Update: Crompton Greaves Consumer Electricals (NSE:CROMPTON) Stock Gained 79% In The Last Three Years

One simple way to benefit from the stock market is to buy an index fund. But many of us dare to dream of bigger returns, and build a portfolio ourselves. Just take a look at Crompton Greaves Consumer Electricals Limited (NSE:CROMPTON), which is up 79%, over three years, soundly beating the market return of 35% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 3.4% in the last year, including dividends.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for Crompton Greaves Consumer Electricals

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

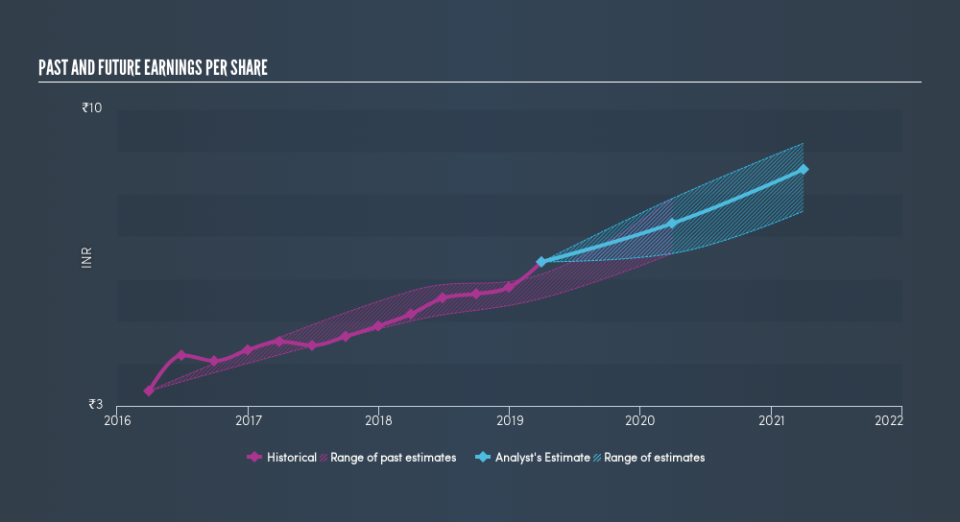

Crompton Greaves Consumer Electricals was able to grow its EPS at 24% per year over three years, sending the share price higher. We note that the 21% yearly (average) share price gain isn't too far from the EPS growth rate. Coincidence? Probably not. This suggests that sentiment and expectations have not changed drastically. Rather, the share price has approximately tracked EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Crompton Greaves Consumer Electricals's TSR for the last 3 years was 82%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Pleasingly, Crompton Greaves Consumer Electricals's total shareholder return last year was 3.4%. That includes the value of the dividend. That falls short of the 22% it has made, for shareholders, each year, over three years. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.