David Tepper Bites Into Alibaba, Boosts 3 Positions in 3rd Quarter

David Tepper (Trades, Portfolio), founder of Appaloosa Management, disclosed last week that his top four buys during the third quarter included a new holding in Alibaba Group Holding Ltd. (NYSE:BABA) and position boosts in Alphabet Inc. (NASDAQ:GOOG), Altaba Inc. (NASDAQ:AABA) and Micron Technology Inc. (NASDAQ:MU).

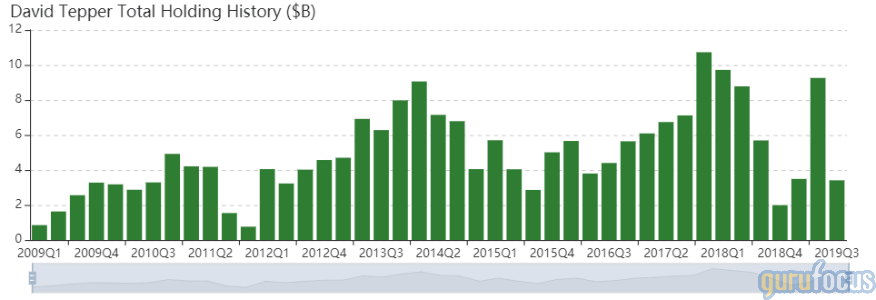

A distressed debt specialist, the Pittsburgh-based fund manager has earned international praise for producing some of the highest returns on Wall Street. Despite this, CNBC sources said on May 23 that Tepper is "planning to return Appaloosa capital to investors and converting the fund into a family office." The Wall Street Journal added that Tepper wants to focus more on managing the NFL's Carolina Panthers, which he purchased for an NFL-record $2.275 billion according to an ESPN article.

As of quarter-end, Tepper's $3.38 billion equity portfolio contains 24 stocks, of which three represent new holdings. The top three sectors in terms of portfolio weight are communication services, consumer cyclical and technology, with weights of 32.57%, 23.90% and 13.74%.

Alibaba

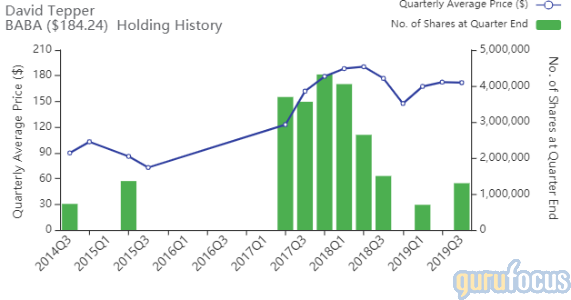

Tepper purchased 1.3 billion shares of Alibaba, giving the stake 6.43% weight in the equity portfolio. Shares averaged $171.94 during the quarter.

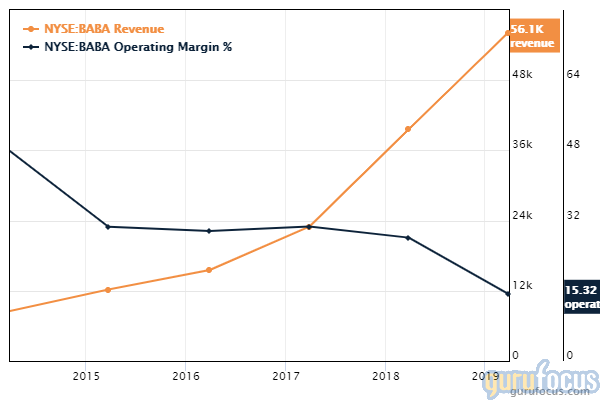

The Hangzhou, Zhejiang-based company operates various online retail market places, including Taobao and Tmall. GuruFocus ranks Alibaba's profitability 9 out of 10 on several positive investing signs, which include a 2.5-star business predictability rank on consistent revenue growth over the past 10 years. Additionally, operating margins are outperforming over 93.88% of global competitors despite contracting approximately 15% per year on average over the past five years.

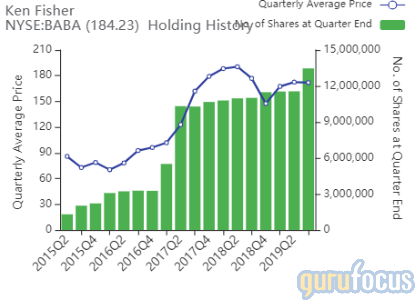

Gurus with large holdings in Alibaba include Ken Fisher (Trades, Portfolio) and PRIMECAP Management (Trades, Portfolio).

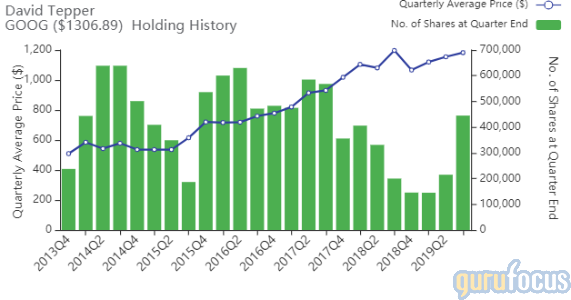

Alphabet

Tepper added 229,900 Class C shares of Google, increasing the position 106.93% and the equity portfolio 8.29%. The portfolio's 444,900 shares, which averaged $1,182.53 during the quarter, represent Tepper's largest holding with a weight of 16.05%.

