Defense Stock Due to Break Out

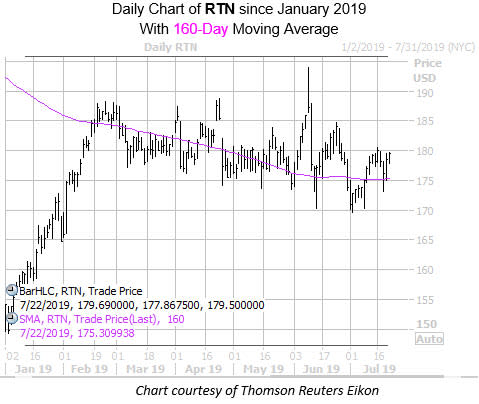

Shares of U.S. defense contractor Raytheon Company (NYSE:RTN) are moving higher this afternoon, last seen up 0.6% at $179.61. RTN has been relatively stagnant since mid-February, struggling to break above the $185 mark. However, the stock has held onto its 17% year-to-date lead, and with new Iran tensions surfacing -- and a reliable buy signal flashing, per data from Schaeffer's Senior Quantitative Analyst Rocky White -- Raytheon stock may be preparing for its next leg higher.

Specifically, the security just pulled back to within one standard deviation of its 160-day moving average, after a lengthy stretch above the trendline. This signal has flashed five times in the past few years, per White, resulting in an average 21-day gain of 3.2%, with with an impressive 80% of the returns positive. A similar lift would put RTN back above $185 for the first time since early June.

Call traders have favored Raytheon stock in recent weeks. This is per data from the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which shows RTN with a 10-day call/put volume ratio of 2.15. Ranking in the 85th percentile of its annual range, this suggests calls have been purchased over puts at a faster-than-usual clip in recent weeks.

Lastly, for those looking to bet on a bounce for the defense stock, near-term options on the security look attractively priced right now. Raytheon's Schaeffer's Volatility Index (SVI) of 22% sits in just the 26th percentile of its annual range. In other words, short-term options are pricing in relatively low volatility expectations for RTN.