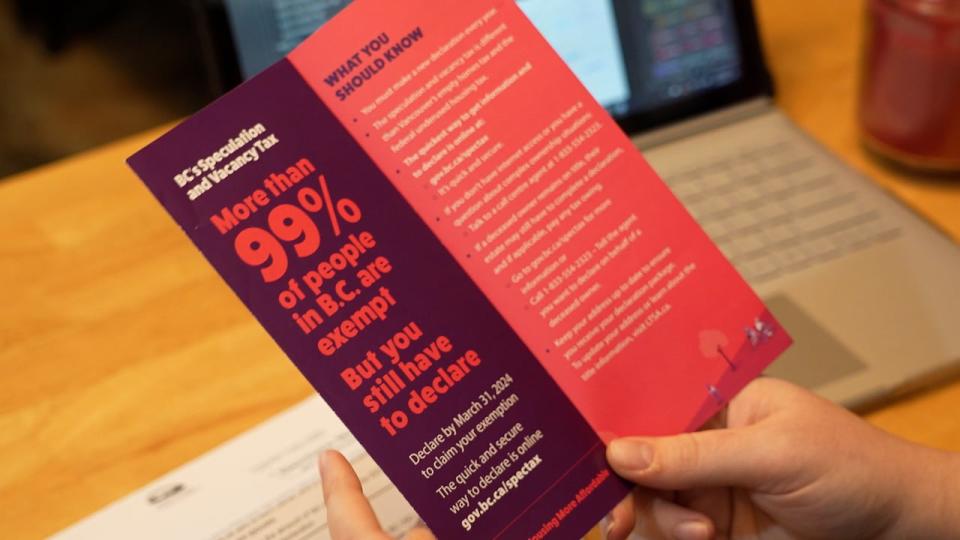

The Becerras received this pamphlet outlining how 99 per cent of British Columbians are exempt from the vacancy tax. They later found out online they do not qualify for an exemption. (Claire Palmer/CBC News )

The Ministry of Finance says those who believe the vacancy tax has been applied incorrectly in their case can appeal the assessment. Appeals must be received by the minister of finance within 90 days from the date on the assessment.

The Becerras plan to file an appeal but have been told that because they are not permanent residents, they do not qualify for an exemption.

'We can't even afford to take a vacation'

Madison says they are worried about losing their home.

"It's a little bit hard to swallow that we're expected to pay a vacancy tax meant for leaving our home empty, when we can't even afford to take a vacation," she said.

"We've stayed here every night since we bought the home. We couldn't afford to leave if we wanted to."

Duncan Soproniuk, a certified professional accountant in Nanaimo, says that while he believes the vacancy tax program overall has been beneficial, it may have cast a wide net and caught some people it didn't mean to in the process.

"It's just about working on the program and trying to evolve it. So it maybe these situations don't arise in the future," said Soproniuk.

According to a statement from the Ministry of Finance, since 2018, the tax has raised more than $394 million to help fund affordable housing in regions where the speculation and vacancy tax applies. During the same period, more than $5.2 billion have been allocated for housing initiatives in these regions, as of October 2023.