In decision affecting 685,000 Wisconsin borrowers, Supreme Court strikes down student loan forgiveness

The U.S. Supreme Court on Friday struck down President Joe Biden's student loan forgiveness plan, killing the program in a decision affecting nearly 700,000 Wisconsin borrowers.

The justices ruled 6-3 along ideological lines that the $400 billion plan amounted to illegal executive overreach.

Biden's plan called for cancelling up to $10,000 in federal student loan debt for borrowers who earn less than $125,000 per year, or less than $250,000 for married couples. It also called for up to $20,000 in forgiveness for those who received federal Pell grants as a way to target relief toward those from the lowest-income households.

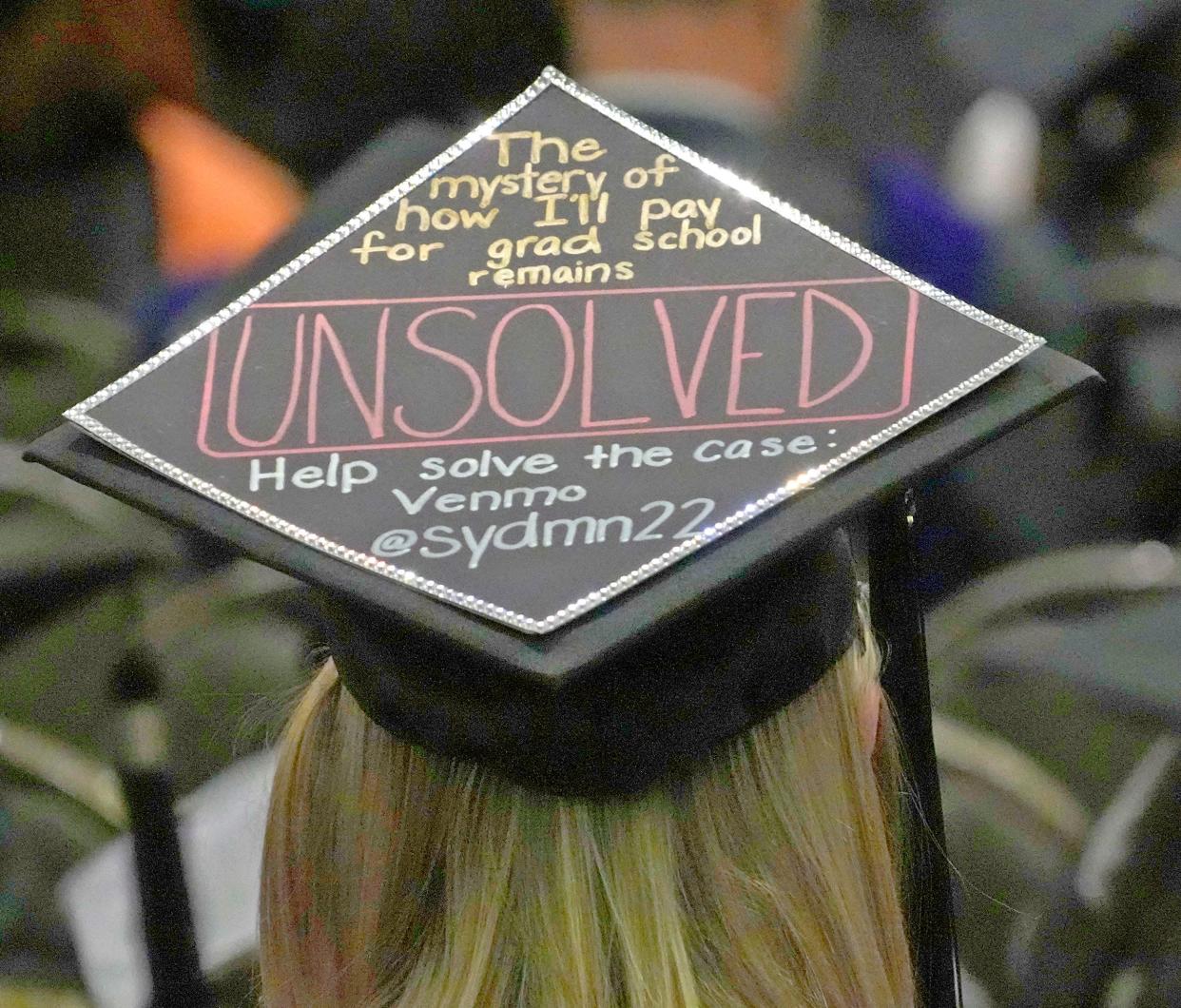

The program would have been life-changing for Sinyetta Hill, who graduated from the University of Wisconsin-Milwaukee last month with a bachelor's degree in political science and philosophy.

"Erasing this debt would have provided a new path for me to have a fresh start," said Hill, who plans to go to law school and become a criminal defense attorney. "Now, it just places a bigger burden on students and on our generation."

