Deckers (DECK) Queues Up for Q4 Earnings: What's in Store?

Deckers Outdoor Corporation DECK is likely to register an increase in the top line when it reports fourth-quarter fiscal 2021 numbers on May 20. The Zacks Consensus Estimate for net sales is pegged at $434.6 million, which indicates an improvement of 15.9% from the prior-year quarter’s reported figure.

However, the bottom line of this designer, marketer and distributor of footwear, apparel and accessories is expected to decline year over year. The Zacks Consensus Estimate for earnings for the quarter under review is pegged at 54 cents per share, suggesting a decline of about 5.3% from the prior-year quarter’s number. The consensus mark has remained stable in the past 30 days. The company delivered an earnings surprise of 28.3% in the last reported quarter. It has a trailing four-quarter earnings surprise of 485%, on average.

Key Factors to Note

Deckers’ top-line performance in the fourth-quarter is likely to have benefited from strong omni-channel operations. Keeping pace with the changing trends, the company has been constantly developing its e-commerce portal to capture incremental sales. It has been making substantial investments to strengthen its online presence and improve consumers’ shopping experience.

Additionally, Deckers’ strategic efforts to boost brand offerings under banners like HOKA and UGG as well as impressive customer-centric product and marketing strategies have been yielding. Also, the company’s focus on enhancing direct-to-consumer business contribution is likely to have acted as a tailwind during the quarter in review.

However, persistent softness in the Sanuk brand is a worry. Also, adverse impacts of the pandemic upon the company’s store operations cannot be ignored. During its last earnings call, management cautioned about temporary retail store closures across certain geographical areas for at least some point in the fiscal fourth quarter. Moreover, increased marketing spend as well as higher costs with respect to logistics and warehouse fulfillment amid the pandemic are likely to have dented the company’s margins in the to-be-reported quarter.

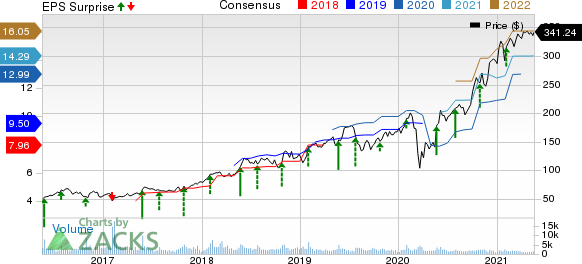

Deckers Outdoor Corporation Price, Consensus and EPS Surprise

Deckers Outdoor Corporation price-consensus-eps-surprise-chart | Deckers Outdoor Corporation Quote

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Deckers this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Deckers currently carries a Zacks Rank #2 and an Earnings ESP of 0.00%.

Other Stocks Poised to Beat Estimates

Here are some other companies you may want to consider, as our model shows that these also have the right combination of elements to post an earnings beat.

Target Corporation TGT currently has an Earnings ESP of +20.84% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Foot Locker, Inc. FL currently has an Earnings ESP of +4.72% and carries a Zacks Rank #2.

NIKE, Inc. NKE currently has an Earnings ESP of +2.67% and a Zacks Rank #3.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NIKE, Inc. (NKE) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Foot Locker, Inc. (FL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research