Deceit, rigged bids and extortion: How HOA foreclosures can open the door to predators

A federal lawsuit focused on an intricate bid-rigging and extortion scheme has helped illuminate another pitfall of HOA foreclosures: They can leave homeowners vulnerable to profiteers.

The four plaintiffs in the lawsuit, all North Carolina homeowners who fell behind on their homeowners association dues, were victimized by a network of people who “were unjustly enriched by their illegal conduct,” U.S. District Judge Catherine Eagles concluded last year, after a federal jury ruled in favor of the homeowners.

A Cary-based limited liability company known as The Estates engaged in bid-rigging in order to limit competition and buy foreclosed houses at lower prices, jurors found.

But before the sales closed, high bidders sometimes approached homeowners with an offer: They would not take their homes if the homeowners paid them tens of thousands of dollars.

Hopes Foreclosed

NC rules make it easy for HOAs to foreclose on homeowners. State law allows them to force the sale of homes for any amount of unpaid dues, no matter how small. Our investigation shows how often it's happening — and how it can be devastating to homeowners.

Hundreds in NC lose homes, equity after HOAs foreclose. Who protects homeowners?

Deceit, rigged bids and extortion: How HOA foreclosures can open the door to predators

‘Once. Twice. Sold for $4,400.’ How HOA foreclosure auctions cost owners their homes

Can an HOA sell your home? What NC law says, and how to challenge foreclosures

“This was an elaborate scheme to take advantage of people who were in a horrible period of their lives,” said Chapel Hill attorney Jim White, who represented the plaintiffs.

Jurors awarded the plaintiffs more than $1.2 million in damages.

Evidence produced in the case suggested that more than 100 homeowners in the Carolinas and Texas were victimized.

Maricol Tineo and her husband, Jairo Leon, were among them.

A knock at the door

The Raleigh couple say they thought they were current on paying their HOA dues. They didn’t see the HOA’s delinquency notices because they were sent to their old address in Texas, said White, their attorney.

The couple said they didn’t realize their HOA had foreclosed on their four-bedroom townhouse until 2019, when they got a knock on their door from Carolyn Souther, who court records say was employed by a dues-paying member of the Estates.

Souther told the couple that she was representing an investor who won the house in a foreclosure auction, according to Gretel Leon, the couple’s adult daughter, who was there at the time.

Souther walked through the remodeled townhome near Wake Forest and “kept saying how pretty the house was,” Gretel Leon recalled. Then, the couple said, Souther gave them options: The investor could pay them to move out of the house. Or the couple could pay thousands to hold on to it.

“She did say we were going to be without a house,” Gretel Leon said. “And if we didn’t pay, she couldn’t help us.”

Afterward, Gretel Leon said, Souther began calling and texting her, “pressuring me to make my parents make a decision.”

In one of those texts, the federal lawsuit says, “Souther demanded $80,000 in exchange for which: “My investor will then walk away giving you clear rights to the home.”

“They’d worked their whole life to build something for us,” Gretel said of her parents. “And then in a second, it seemed like they could lose everything.”

In fact, White said, no one from the Estates had actually paid for the house. Souther lied to the couple about the status of the foreclosure, claiming that another Estates member already owned it, the federal judge wrote.

Souther declined to comment for this story, according to her attorney, Bob Culver.

Ultimately, the investor did attempt to buy the house out of foreclosure. But by that time, the family had contacted White, who sued the Estates. The judge who ruled on the lawsuit ordered that the pending foreclosure sale be blocked and that the family be allowed to keep their house.