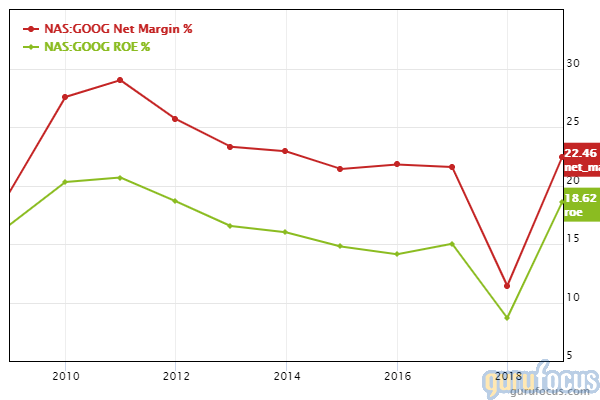

The Mountain View, California-based company operates the popular search engine Google and video platform YouTube. GuruFocus ranks Alphabet's financial strength 9 out of 10 and profitability 10 out of 10 on several positive investing signs, which include robust interest coverage and Altman Z-scores, as well as net profit margins that outperfrom 83.88% of global competitors.

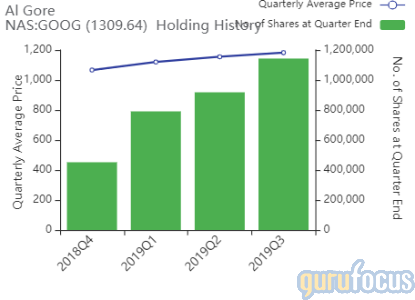

Other gurus with holdings in Alphabet include Dodge & Cox and Al Gore (Trades, Portfolio)'s Generation Investment Management.

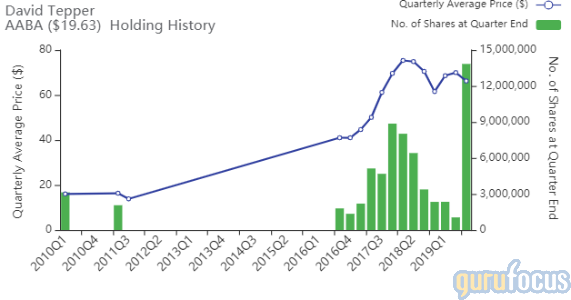

Altaba

Tepper added 12,788,684 shares of Altaba, increasing the stake 1,217.97% and the equity portfolio 7.37%. Shares averaged $66.23 during the quarter.

After Yahoo sold its core business to Verizon Communication Inc. (VZ) in June 2017, Yahoo changed its name to Altaba and became a publicly traded investment holding company.

Micron Technology

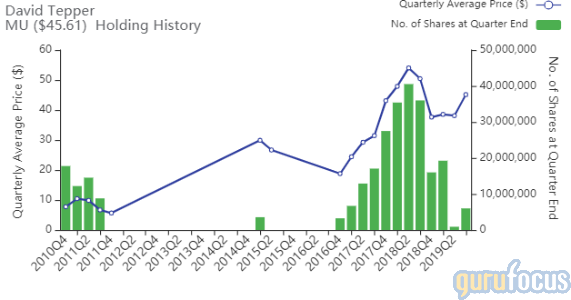

Tepper added 5.1 million shares of Micron Technology, a holding he sold all but 900,000 shares in during the prior quarter. Shares averaged $45.13 during the third quarter.

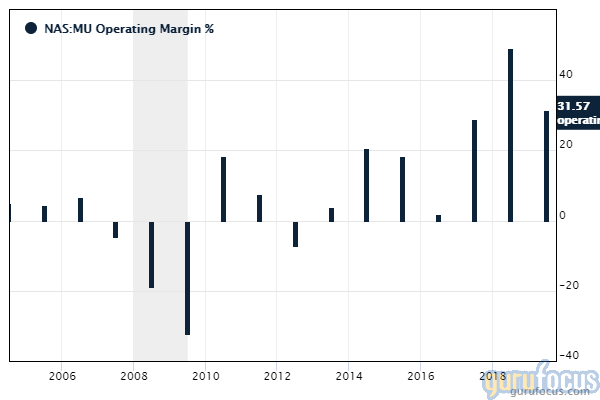

GuruFocus ranks the Boise, Idaho-based memory chip manufacturer's profitability 9 out of 10 on several positive investing signs, which include operating margins that have increased approximately 25% per year on average over the past five years and are outperforming 96.19% of global competitors. Additionally, Micron's business predictability ranks 3.5 stars out of five.

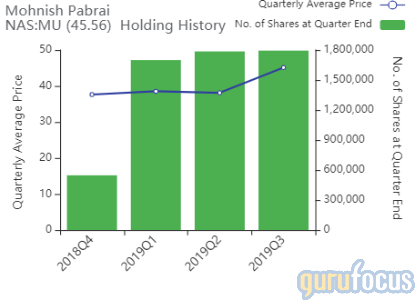

During the quarter, Mohnish Pabrai (Trades, Portfolio) also added shares of Micron to his U.S.-based portfolio, which represents a fraction of his total assets under management.

Disclosure: No positions.

Read more here:

Top 5 Buys of George Soros' Firm in 3rd Quarter

Top 5 Buys of John Rogers' Ariel Investment

Prem Watsa's Top 4 Buys of the 3rd Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.