Is There Any Credibility to This Century-Old Trading Theory?

- Oops!Something went wrong.Please try again later.

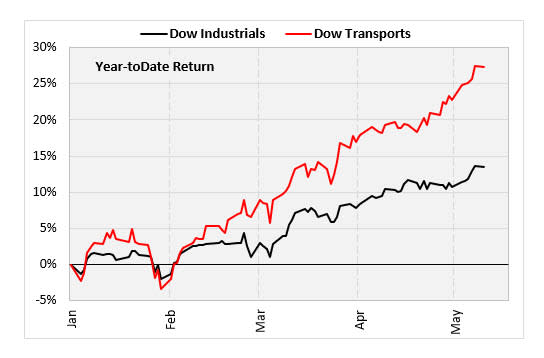

The Dow Jones Industrial Average (DJI) is having an outstanding year, but the Dow Jones Transportation Index (DJT) is having an even better year. This is good news according to Dow Theory. Dow Theory, developed by founder of the Wall Street Journal Charles Dow, says if the Dow is going higher, then the transportation index should also be going higher. The transportation index contains many companies that ship goods so strength in these companies indicates strength in the economy. If the transportation companies are lagging, then it could foreshadow a fall in industrials. Let’s look at some numbers to see if there’s any credibility to this theory.

Year-to-Date

The Dow has gained an impressive 12% so far this year. The Transportation Index, however, has doubled that at 25% year-to-date. Going back to 1950, I looked at years in which the Dow was up at least 10% at this point in the year. The tables below compare to how the Dow did going forward based on whether the Transportation Index was beating the Dow or lagging.

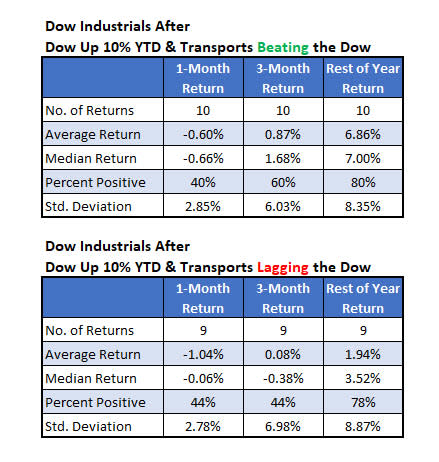

There might be something to this theory. When the Dow has gained 10% at this point and the Transports beat the index, the Dow averaged a gain of 6.86% for the rest year. If, however, the Transports were lagging the Industrials, the Dow gained only 1.94% on average the rest of the year. Either way, about 80% of the returns were positive. Looking at the short-term returns, it has not mattered what the Transportation index has done. If the Dow was up double digits at this point, stocks struggled. If Transports beat the Dow, the Dow averaged a loss of 0.6% with 40% of the returns positive. When transports lagged, it averaged a loss of 1.04% with 44% positive.

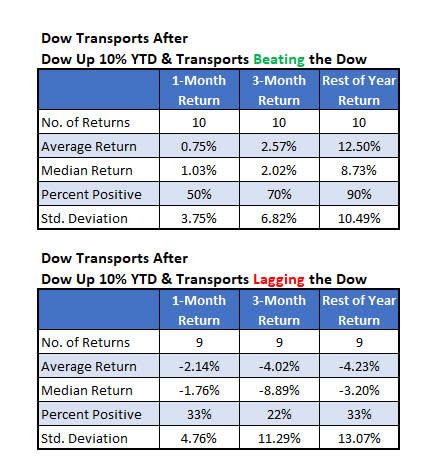

Dow Theory has been a better tell for the Transportation Index itself rather than for the industrials. The tables below summarize the returns for the Transportation Index. When the Dow gained double digits at this point and the Transports did even better, the Transportation Index averaged a 12.5% return for the rest of the year with nine of the ten returns positive. When the Dow was up that much but the Transports lagged, the Transportation Index lost over 4% on average with just 33% of the returns positive. Strong outperformance is also prominent at the shorter term returns too.

Finally, the tables below show the individual instances of the data summarized above. First, I show the returns of the Dow Jones Industrial Average after years in which it was up 10% or more and the Dow Transportation Index gained even more. I bolded this year along with 2013, 1997 and 1983. Those were the years in which both indexes were within a percent of an all-time high. This is a good omen as the Dow was positive for the rest of the year on all three occasions.

Here are returns in these instances for the Transportation Index. Again, this index performed very well in these circumstances.