Credit card skimmers have been popping up in California. How do you spot and report them?

Credit card skimmers have been popping up across the country in recent months, including in California.

According to a 2023 Fair Issac Corporation report, credit card skimming in the United States increased by 20% from the previous year.

The FICO report, the most recent report available from the data analytics company, looked at skimming incidents in the first half of 2023 compared to the same time period in 2022.

Although skimming reports decreased in California, the report said, the Golden State still remained the top state for skimming activity in the nation.

In May, a theft ring allegedly used card skimmers and ATMs to drain millions of dollars in financial aid from electronic benefit transfer card accounts, The Sacramento Bee reported. An investigation resulted in 13 arrests in Los Angeles.

Two people were arrested in Grover Beach on suspicion of card skimming in November, and police allegedly caught a man using a skimmer at a San Luis Obispo bank in December.

Here are ways you can stay protected while using ATMs and card machines.

What is credit card skimming?

Credit and debit card skimming usually occurs at ATMs and gas stations, according to the FBI.

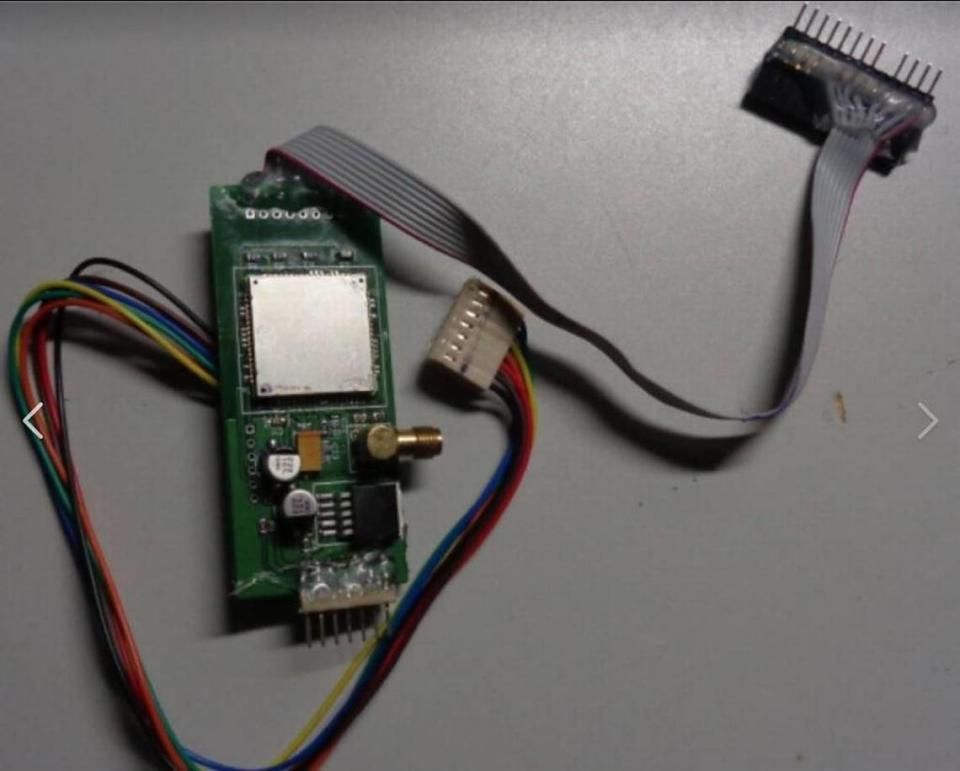

The illegal activity usually involves someone installing an “undetectable device” that can record bank information data, the agency said.

That stolen information is then encoded onto a blank card, according to the FBI.

According to the FICO report, 67% of credit card skimming incidents in the first half of 2023 took place at convenience stores and gas stations, while 33% took place at bank branch ATMs.

How can you spot a card skimmer at ATM or gas station?

At a gas station, skimming devices are typically “attached in the internal wiring of the machine and aren’t visible to customers,” the FBI said.

Skimming devices at ATMs can take many forms, according to the FBI.

Usually the devices “fit over the original card reader,” the agency said. They can also be inserted in the card reader or placed along exposed cables.

In some cases, thieves also install a camera in the pinhole to see when customers enter their personal identification numbers, or, PINs, the FBI warns.

Though they’re designed to blend in, there are a few ways you can check. Here are some tips from Capital One:

Look for raised or bulging pieces of the machines.

Feel the card reader. If it doesn’t feel sturdy, that could be a sign of a skimmer.

At gas stations, check that the security seal is in tact on the pump.

If you suspect there’s a skimmer on your gas pump, you can compare it to others at the station.

How do you keep your bank information from being stolen?

The FBI offered these tips on how to prevent your credit card information from being stolen:

When arriving at a gas station, it’s best to choose a fuel pump that’s in clear sight of the store attendant, the agency said, noting that these pumps are less likely to have been tampered with.

If possible, you should run your debit card payment as a credit card. This will allow you to avoid providing your PIN, the FBI said.

According to the FBI, it’s always best to go into the store and pay for your fuel in person.

When using an ATM, you should inspect the machine before inserting your card.

The FBI suggests keeping a lookout for “anything loose, crooked, damaged or scratched” and trying to “pull at the edges of keypads” there aren’t any overlays installed by criminals.

Seek out ATMs that are indoors or well lit, the FBI said, as these are less likely of being tampered with.

According to the FBI, debit cards with chip technology are less vulnerable to being skimmed. If you don’t already have a chip on your debit card, ask your bank for an upgrade.

Avoid using debit cards that have linked accounts.

If the ATM you’re using doesn’t return your debit card, contact your bank immediately, the FBI said.

How to report credit card skimmers

If you fall victim to card skimmers, you should immediately contact your bank, according to federal website USA.gov.

If you see a skimming device, you should call the authorities.

To report identity theft, USA.gov said, you should contact the Federal Trade Commission online at IdentityTheft.gov or by calling 1-877-438-4338.

You should also reach out the three major credit reporting agencies — Equifax, Experian and TransUnion — and ask them to place fraud alerts and a credit freeze on your accounts.

In addition, you should contact the fraud department at your credit card issuer, bank and other places where you have accounts, the site said.

The Federal Trade Commission advises anyone whose debit or credit card Information was exposed to do the following:

Contact your bank or credit card company to cancel your card and request a new one;

Review your transactions regularly to make sure no one misused your card;

Update any automatic payments with your new card number, and

Check your credit report at annualcreditreport.com.

What do you want to know about life in Sacramento? Ask our service journalism team your top-of-mind questions in the module below or email servicejournalists@sacbee.com.