David Rolfe's Wedgewood Sells Longtime Holding Berkshire Hathaway

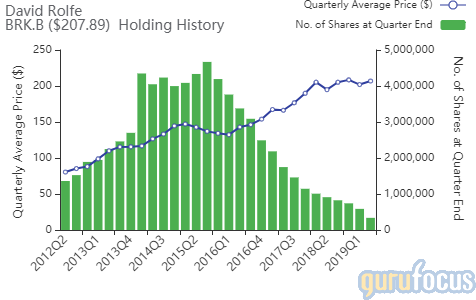

David Rolfe (Trades, Portfolio), the chief investment officer at St. Loius-based Wedgewood Partners, disclosed last week he exited his firm's longtime holding in Berkshire Hathway Inc. (NYSE:BRK.A)(NYSE:BRK.B).

Having held the stock for decades, the investor revealed in the firm's third-quarter shareholder letter that after trimming the position over the past several quarters, he decided to exit the holding altogether due to his growing frustration with Berkshire Hathaway's massive cash hoard, lackluster investments and what he believes were missed opportunities by Warren Buffett (Trades, Portfolio) and his team over the course of the extended bull market.

As of the end of the second quarter, Wedgewood held 337,406 shares of the Omaha, Nebraska-based insurance conglomerate's Class B stock, which represented 6.09% of its equity portfolio.

During the decade-long bull market, which began in March 2009, Berkshire's Class B stock has lagged the S&P 500. Rolfe noted the shares have climbed 269% over that period through Sept. 30, while the index has gained 334%.

One major issue the Wedgewood CIO highlighted was Berkshire's cash pile, which had ballooned to a record of more than $120 billion by the end of second-quarter 2019. Buffett said in his annual shareholder latter that he wanted to use the cash to make an "elephant-sized acquisition," but noted that prices were "sky-high."

Rolfe argued the cash hoard is proving to be a "considerable impediment of growth" as opposed to the "valuable call option" he had considered it to be previously.

"Further, the efficacy of putting this cash pile to work (plus $25 billion in annual operating cash flows in Omaha) will be paramount if Berkshire Hathaway is to once again regain their former status as a meaningful grower over just baseline U.S. GDP growth," he wrote.

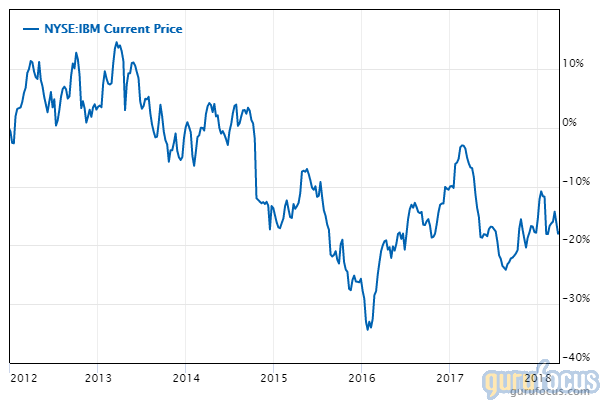

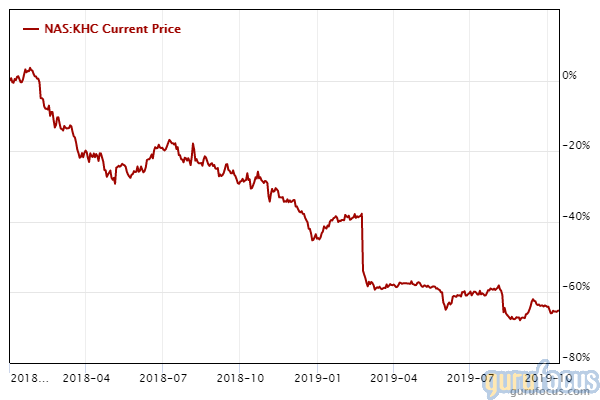

Rolfe also lamented over some of the company's failed investments during the bull run, pinpointing International Business Machines Corp. (NYSE:IBM), Kraft Heinz Co. (NASDAQ:KHC) and several other stocks.

