Critics allege CO2 pipelines ‘farm the government’ for climate money while helping oil industry

Plans to capture carbon dioxide emitted by ethanol plants, ship it via pipelines and store it underground are viewed by some as a way to fight climate change.

The process is one way to keep carbon dioxide out of the atmosphere, where it acts as a heat-trapping greenhouse gas.

But critics say the process known as carbon capture and sequestration could also aid oil production.

In a process called enhanced oil recovery, CO2 can be injected into aging oil wells to make it less thick, help it flow better, and cause the oil to expand toward wells.

Silvia Secchi, an environmental impacts researcher and professor at the University of Iowa, said oil extraction runs contrary to the goals of carbon sequestration, and to the goals of federal tax credits for sequestration projects. Those credits — up to $85 per metric ton of annual sequestered carbon — are supposed to motivate companies to help mitigate climate change.

“These people farm the government,” Secchi said. “They don’t care about climate change.”

That’s a belief shared by the lawyer representing over 1,000 landowners in four states who are opposed to carbon pipeline projects using eminent domain – the power to access private property for public use, provided the owner is given just compensation.

“Their climate change mask is being removed,” said the Omaha-based lawyer, Brian Jorde. “Do you honestly believe the majority of that CO2 will not be used for enhanced oil recovery? This is all the biggest joke on the taxpayer.”

Both of the multi-state carbon pipeline proposals that include South Dakota have had their permit applications rejected by state regulators, due in part to landowner opposition. One company, Navigator C02, has since withdrawn its proposal. The other company, Summit Carbon Solutions, plans to adjust its route and reapply.

Summit plans and possibilities

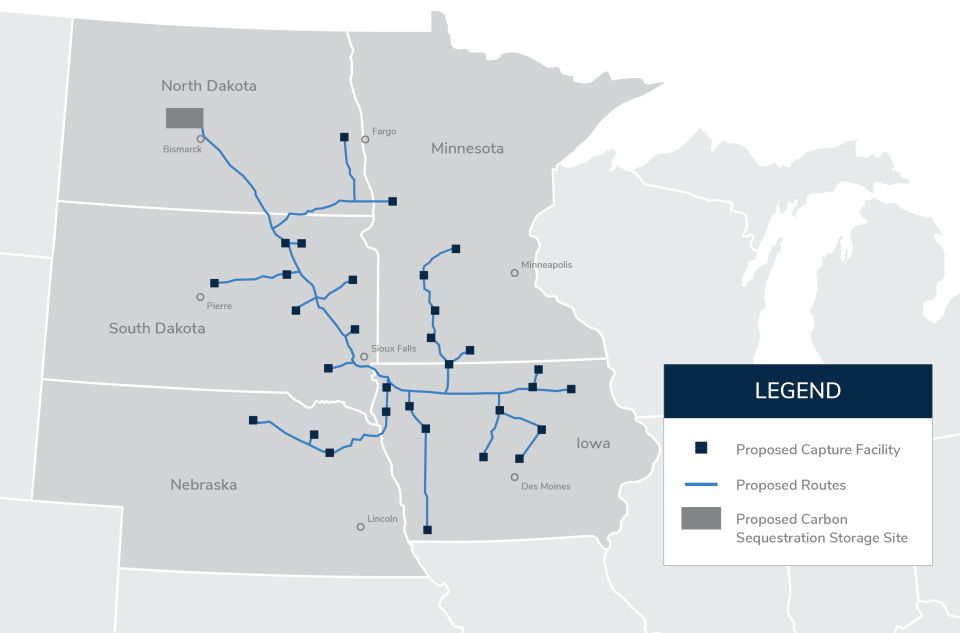

Summit’s pipeline could permanently store up to 18 million tons of carbon dioxide annually; at $85 per ton, that would equal $1.5 billion per year from the sequestration tax credit. The pipeline would capture carbon dioxide emitted from more than 30 ethanol plants in South Dakota, North Dakota, Minnesota, Iowa and Nebraska and transport it for sequestration in North Dakota.

In August, North Dakota’s Department of Mineral Resources said more CO2 will be needed to sustain oil production in the state for the long term.

However, Summit says its project will not be used for enhanced oil recovery.

“The permits we have filed, which specifies exactly what we are requesting from regulators, note clearly that our project is about the permanent sequestration of CO2,” the company’s website reads. “Additionally, Summit Carbon Solutions’ sequestration site outside of Bismarck, North Dakota, is entirely separate and apart from the Bakken or other areas where enhanced oil recovery is possible.”

Yet project maps show the sequestration area is near the oilfields of western North Dakota.

During a September permit hearing in Iowa, Jimmy Powell, Summit’s chief operations officer, left open the possibility that CO2 transported in the pipeline to North Dakota could be used to extract oil in the future.

“If another carrier decided to use, or ask us to transport CO2 for another purpose, like enhanced oil recovery, then that’s a possibility,” Powell said.

