Current Mortgage Rates: 30-Year Rates Remain Unchanged

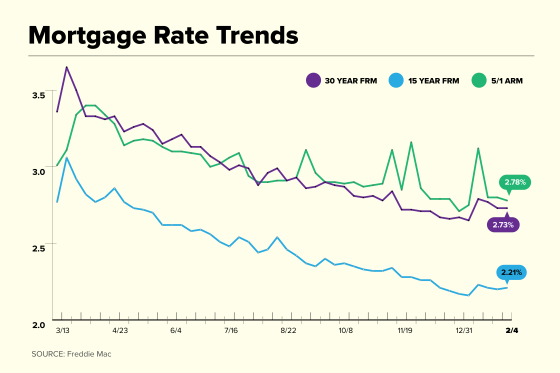

This week, the average rate for a 30-year fixed-rate mortgage stayed at 2.73% with 0.7 discount points paid, according to Freddie Mac’s benchmark Primary Mortgage Survey.

“Mortgage rates remained flat this week and near record lows, signifying an economy that continues to struggle,” said Sam Khater, chief economist at Freddie Mac. “This rate environment is advantageous for those who are looking to refinance in order to strengthen their financial position.”

The average rate for a 15-year fixed-rate mortgage, however, increased by .01 percentage point to 2.21% with 0.6 points paid. A year ago the rate averaged 2.97%.

The rate on a 5-year adjustable-rate mortgage came in at 2.78% with 0.3 points paid. A year ago the ARM rate was 3.32%.

2021 Mortgage Rate Trends

Will Mortgage Rates Go Back Down?

Interest rates remained steady this week as the economy has started showing modest signs of renewed recovery. Treasury yields have been trending higher, the number of new COVID-19 cases has slowed, and today’s unemployment numbers beat expectations.

Whether rates start trending higher again may depend on Friday’s jobs report, which will provide an indication of the overall health of the economy.

“If the report reflects renewed improvements in the labor market, and especially if it coincides with meaningful progress regarding more fiscal relief, then mortgage rates could move upward quickly,” says Matthew Speakman, economist for Zillow. “If not, the pattern of modest weekly oscillations in mortgage rates is likely to continue in the coming weeks.”

On Thursday, the yield on the 10-year Treasury note opened at 1.143%, up from Wednesday’s close of 1.131%. Historically, there tends to be a spread of about 1.8 percentage points between the 10-year Treasury and average mortgage rates.

At the start of the coronavirus pandemic yields dropped below the 1% mark for the first time. Before last March, the 10-year yield had never dipped below 1%, even during the financial crisis. Treasury yields have held at low levels with the Federal Reserve repeatedly indicating that it expects to keep the short-term Federal Funds rate near zero through 2022 or longer.

At its meeting ending January 27, the Fed also stuck to its commitment to continue purchasing mortgage-backed securities and treasuries to help control volatility and keep money flowing to the economy.

Home Purchase Loan Applications Increase

The total number of mortgage loan applications jumped by 8% the week ending January 29, according to the Mortgage Bankers Association. Purchase loans ticked up by 0.1% from the previous week and were 16% higher than the same week last year. Rates are still historically low, however, so prospective homebuyers should still be able to find great rates.

Refinance Applications Jump Higher

Refinance applications increased by 8%, week-over-week. Compared to the same week last year, refi’s were 59% higher. Refinance applications made up 71% of the total loan application volume.

Homeowners interested in lowering their monthly mortgage payments can still take advantage of these low mortgage rates.

“While many have already refinanced, the evidence suggests that upper-income homeowners have taken advantage of the opportunity more so than lower-income homeowners who could stand to benefit the most by lowering their monthly mortgage payment,” noted Freddie Mac’s Khater.

Why Your Personal Mortgage Rate May Be Different From Current Mortgage Rates

Not all applicants will receive the very best rates when taking out a mortgage or refinancing. Credit scores, loan term, interest rate types (fixed or adjustable), down payment size, home location, and the loan size will affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. It’s estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their realtors. Yet this means that they may miss out on a lower rate elsewhere.

Last year, Freddie Mac reported that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didn’t get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Today’s Mortgage Rates and Your Monthly Payment

More than other factors, your annual percentage rate on your real estate purchase will affect your monthly payments — whether you’re refinancing or buying a new home.

On a $200,000 home loan with a fixed rate for 30 years:

At 3% interest rate = $843 in monthly payments (not including taxes, insurance, or HOA fees)

At 4% interest rate = $955 in monthly payments (not including taxes, insurance, or HOA fees)

At 6% interest rate = $1,199 in monthly payments (not including taxes, insurance, or HOA fees)

At 8% interest rate = $1,468 in monthly payments (not including taxes, insurance, or HOA fees)

Refinancing to a lower interest rate could save hundreds of dollars a month if you kept the same loan terms. Shortening the loan term could negate your monthly savings but save thousands over the life of the loan. You can experiment with a mortgage calculator to find out how much a lower rate could save you.