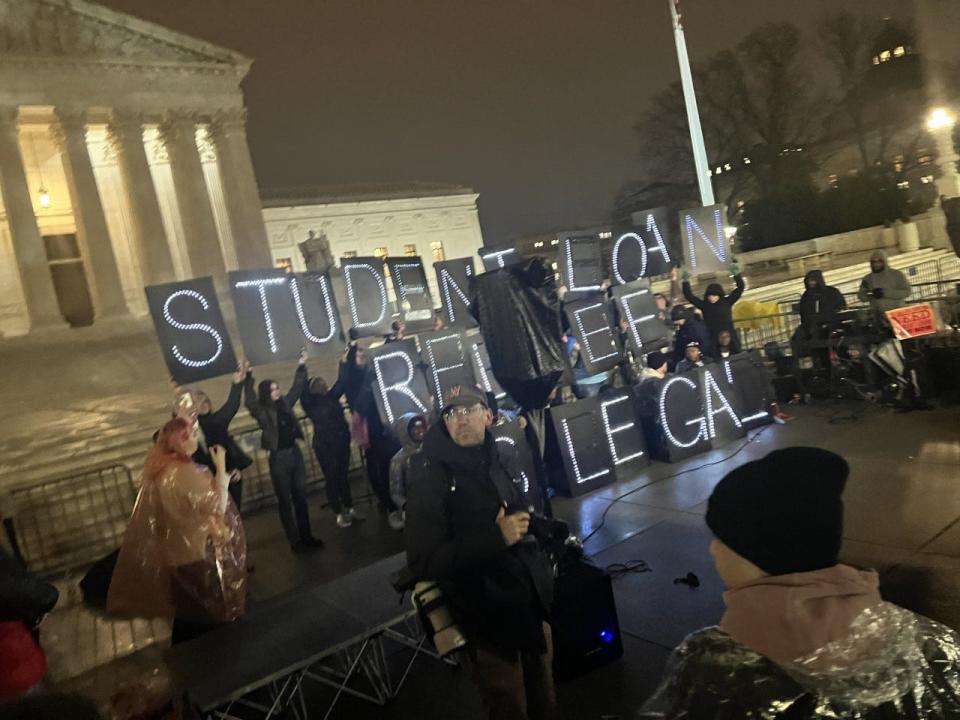

Hill traveled to Washington, D.C., in February to hear oral arguments in the case. She said she arrived the night before and slept outside in the rain, but it was worth it. She said she was third in line to enter the U.S. Supreme Court.

The court's decision crushed her. Hill qualified for a Pell grant and took out about $20,000 in loans to pay for her college degree. Her mom took out about $15,000 in Parent PLUS loans to help finance her daughter's education.

Most of the debt would have been forgiven under Biden's plan, which White House officials said would help narrow the racial wealth gap. Black borrowers such as Hill disproportionately bear the burden of student debt, taking out more loans than white students and defaulting at a higher rate.

“It’s an unfortunate day for student debtors,” said Karen Bauer, managing attorney for the Legal Aid Society of Milwaukee.

Bauer has spent 15 years helping borrowers with student loan questions, many of whom were banking on having their debt forgiven. She said students who attended college but didn't graduate stood to gain the most from Biden's plan.

685,000 Wisconsin borrowers would have been eligible under Biden's plan

Biden enacted the debt relief under the HEROES Act, which was passed after the Sept. 11 attacks and allows the U.S. Secretary of Education to modify the terms of federal student loans during national emergencies. Biden argued the act gives the administration authority to alleviate borrowers' debt during the COVID-19 pandemic.

The court's conservative justices knocked down that argument, saying Biden overstepped and such an expensive plan needed Congress' approval.

The lawsuit was brought by a group of state attorneys general who argued the program would harm tax revenues of the Missouri Higher Education Loan Authority, a state-created company that services student loans.

Wisconsin's 741,500 borrowers hold $24 billion in federal student loan debt, according to the latest federal education data.

The White House previously said about 685,000 borrowers in Wisconsin would be eligible for relief under Biden's plan.

Resources for student loan borrowers

Loan repayments will resume in October, although interest will begin accruing in September, the U.S. Education Department said. Payments have been on hold since the pandemic started.

Bauer advised borrowers to read all letters that come in the mail and prepare for the start of repayments by calling their student loan servicer.

She is concerned about fraudulent actors who capitalize on changes in the student loan space to defraud borrowers. Don't respond to any text messages about the Supreme Court decision or that offer help with student loan repayments, she said.

The federal government doesn’t send texts. Borrowers can learn about their federal student loans at studentaid.gov.

For other reliable sources of information, visit studentloanborrowerassistance.org or the Legal Aid Society of Milwaukee Facebook page.

Contact Kelly Meyerhofer at kmeyerhofer@gannett.com. Follow her on Twitter at @KellyMeyerhofer

This article originally appeared on Milwaukee Journal Sentinel: Wisconsin borrowers affected by Supreme Court student loan forgiveness decision