David Abrams Buys Shire, Boosts Lithia Motors

- By Tiziano Frateschi

David Abrams (Trades, Portfolio), founder of Abrams Capital Management, increased his holdings of the following stocks during the third quarter.

Warning! GuruFocus has detected 7 Warning Signs with SHPG. Click here to check it out.

The intrinsic value of SHPG

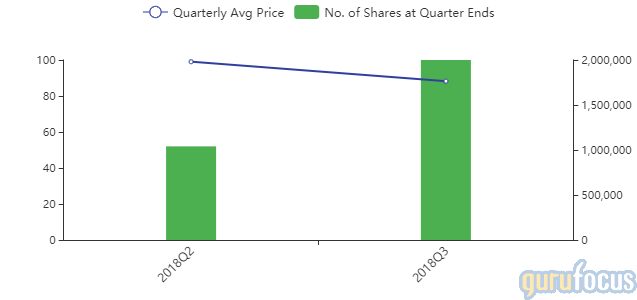

The guru established new position in Shire PLC ADR (SHPG), buying 2,247,133 shares. The trade had an impact of 10.77% on the equity portfolio.

The pharmaceutical company, which develops treatments for patients with rare diseases, has a market cap of $55.23 billion and an enterprise value of $70.47 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 13.33% and return on assets of 7.22% are outperforming 90% of companies in the Global Biotechnology industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.01 is below the industry median of 64.02.

The company's largest shareholder among the gurus is Larry Robbins (Trades, Portfolio) with 1.63% of outstanding shares, followed by John Paulson (Trades, Portfolio) with 0.92%, Abrams with 0.74% and Chris Davis (Trades, Portfolio) with 0.61%.

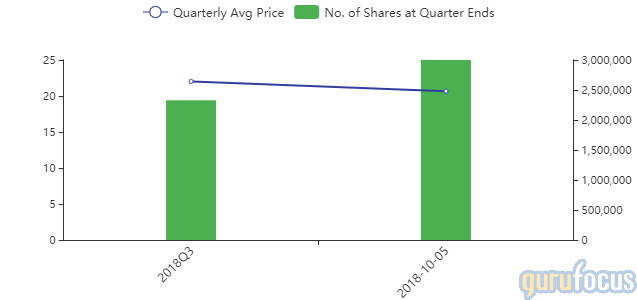

Abrams' position in Lithia Motors Inc. (LAD) was boosted 92.25%. The trade had an impact of 2.07% on the portfolio.

The retailer of new and used vehicles has a market cap of $1.95 billion and an enterprise value of $5.06 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 26.32% and return on assets of 6.03% are outperforming 61% of companies in the Global Auto and Truck Dealerships industry. Its financial strength is rated of 5 out of 10. The cash-debt ratio of 0.01 is below the industry median of 0.53.

Abrams is the largest guru shareholder of the company with 8.51% of outstanding shares, followed by Hotchkis & Wiley with 0.15%.

The investor added 25.17% to his position in Franklin Resources Inc. (BEN). The trade had an impact of 1.61% on the portfolio.

The investment management has a market cap of $16.02 billion and an enterprise value of $10.43 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. While the return on equity of 6.87% is underperforming the sector, the return on assets of 4.59% is outperforming 55% of companies in the Global Asset Management industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 9.49 is below the industry median of 85.28.

Richard Pzena (Trades, Portfolio) is the company's largest shareholder among the gurus with 1.73% of outstanding shares, followed by the T Rowe Price Equity Income Fund (Trades, Portfolio) with 1.05%, Diamond Hill Capital (Trades, Portfolio) with 0.74%, Mason Hawkins (Trades, Portfolio)' Southeastern Asset Management with 0.3% and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.11%.

The guru added 20.32% to his Express Scripts Holding Co. (ESRX) holding, expanding the equity portfolio 1.35%.

The pharmacy benefits manager has a market cap of $56 billion and an enterprise value of $67.3 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 26.51% and return on assets of 9.11% are outperforming 75% of companies in the Global Health Care Plans industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.25 is below the industry median of 1.15.

The company's largest guru shareholder is Dodge & Cox with 7.35% of outstanding shares, followed by Barrow, Hanley, Mewhinney & Strauss with 2.45% and Robbins with 1.24%.

Abrams bought 2,328,100 shares of Camping World Holdings Inc. (CWH), expanding the portfolio by 1.31%.

The company, which manufactures recreational vehicles, has a market cap of $1.5 billion and an enterprise value of $3.34 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. While the return on equity of 29.23% is outperforming the sector, the return on assets of 0.99% is underperforming 74% of companies in the Global Recreational Vehicles industry. Its financial strength is rated 5 out of 10 with a cash-debt ratio of 0.07.

Abrams is the largest guru shareholder of the company with 3.42% of outstanding shares, followed by Ron Baron (Trades, Portfolio) with 2.65% and Chuck Royce (Trades, Portfolio) with 1.49%.

Abrams added 46.08% to his Asbury Automotive Group Inc. (ABG) position, expanding the portfolio by 0.91%.

The company, which owns and operates auto dealerships, has a market cap of $1.33 billion and an enterprise value of $3.02 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 40.55% and return on assets of 7.03% are outperforming 69% of companies in the Global Auto and Truck Dealerships industry. Its financial strength is rated 5 out of 10 with a cash-debt ratio of 0.19.

Joel Greenblatt (Trades, Portfolio) is another notable shareholder of the company with 0.41% of outstanding shares, followed by Hotchkis & Wiley with 0.19% and Jeremy Grantham (Trades, Portfolio) with 0.03%.

The guru purchased 1,119,286 shares of Akebia Therapeutics Inc. (AKBA), expanding the portfolio 0.26%.

The biopharmaceutical company has a market cap of $423.38 million and an enterprise value of $33.24 million.

GuruFocus gives the company a profitability and growth rating of 3 out of 10. While the return on equity of -49.16% is underperforming the sector, the return on assets of -18.15% is outperforming 66% of companies in the Global Biotechnology industry. Its financial strength is rated 8 out of 10 with no debt.

The largest guru shareholder of the company is Simons' firm with 3.29% of outstanding shares.

Disclosure: I do not own any stocks mentioned in this article.

Read more here:

David Abrams Buys 3 Stocks in 3rd Quarter

David Abrams Sets Date With Camping World Holdings

David Abrams Drives Away With Lithia Motors

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 7 Warning Signs with SHPG. Click here to check it out.

The intrinsic value of SHPG