The Oracle of Omaha entered his multibillion-dollar stake in IBM in the fourth quarter of 2011. By early 2018, he had divested of the entire holding. In that time, the computer hardware company's stock dropped approximately 20%.

Similarly, Kraft Heinz has recently proven to be a disappointment. Since the beginning of 2018, shares of the consumer packaged goods company have tumbled more than 60%.

These "notable mistakes," as Rolfe called them, "do not inspire confidence that Buffett & Co. are still at the top of their game."

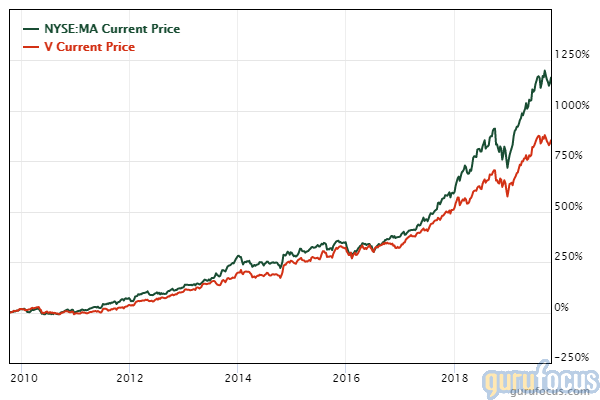

As for missed opportunities in the early years of the bull market, the Wedgewood manager pointed to Mastercard Inc. (NYSE:MA) and Visa Inc. (NYSE:V). Given the investing legend's history with the payments processing industry via his investment in American Express (NYSE:AXP), Rolfe said the "two stocks should have been layups for Buffett."

While Berkshire now has stakes in both companies, they make up a fraction of the company's overall equity portfolio. Over the past 10 years, GuruFocus estimates Mastercard shares have soared more than 1,800%, while Visa's stock has skyrocketed over 750%.

Two other opportunities Rolfe said Berkshire missed out on were Costco (NASDAQ:COST) and Miscrosoft (NASDAQ:MSFT).

While some may think Amazon (NASDAQ:AMZN) could be added to the list of missed opportuinites for Berkshire, in a phone interview with GuruFocus, Rolfe said he's not so sure.

"Buffett has spoken about his significant admiration for Jeff Bezos, maybe over the last 10 to 15, even 20, years," Rolfe said. "I don't specifically recall Buffett saying 'Charlie Munger (Trades, Portfolio) and I took a hard look at it, you know, in a certain timeframe and we felt we wanted to buy but wanted to wait for a cheaper price and we just never pulled the trigger. It was a missed opportunity.' I know he has sung the praises of Jeff Bezos, so I would give him a pass on Amazon."

Rather, he feels Alphabet Inc. (GOOG)(NASDAQ:GOOGL) was a bigger mistake.

"Him and Munger have repeatedly over the years talked about how much they admire the Google ad search business, that they understand it very well and that they actually use it with Geico," he said. "So I think you could put that in the missed column."

Rolfe closed his assessment by saying any further confidence in Berkshire Hathaway will "closely mirror that of Buffett's own conviction in Berkshire share buybacks."

Wedgewood's strategy, portfolio and performance

Rolfe and his team at Wedgewood approach potential investments with the mindset of a business owner, evaluating a handful of undervalued companies that have a dominant product or service, consistent earnings, revenue and dividend growth, are highly profitable and have strong management teams.

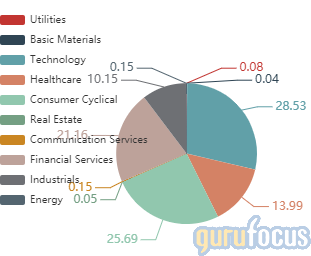

The firm's $1.18 billion equity portfolio, which was composed of 38 stocks as of the end of the second quarter, is largely invested in the technology, consumer cyclical and financial services sectors.

According to GuruFocus, Wedgwood posted a return of -4.01% in 2018, slightly outperforming the S&P 500 Index's -4.38% return.

Disclosure: No positions.

Read more here:

Ariel Investments' Rupal Bhansali Taking GuruFocus Reader Questions

Dodge & Cox Slashes Stake in Zayo Group

Bed Bath & Beyond Shares Soar After Target's Mark Tritton Named CEO

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.