Powell also said the project is “maintaining 10% of the capacity of the pipeline for other shippers.” He said that’s something the project is doing as a “common carrier.”

A common carrier, as defined by federal law, is to be available for hire, at a rate deemed reasonable, by any company that needs to move commodities the pipeline ships. Additionally, the pipeline is to provide service on a non-discriminatory basis.

Being defined as a common carrier is an important designation because it is required for the project to use eminent domain, which Summit needs to complete the project. The company filed eminent domain actions against dozens of landowners earlier this year but withdrew them, at least temporarily, after the company’s permit application was denied. The company says it has voluntary access agreements called easements with nearly 75% of the project’s affected landowners.

Summit is a member of the Renewable Fuels Association. In response to the U.S. Department of Agriculture’s 2020 call for input on increasing agricultural production, the association submitted a letter that addressed ways the renewable fuels industry works to reduce carbon emissions, including carbon capture and sequestration.

“These technologies include using the carbon dioxide emissions to extract other forms of energy from the ground, such as through enhanced oil recovery,” the letter said. It continued, “only a handful of plants are capable of supplying carbon dioxide for enhanced oil recovery efforts given their location with respect to EOR [enhanced oil recovery] activity.”

Summit’s ties to the oil industry include a $250 million project commitment last year from Continental Resources, a petroleum and natural gas exploration and production company.

Jason Hill, a bioenergy professor and researcher at the University of Minnesota, said people should understand that while ethanol producers once had to fight to get their product sold at gas stations against the interests of the oil industry, things have changed since electric vehicles hit the market.

“Petroleum and ethanol now have the same interest, and it’s liquid fuels,” Hill said.

A bridge to electric, or to ethanol

Silvia Secchi said biofuels producers once branded themselves as “a bridge to electric vehicles,” but behind the scenes, the industry has been lobbying to ensure a future for liquid fuels, “making that bridge as long as possible.”

Hill said the destination of the “bridge” has also changed: “What ethanol is, is a bridge to more ethanol.”

Poet, a Sioux Falls-based ethanol producer, said liquid fuels and internal combustion engines will be necessary for the foreseeable future.

“There’s a multitude of opinions around the growth of electric vehicles, but over time the world will need more low-carbon biofuels for sustainable aviation fuel, heavy trucking and other hard-to-decarbonize transportation sectors,” Poet said in a written statement.

Poet was a partner in the Navigator CO2 pipeline project.

During the regulatory hearing in South Dakota on the Navigator proposal, lawyers for that company brought in Michael Harrison, vice president of commercial operations for Valero Renewable Fuels Company. That’s a biofuel subdivision of Valero, a company that operates 15 oil refineries and describes itself as the world’s largest independent refiner.

Harrison explained that electric vehicles are “a much bigger threat than ethanol to us.”

He added that “California is hostile to all liquid fuels.” California, the country’s largest auto market, has approved a plan to phase out new gas cars by 2035. Additionally, the Biden administration has a goal of all newly manufactured light-duty vehicles being electric by 2027 and all vehicles by 2035. And General Motors announced it would phase out gas-powered vehicles by 2035.

Harrison said liquid fuel producers can use carbon capture and sequestration to lower the carbon emissions score of biofuel-blended gas, so it can be sold in places with strict emissions standards – keeping liquid fuels in those markets longer.

“That’s why it’s necessary for us to get the sequestration done, so we can compete on the world market,” he said.

Securing a future for ethanol

Sabrina Zenor, a spokeswoman for Summit, told South Dakota Searchlight during the company’s September hearing with state regulators – which failed to result in a permit – that ethanol could make up for lost demand from electric vehicles with bio-aviation fuel, which could be produced at a proposed Gevo plant in Lake Preston.

The Gevo plant, if constructed, would buy ethanol from regional ethanol plants and use that to create bio-aviation fuel, giving ethanol another market, she explained.

Gevo recently issued a press release saying that without a carbon sequestration pipeline in South Dakota, the company may seek opportunities in states that are more open to those projects.

“Let me be clear, Gevo does not want to leave South Dakota. We have a strong commitment to the state, our investments in Lake Preston, and to the local producers. We are just here to state the facts,” said CEO Patrick Gruber in the release.

The release went on to say carbon sequestration would boost demand for corn, create new jobs, help ensure a future for ethanol, and turn the Midwest into America’s hub for bio-aviation fuel.

During Summit’s September permit hearing, Zenor told South Dakota Searchlight the pipeline project is less about climate change and more about supporting the ethanol industry – a view that was echoed by Summit’s Jimmy Powell during the Iowa hearing.

“The purpose is to help the ethanol plant partners that we have contracted with, to capture their CO2 before it is emitted, transport it to North Dakota and sequester it subsurface, which will allow them to significantly reduce their carbon intensity, which will then give them access to low carbon fuel markets,” Powell said. “Hopefully sustain the livelihood of their businesses and the demand for corn.”

This article originally appeared on Sioux Falls Argus Leader: Critics: CO2 pipelines in SD, Midwest could also aid oil production