New study highlights just how bad Americans are with credit cards

A new study details how Americans manage credit cards and how stressful credit debt can be.

Commissioned by Clever Real Estate and conducted by online polling software Pollfish, the report looked at 1,000 survey responses of Americans who owned at least one credit card.

“The most shocking find to me was how many Americans carry credit card balances month to month,” Tommy O'Shaughnessy, an analyst at Clever Real Estate Analyst and the author of the report, told Yahoo Finance.

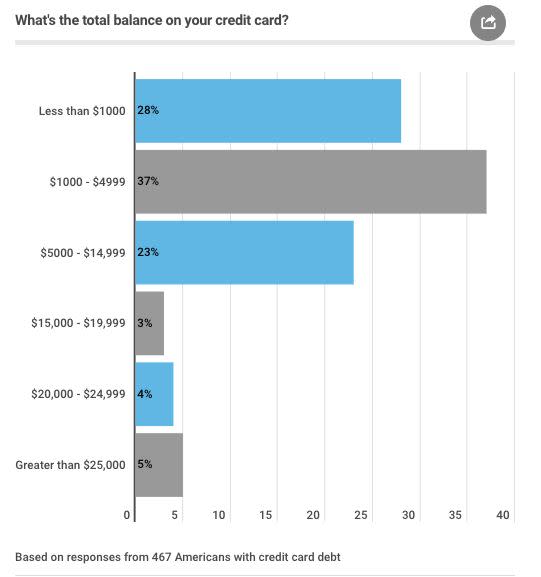

Nearly half of the respondents (47%) carried some amount of credit card debt month to month, according to the survey, with 72% of borrowers carrying more than $1,000.

“With the average 17.64% APR, that debt compounds quickly and can become unmanageable for lower income families,” O'Shaughnessy noted.

Half of Americans carry credit card balances over $1,000

“We embarked on this study because credit building is such an important part of the home buying process,” O'Shaughnessy said. “We also wanted to know if credit card debt would impact major life purchases like home buying.”

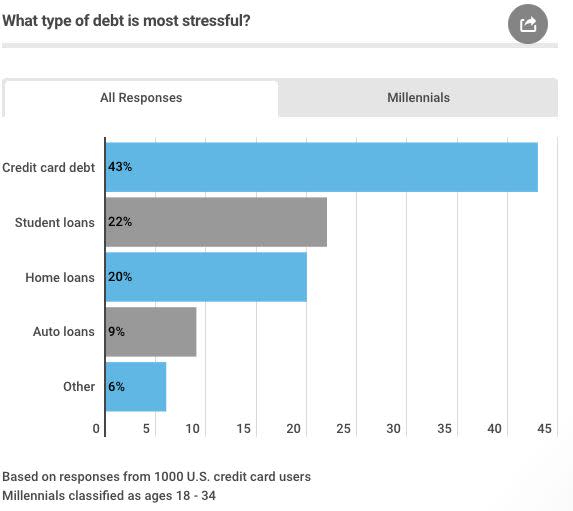

About 38% of respondents said that credit card debt has stopped them from making a big life purchase — which could include things like buying a home or a car. The survey also found that credit card debt “ranks as the most stressful debt” for Americans.

About 28% of the borrowers had missed a monthly payment — the biggest reason being that they simply forgot. And 41% of respondents didn’t even know the interest rate on their card.

Interestingly, 62% of younger credit card users between the ages of 18 and 34 were were found to have regularly paid off their credit cards each month — as compared to only 48% of older generations.

Big data and lending

And in the near future, consumers may soon find their credit score determined by big data — which could boost those with lower scores and stimulate further loan growth, according to a report by Moody’s.

The report said that consumer loan underwriters could soon use big data to “identify lifetime events that create specific financial needs for existing clients, like marriages, births and first jobs (related to the need of vehicle or housing) to pre-approve loans.

O'Shaughnessy recognized this trend.

“With the amount of data being collected about you every day, there are so many factors data scientists,” O'Shaughnessy said. “It's a little troubling for consumers, because exactly what determines your credit score will become more opaque.”

In any case, as consumer loan delinquencies and interest rate payments rise further, “the clock is ticking,” Deutsche Bank’s chief international economist Torsten Slok recently told Yahoo Finance.

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

Elizabeth Warren torches consumer protection head for not protecting consumers

'The clock is ticking' on U.S. consumer loans — and that could mean a slowdown, Deutsche Bank warns

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.