Deere's (DE) Earnings and Revenues Miss Estimates in Q3

Deere & Company DE reported third-quarter fiscal 2019 (ended Jul 28, 2019) adjusted earnings of $2.71 per share, missing the Zacks Consensus Estimate of $2.80 by a margin of 3.2%. However, the reported figure recorded an improvement of 4.6% from the prior-year quarter’s adjusted earnings per share of $2.59.

Prevalent concerns over export-market access, near-term demand for commodities such as soybeans, and overall crop conditions resulted in farmer’s getting cautious about their equipment purchases. Nevertheless, upbeat economic conditions are contributing to Deere's construction and forestry business’ solid performance.

Including one-time items, the company reported earnings per share of $2.81 in the fiscal third quarter compared with $2.78 in the year-ago quarter.

Net sales of equipment operations (which comprise Agriculture and Turf, Construction and Forestry) came in at $8.97 billion, down 3% year over year. Revenues missed the Zacks Consensus Estimate of $9.30 billion. Total net sales (including financial services and others) came in at $10.04 billion, down 3% year over year.

Operational Update

Cost of sales in the reported quarter declined 4% year over year to $6.9 billion. Gross profit excluding financial services in the July-end quarter edged down 1.6%, year over year, to $2,099 million. Selling, administrative and general expenses slipped 1.8% year over year to $896 million. Equipment operations reported operating profit of $990 million in the quarter compared with $1,087 million witnessed in the prior-year quarter. Total operating profit (including financial services) dipped to $1,194 million from $1,283 million reported in the year-ago quarter.

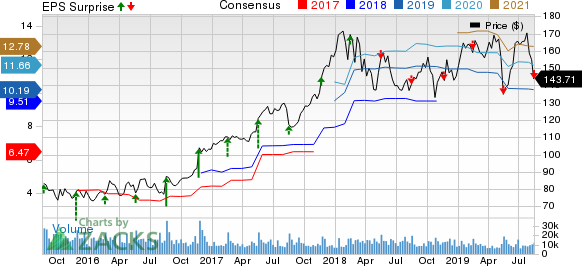

Deere & Company Price, Consensus and EPS Surprise

Segment Performance

Agriculture & Turf segment’s sales were down 6% year over year to $5.9 billion, primarily due to lower shipment volumes and unfavorable currency-translation impact, partly offset by price realization. Operating profit in the segment declined 24% year over year to $612 million, resulting from lower shipment volumes, higher production costs and unfavorable impact of foreign-currency exchange. These were partially mitigated by price realization.

Construction & Forestry sales inched up 1% year over year to $3 billion from the prior-year quarter, aided by price realization, partly offset by the unfavorable impact of currency translation. This segment reported an operating profit of $378 million, an improvement of 35% from the prior-year quarter figure of $281 million.

Net revenues in Deere’s Financial Services division totaled $910 million in the reported quarter, up 10% year over year. The segment’s operating profit came in at $204 million, up 4% year over year.

Financial Update

Deere reported cash and cash equivalents of $3.38 billion at the end of the fiscal third quarter compared with $3.92 billion at the end of the prior-year quarter. Cash provided by operating activities were $404 million in the fiscal third quarter compared with cash usage of $672 million in the prior-year quarter. At the end of the reported quarter, long-term borrowing was approximately $29.2 billion, up from $26.8 billion at the end of year-ago quarter.

Fiscal 2019 Outlook

For fiscal 2019, Deere expects year-over-year equipment sales growth of 4%. The Wirtgen acquisition will contribute about 1% to net sales for the fiscal year. The forecast also factors an unfavorable impact of 2% for foreign-currency translation for fiscal 2019.

For the ongoing fiscal year, the company now anticipates net sales and revenues to increase about 5%. Net income for the fiscal is now projected at $3.2 billion.

Share Price Performance

Shares of Deere have gained around 4.2% over the past year compared with the industry’s growth of 2.8%.

Click to get this free report Cintas Corporation (CTAS) : Free Stock Analysis Report Unifirst Corporation (UNF) : Free Stock Analysis Report Deere & Company (DE) : Free Stock Analysis Report Albany International Corporation (AIN) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research