Deep discounting is running rampant before Christmas and that's bad for retail stocks

My mom gushed over the weekend about a $5 flannel shirt she scored at Kohl’s a few days earlier. It was marked down several times, much like most other apparel at my mother’s favorite store, she noticed.

Ultimately what’s good news for my mom’s wallet during her holiday spending travels is likely to be bad news for Kohl’s (KSS) come fourth quarter earnings report day sometime in March 2020. And Kohl’s probably won’t be alone — after a strong start to the holiday shopping season on Black Friday, apparel retailers of all kinds have been swept up into a profit-busting discounting vortex.

“It has been more promotional,” UBS retail analyst Jay Sole said on Yahoo Finance’s The First Trade. “From where we sit, the retail environment was, and remains, heavily promotional,” Tailored Brands CEO Dinesh Lathi acknowledged on a call with analysts Dec. 11.

Just head over to retail websites to catch a whiff of the discount fever. Macy’s (M) is currently offering 40%-70% off “thousands” of gift specials. J.C. Penney (JCP) is touting up to 83% off select diamond jewelry. American Eagle Outfitters (AEO) is running a 50% off promotion on its assortments.

Various retail experts Yahoo Finance have talked with point to at least two reasons for the pick up in discounting this year compared to last.

Shorter shopping season

First, with six fewer shopping days this holiday season retailers have pulled forward promotions — and made them more salivating — to ensure they get the sale and keep inventory moving. No retailer wants to enter the January period with excess, boring inventory when consumers return with gift cards in hand. They want to put their best foot forward and show off new styles at full price.

In the meantime, weather across most of the Northeast has been warmer than average for this time of year. While some parts of the country have been dumped on with snow, consensus among retail pros is that there hasn’t been the barrage of storms that would spur strong demand for new winter coats, boots, hats and other accessories.

“I think we are in a real lull post Black Friday,” one source told Yahoo Finance.

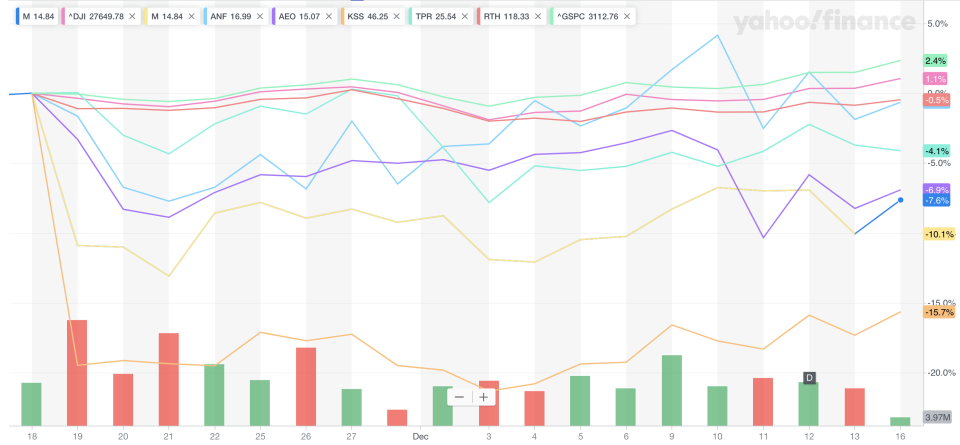

That post Black Friday spending hangover — and the strong potential for profit warnings — has begun to be reflected in the stock prices of several big name retailers over the past month. Not only have the stocks declined in many instances, but the VanEck Vector Retail ETF has lagged a broader market by most measures that is melting up.

Sentiment on retail stocks wasn’t helped last week by a worse than expected November retail sales report from the government.

Discounts on retail stocks and their clothing is now in play. Happy shopping.

Brian Sozzi is an editor-at-large and co-anchor of The First Trade at Yahoo Finance. Follow him on Twitter @BrianSozzi

Read the latest financial and business news from Yahoo Finance

Beyond Meat founder: things are going very well with McDonald’s

Starbucks CEO on what China has in store for the coffee giant

Follow Yahoo Finance on Twitter,