David Swensen Sells DocuSign in 2nd Quarter

David Swensen (Trades, Portfolio) has been the chief investment officer at Yale University since 1985. He sold shares of the following stocks in the second quarter.

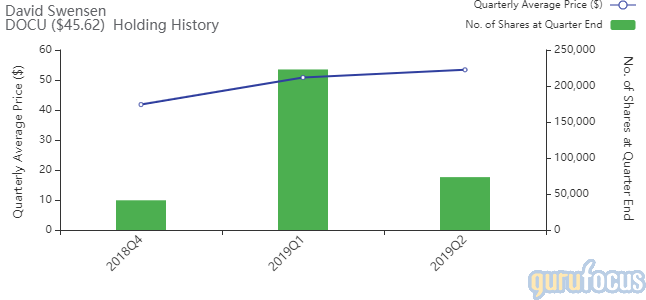

The guru trimmed his DocuSign Inc. (DOCU) holding by 67.07%. The trade had an impact of -8.79% on the portfolio.

The company has a market cap of $7.93 billion and an enterprise value of $7.79 billion.

GuruFocus gives the company a profitability and growth rating of 1 out of 10. The return on equity of -41.43% and return on assets of -14.69% are underperforming 100% of companies in the Application Software industry. Its financial strength is rated 4.9 out of 10. The cash-debt ratio of 1.22 is below the industry median of 3.13.

The largest guru shareholder of the company is Pioneer Investments (Trades, Portfolio) with 0.23% of outstanding shares, followed by Stanley Druckenmiller (Trades, Portfolio) with 0.19% and Chase Coleman (Trades, Portfolio)'s Tiger Global Management with 0.17%.

The guru exited his Vanguard FTSE Emerging Markets ETF (VWO) position. The portfolio was impacted by -8.15%.

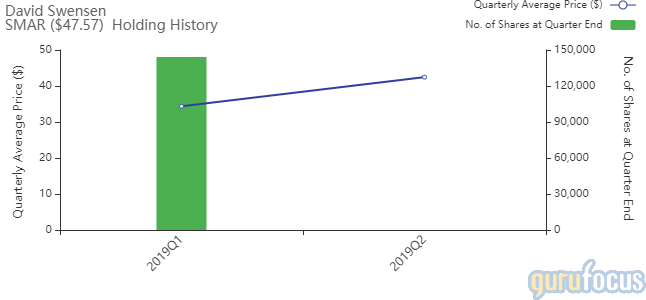

Swensen exited his Smartsheet Inc. (SMAR) position. The portfolio was impacted by -6.67%.

The company has a market cap of $5.07 billion and an enterprise value of $4.91 billion.

GuruFocus gives the company a profitability and growth rating of 1 out of 10. The return on equity of -42.47% and return on assets of -21.76% are underperforming 100% of companies in the Application Software industry. Its financial strength is rated 6.2 out of 10. The cash-debt ratio of 4.18 is above the industry median of 3.13.

The largest guru shareholder of the company is Steven Cohen (Trades, Portfolio)'s Point72 Asset Management with 1.69% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.59% and Louis Moore Bacon (Trades, Portfolio) with 0.28%.

The investor sold out shares of Arvinas Inc. (ARVN). The portfolio was impacted by -3.09%.

The company has a market cap of $823.04 million and an enterprise value of $652.88 million.

GuruFocus gives the company a profitability and growth rating of 1 out of 10. The return on equity of -133.77% and return on assets of -43.79% are underperforming 100% of companies in the Biotechnology industry. Its financial strength is rated 6.6 out of 10. The cash-debt ratio of 36.57 is above the industry median of 12.38.

The company's largest guru shareholder is Cohen with 1.33% of outstanding shares.

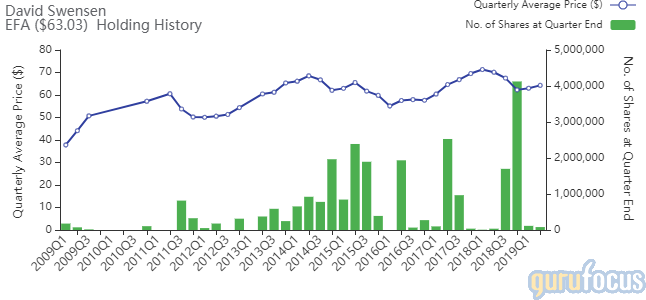

The guru cut his iShares MSCI EAFE ETF (EFA) position by 29.57%, impacting the portfolio by -2.50%.

Swensen closed his holding of Zuora Inc. (ZUO), impacting the portfolio by -1.25%.

The company has a market cap of $1.54 billion and an enterprise value of $1.38 billion.

GuruFocus gives the company a profitability and growth rating of 1 out of 10. The return on equity of -48.29% and return on assets of -26.07% are underperforming 100% of companies in the Application Software industry. Its financial strength is rated 6.4 out of 10 with a cash-debt ratio of 13.31.

The largest guru shareholder of the company is Cohen's firm with 0.30% of outstanding shares, followed by Chuck Royce (Trades, Portfolio) with 0.23% and Mario Gabelli (Trades, Portfolio)'s GAMCO Investors with 0.09%

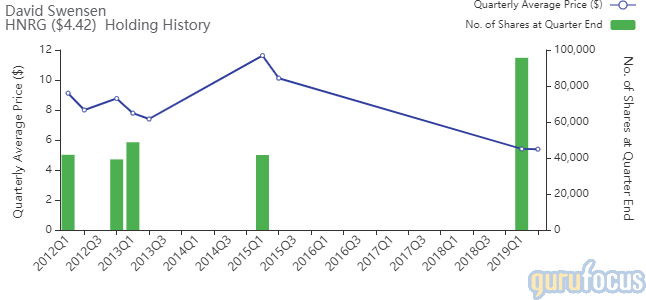

Swensen closed his Hallador Energy Co. (HNRG) position. The portfolio was impacted by -0.57%.

The coal mining company has a market cap of $133.70 million and enterprise value of $291.75 million.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 3.50% and return on assets of 1.77% are underperforming 92% of companies in the coal industry. Its financial strength is rated 4.3 out of 10. The cash-debt ratio of 0.05 is below the industry median of 0.54.

Simons' firm is the company's largest guru shareholder with 1.40% of outstanding shares.

The iShares Core S&P Total U.S. Stock Market ETF (ITOT) holding was reduced by 17.97%, impacting the portfolio by -0.10%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Cheap Stocks With Low Price-Earnings Ratios

Jim Simons Exits UnitedHealth, Costco

5 Companies Boosting Book Value

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.