Anatomy of a scam

‘More money with less risk’

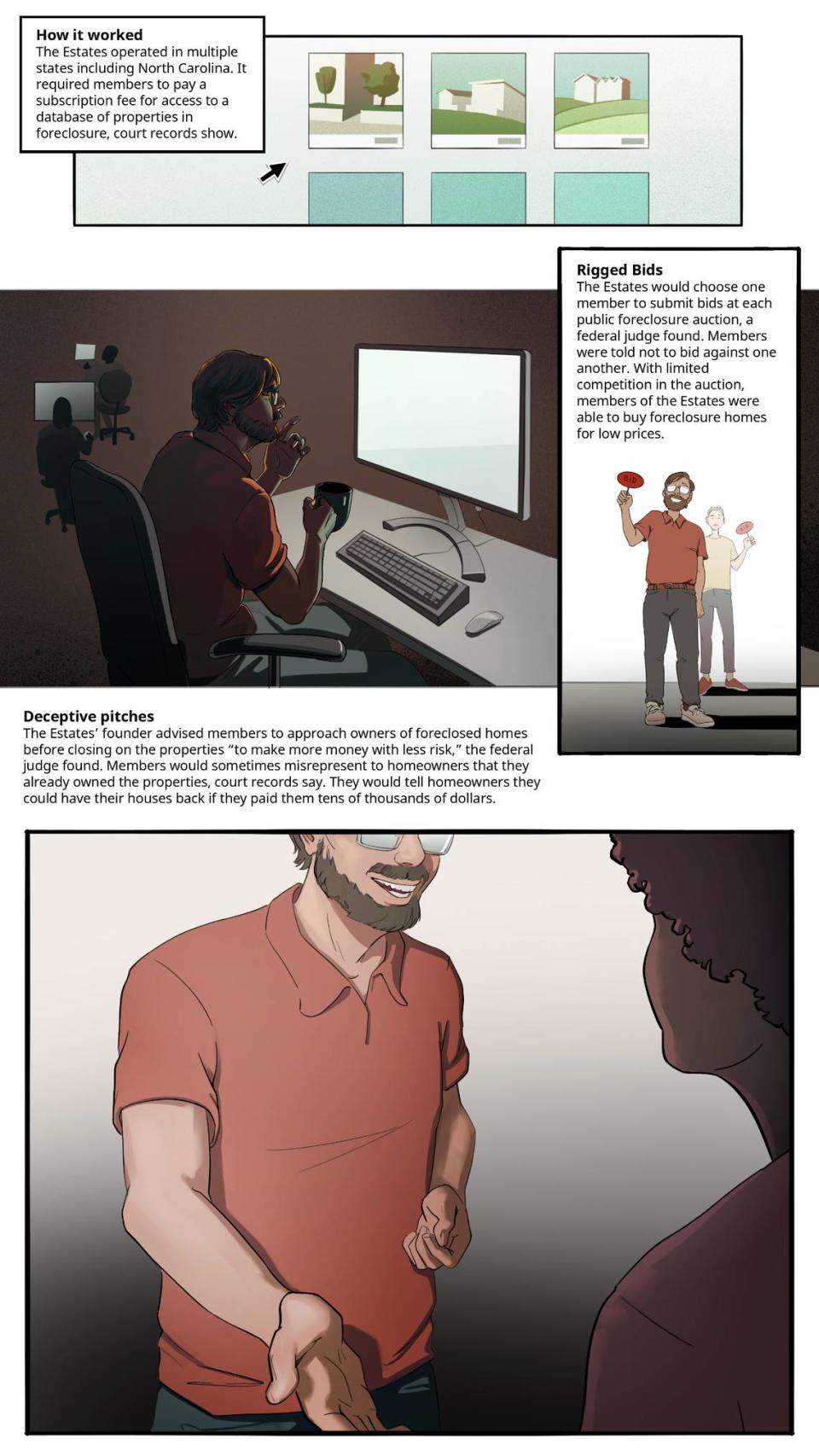

A principal figure in the scheme, according to court documents, was Estates founder Craig Brooksby. Brooksby’s real estate company charged monthly membership fees for users to access a database of homes facing foreclosure by HOAs or others. The system was set up to ensure that just one of the members bid on each property, the judge found.