Other factors besides interest affect how much you’ll pay in mortgage payments:

Mortgage Insurance: Mortgage insurance costs up to 1% of your home loan’s value to your payment each year. Borrowers with conventional loans can avoid private mortgage insurance by making a 20% down payment or reaching 20% home equity. FHA borrowers pay a mortgage insurance premium throughout the life of the loan.

Closing Costs: Some buyers finance their new home’s closing costs into the loan, which adds to debt and increases monthly payments.

Loan Term: Choosing a 15-year mortgage instead of a 30-year mortgage will increase monthly mortgage payments but reduce the amount of interest paid throughout the life of the loan.

Fixed vs. ARM: An adjustable-rate mortgage’s monthly payment could change from year to year after the loan’s introductory period expires. A fixed-rate loan’s payments remain the same throughout the life of the loan.

Taxes, HOA Fees, Insurance: A monthly mortgage payment could also include homeowners insurance premiums, city or county property taxes, and Homeowners Association fees. Check with your real estate agent to find out how much they would add to your payments.

Will Today’s Mortgage Rates Save You Money on a Refinance?

You should consider refinancing your home loan if your current mortgage rate exceeds today’s mortgage rates by more than one percentage point. Mortgage refinance fees and closing costs would cut into your savings. You also have to consider whether your credit score would qualify you for today’s best refinance rates.

Many online lenders can give you free rate quotes to help you decide whether the money you’d save in interest charges justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

You could enhance interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments may be higher, but you could save thousands in interest charges over time, and you’d pay off your house sooner.

Should You Buy Discount Points to Lower Mortgage Rates?

Many lenders sell discount points. Buying discount points means you’d pay more up front to lower your mortgage rate which could save you money long-term. A mortgage discount point normally costs 1% of your loan amount and could shave 0.25% off your interest rate.

With a $200,000 mortgage loan, a point would cost $2,000. Buying two points would cost $4,000 which would be due, in cash, when you close the loan. These two discount points would translate into a 0.5% reduction to your interest rate.

Discount points could pay off but only if you keep the home loan long enough. Selling the home or refinancing the mortgage within a couple of years would short circuit the discount point strategy. But if you stayed in the loan indefinitely, you’d reach a break-even point after which the discount points would save you more and more over time.

Often, spending cash on a down payment instead of discount points saves more unless you know for sure you’re keeping the loan for years. If a larger down payment could help you avoid paying PMI premiums, put the money toward your down payment instead of discount points.

How to Find the Best Mortgage Lender

Homebuyers have numerous choices for lenders. Your local bank or credit union probably writes mortgage loans with rates close to the current national average. A loan officer in your local branch could guide you through the process.

Online lenders have expanded their market share over the past decade. You could get pre-approved within minutes. Your loan amount combined with current mortgage rates could define your price range for home prices in your area. Many online lenders also assign a dedicated loan officer to offer continuity as you shop.

Shop around to compare rates and terms, and make sure your lender has the loan option you need. Not all lenders write USDA-backed mortgages or VA loans, for example. If you’re not sure about a lender’s veracity, ask for its NMLS number and search for online reviews.

What Type of Mortgage Loan Do You Need?

First-time homebuyers can walk into a mortgage brokerage office or visit an online lender without knowing what kind of mortgage they need. But it’s always better to have an idea of what you’re shopping for, especially since you can’t control other factors such as home prices and current rates.

Mortgage loan types include:

Conventional Borrowing: Shoppers with higher credit scores and higher down payments can get a conventional mortgage with either a fixed or adjustable rate. Mortgage interest rates can be low for qualified buyers.

Subsidized Borrowing: The Federal Housing Administration and the U.S. Department of Agriculture help first-time homebuyers and shoppers in low-income areas buy homes by subsidizing their mortgage loans. FHA and USDA loans allow shoppers with lower credit profiles (a FICO score of 580) to still get affordable home financing. Subsidized loan restrictions include borrowing maximums and safe housing inspections. These loans are for single-family homes in most cases.

Veterans Affairs Loans: Veterans and active-duty service members can buy homes with no down payment and no PMI through the Department of Veterans Affairs’ lending program. Banks make loans that are guaranteed by the VA. VA loans require a funding fee that could range from 1.4% to 3.64% for first-time homebuyers.

Jumbo Loans: Homes in high-value housing markets like San Francisco and New York City may not fit within a conventional or FHA loan. Jumbo loans can help because they exceed the conforming loan limits of Fannie Mae and Freddie Mac.

More from Money:

7 Things to Do Now if You Want to Refinance Your Mortgage in 2021

9 Steps to Take Now That Will Prepare You for Buying a Home in 2021

2021 Real Estate Predictions: How Vaccines, President Biden and More Could Shape Housing Trends

© Copyright 2020 Ad Practitioners, LLC. All Rights Reserved.

This article originally appeared on Money.com and may contain affiliate links for which Money receives compensation. Opinions expressed in this article are the author's alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Offers may be subject to change without notice. For more information, read Money’s full disclaimer.