Crude Oil Price Update – Strengthens Over $39.42, Weakens Under $38.83

U.S. West Texas Intermediate crude oil futures are trading steady-to-better on Tuesday, recovering some of yesterday’s steep decline, on short-covering ahead of a potential drop in U.S. production as oil companies began shutting offshore rigs with the approach of a hurricane in the Gulf of Mexico.

At 15:35 GMT, December WTI crude oil is at $39.08, up $0.52 or +1.35%.

Helping to put a lid on prices is a surge in global coronavirus cases, which could derail global demand recovery and worries over a global supply glut as Libya ramps up production.

Finally, an analyst survey by Reuters ahead of data from the American Petroleum Institute on Tuesday and the U.S. Energy Information Administration on Wednesday estimated that U.S. crude stocks rose in the week to October 23, while gasoline and distillate inventories fell.

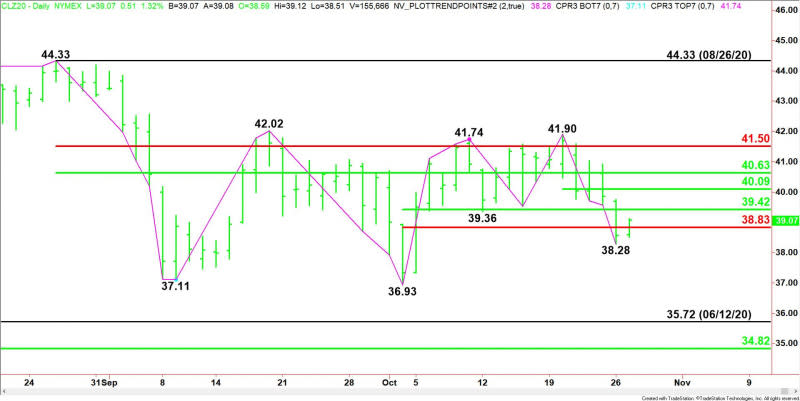

Daily Swing Chart Technical Analysis

The main trend is down according to the daily swing chart. A trade through $41.90 will change the main trend to up. A trade through $38.28 will indicate the selling pressure is getting stronger. A move through $36.93 reaffirms the downtrend.

The short-term range is $44.33 to $36.93. Its retracement zone at $40.63 to $41.50 is resistance.

The minor range is $36.93 to $41.90. The market is currently straddling its retracement zone at $39.42 to $38.83. Counter-trend traders are trying to form a secondary higher bottom.

Short-Term Outlook

Based on the early trade, the direction of the December WTI futures contract into the close is likely to be determined by trader reaction to the minor 50% level at $39.42.

Bullish Scenario

A sustained move over $39.42 will indicate the presence of buyers. If this creates enough upside momentum then look for the rally to possibly extend into the next minor pivot at $40.09.

Bearish Scenario

A sustained move under $39.42 will signal the presence of sellers. This could lead to a retest of $38.83, followed by yesterday’s low at $38.28. This price is a potential trigger point for an acceleration to the downside with the next target the October 2 main bottom at $36.93.

For a look at all of today’s economic events, check out our economic calendar.

This article was originally posted on FX Empire