The COVER 50 (BIT:COV) Share Price Has Gained 10% And Shareholders Are Hoping For More

One simple way to benefit from the stock market is to buy an index fund. But if you choose individual stocks with prowess, you can make superior returns. For example, the COVER 50 S.p.A. (BIT:COV) share price is up 10% in the last three years, clearly besting the market return of around 5.8% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 1.4% in the last year , including dividends .

View our latest analysis for COVER 50

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last three years, COVER 50 failed to grow earnings per share, which fell 7.4% (annualized).

Earnings per share have melted like a stack of ice cubes, in stark contrast to the share price. So we'll need to take a look at some different metrics to try to understand why the share price remains solid.

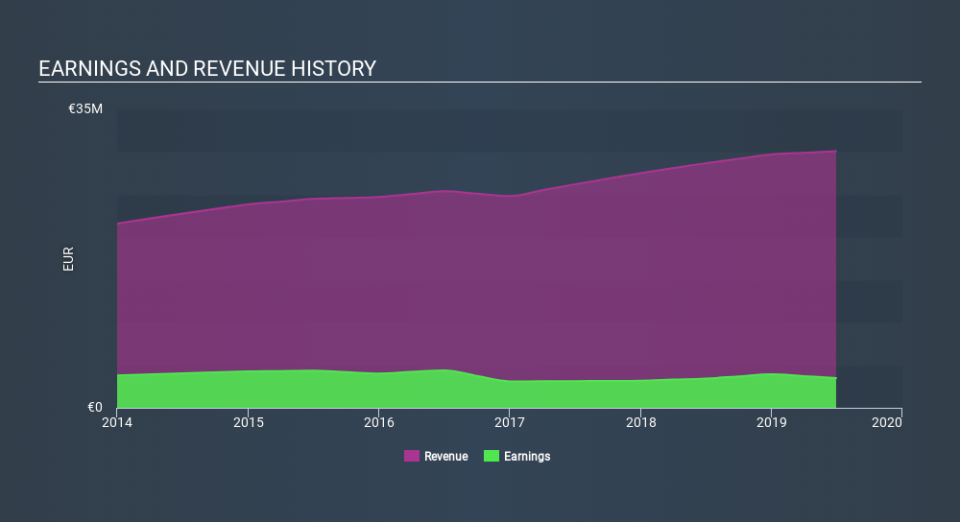

The dividend is no better now than it was three years ago, so that is unlikely to have driven the share price higher. But it's far more plausible that the revenue growth of 7.1% per year is viewed as evidence that COVER 50 is growing. It could be that investors are content with the revenue growth on the basis that the company isn't really focussed on profits just yet. And that might explain the higher price.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, COVER 50's TSR for the last 3 years was 26%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

COVER 50 produced a TSR of 1.4% over the last year. It's always nice to make money but this return falls short of the market return which was about 22% for the year. But the (superior) three-year TSR of 8.0% per year is some consolation. We prefer focus on longer term returns, as they are usually a more meaningful indication of the underlying business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for COVER 50 you should be aware of, and 1 of them shouldn't be ignored.

But note: COVER 50 may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.