Members submitted internal bids to The Estates disclosing the maximum amount they would pay for a property. Based on that information, Brooksby or another Estates official would pick one member to bid on each property.

Brooksby advised members who won bids to negotiate with owners of the foreclosed home before closing on the properties in an effort “to make more money with less risk,” just as one had attempted with Leon and Tineo, the judge concluded.

In an interview with The Charlotte Observer, Brooksby disputed that members of the Estates were involved in bid-rigging or extortion.

“The documents presented to the homeowners and the representations made to the homeowners were 100% accurate,” he said. “The definition of extortion, the way I understood it from the judge, is you had to tell the homeowner something that was not truthful. And that was not done.”

White disputed that, noting that homeowners were given notices that they had to vacate their homes even before the bidders owned them.

Brooksby and other defendants appealed the case to the Fourth Circuit Court of Appeals. The court has dismissed most of those appeals, with the exception of those filed by Brooksby and two other defendants.

Brooksby declined to talk at length about the allegations until the Fourth Circuit weighs in, but contended: “I created a remedy that worked well for everyone. And when I did, they turned it on me and turned me into the bad guy.”

Judge Eagles saw things differently. In December, she held Brooksby in contempt of court, saying he was hiding assets and violating an injunction prohibiting him from buying or selling properties at foreclosure auctions. The judge also put the assets of Brooksby and the Estates in the hands of a receiver.

Brooksby declined to discuss the judge’s contempt ruling or to say how much money he has made in the foreclosure business. But with last year’s court ruling, he said, “I’ve lost everything. …At the end of the day, it broke me.”

White, however, said the real victims were the homeowners.

“It opens the door to all sorts of abuse,” White said of HOA foreclosures. “It certainly opens the door to predators.”

Court: Foreclosure buyers acted in bad faith

Lawyers who represent homeowners in such cases say HOA foreclosures are ripe for abuse because just about anyone with a few thousand dollars can become the high bidder on a house — and then try to take advantage of owners.

Many HOA foreclosure homes are sold for less than $10,000, Charlotte attorney James Galvin noted. And at that price, schemers can sometimes make a profit by persuading the original homeowner to pay them more than what they paid or bid for the house.

“You can’t extract $100,000 from the typical homeowner,” Galvin said. “But you can extract $5,000 or $10,000 or $20,000.”

Two of Galvin’s clients — Calmore and Hygiena George — learned firsthand what can happen.

The couple had paid off the mortgage on their three-bedroom home in southwest Charlotte by 2016, when the Crossings Steele Creek HOA filed a $205 lien against their property for unpaid dues, court records show. Less than two months later, the HOA moved to foreclose.

The Georges lived in the U.S. Virgin Islands but had bought the house in Charlotte so their daughters would have a place to live while they attended a nearby college.

Notice of the foreclosure never reached the Georges in St. Croix, the North Carolina Supreme Court found. The sheriff mistakenly served paperwork on one of their daughters, who was living at the Charlotte house, instead of the owners. In court testimony, Hygiena and Calmore George said they didn’t know the house was being foreclosed on until March 2017, when one of their daughters called to say she’d received an eviction letter.

At the January 2017 foreclosure auction, a company called KPC Holdings bought the house for $2,650.

The Georges then hired Galvin, the Charlotte lawyer, who told KPC that the couple had not been notified about the foreclosure.

Galvin said he gave KPC an offer: The Georges would pay at least twice the auction price to buy their home back. The company refused the offer and demanded that they pay $150,000 to have the property returned to them, court records show.

Instead, the Georges fought to regain their home, all the way up to the state Supreme Court. In 2021, justice ruled in their favor, invalidating the foreclosure and returning the house to the Georges.

The Supreme Court agreed that KPC paid a “grossly inadequate” price to purchase the property and that the company had reason to question whether the Georges had sufficient notice about the foreclosure.

Attorneys for KPC and for the Crossings Steele Creek HOA declined to comment.