The daily business briefing: December 20, 2023

1. Maersk diverts shipping from Red Sea

Danish container-shipping giant Maersk said Tuesday it would divert its Red Sea–bound vessels around South Africa's Cape of Good Hope due to attacks by Houthi rebels in Yemen. Maersk said the fastest way to resume reliable cargo shipping involved re-routing the 20 vessels it had in the northern Red Sea and the Gulf of Aden or headed there from the Mediterranean through the Suez Canal. Maersk halted the vessels Friday on safety grounds after a "near miss" with a Houthi missile. The Houthis have attacked multiple vessels in retaliation for Israel's war with Hamas, although most of the ships had no ties to Israel. The United States is leading a multinational naval task force to protect the vital shipping route. UPI, Bloomberg

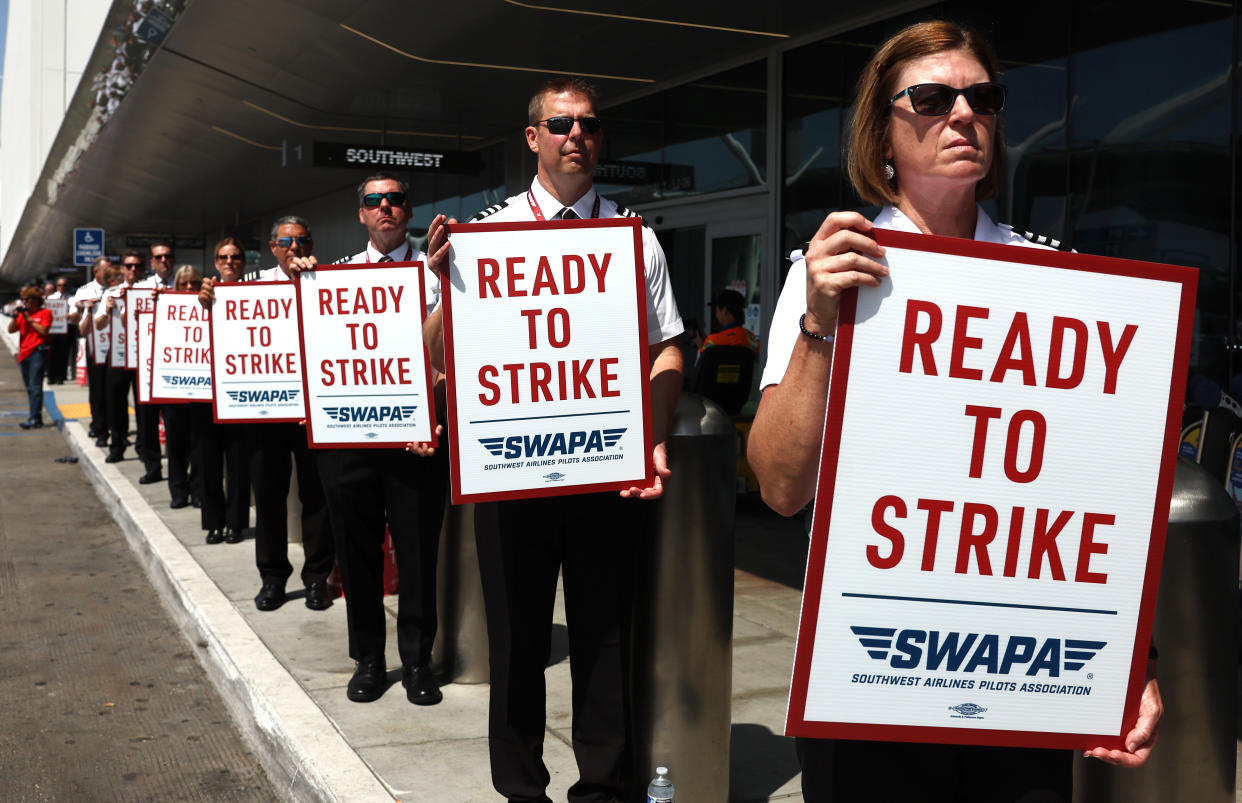

2. Southwest, pilots reach tentative deal

Southwest Airlines and the union that represents its pilots reached a preliminary deal Tuesday on a new five-year contract after three years of haggling. The deal is expected to cost $12 billion. "We are finally at a place where we think the value of our pilots and their productivity is being realized," said Southwest Airlines Pilots Association President Casey Murray. The union said its board would go over the proposal on Wednesday to decide whether to officially back it, setting up a vote by the union's nearly 11,000 members. Southwest called the agreement "a key milestone in the process, and we look forward to the next steps." Bloomberg, CNN

3. Toshiba delisted after 74 years on Tokyo exchange

The Tokyo stock exchange on Tuesday delisted Japan's crisis-plagued Toshiba electronics conglomerate after what Reuters described as "a decade of upheaval." Toshiba, which had been on the exchange for 74 years, is being taken private by investors led by private equity firm Japan Industrial Partners. Other investors include financial services firm Orix, utility Chubu Electric Power and chipmaker Rohm. Foreign activist investors had pushed for changes, paralyzing Toshiba. The $14 billion takeover puts it back in "domestic hands," Reuters noted. The maker of batteries, microchips and nuclear and defense equipment said it would "now take a major step toward a new future with a new shareholder." Reuters

4. Stocks slip after Dow sets another record

U.S. stock futures edged lower early Wednesday as the Dow Jones Industrial Average came off its ninth straight winning session. Futures tied to the Dow and the S&P 500 were down 0.2% at 7 a.m. ET. Nasdaq futures were down 0.3%. Changes in futures don't necessarily lead to changes after the morning bell, Morningstar noted. The 30-stock Dow gained 0.7% on Tuesday, lifting it to the latest in a string of records highs. The S&P 500 rose 0.6%, closing in on its record close set in January 2022. All three of the major U.S. indexes are closing 2023 strong as investors anticipate Federal Reserve interest-rate cuts now that inflation is cooling. CNBC, Morningstar

5. FedEx cuts full-year forecast, shares drop

FedEx shares dropped as much as 10% in pre-market trading Wednesday after the package-delivery giant cut its full-year sales forecast due to concerns about possible weak holiday-season demand. FedEx previously forecast "approximately flat" sales growth, but now expects a "low-single-digit percentage decline" in its 2024 fiscal year. Chief Executive Raj Subramaniam said during the company's earnings call that shipping demand had taken a hit from weaker global industrial production and caution among businesses worried about the economy. The news followed an aggressive effort to slash costs by cutting staff and package-hauling flights, helping FedEx shares gain 59% this year. MarketWatch