Delaware loses Supreme Court case with millions at stake over unclaimed property

A U.S. Supreme Court ruling will affect a Delaware practice that contributes tens of millions to the state's budget annually.

Each year, Delaware seizes millions in "unclaimed property" related to the nearly 2 million businesses registered in the state. The property ranges from unattended bank and business accounts to unused gift cards and unclaimed stock dividends. Delaware searches for idle dollars across the country, anywhere that companies incorporated in the state do business.

The case decided Tuesday, Delaware v. Pennsylvania, centered on Delaware's collection of unclaimed checks issued by MoneyGram, a cash-transfer company headquartered in Dallas but incorporated in Delaware.

The Supreme Court ruled against Delaware, saying that MoneyGram checks should be returned to the states where they were purchased, not the company's place of incorporation.

Although Delaware's aggressive pursuit of unclaimed property has been previously criticized by the Supreme Court and neighboring states, the ruling is the first in recent history to go against Delaware, which relies on unclaimed property more than any other state. According to a December report, unclaimed property contributed 6% of Delaware's 2022 revenue (about $350 million).

It's another effect of the state's status as America's corporate capital — two-thirds of Fortune 500 companies are drawn to Delaware for its business-friendly Chancery Court. In previous years, unclaimed property seizures have totaled more than $500 million and funded more than 10% of the state budget.

The theory of unclaimed property rights

States can claim abandoned property under escheatment, a principle carried over from English law that states it's the right of a government to take ownership of unclaimed property until an owner or heir reclaims it.

It's a straightforward rule when considering physical property — the property goes to the state that it's in — but can be complicated when intangible property is in question.

A 1965 Supreme Court decision said unclaimed property should escheat to the state of the creditor's last known address, but often records aren't kept. In that case, the property should go to the state in which the owner is incorporated, the court said.

Congress in 1974 passed a law called the Disposition of Abandoned Money Orders and Traveler's Checks Act that states money orders, traveler's checks or other similar written instruments should escheat to the state where the instrument was purchased not the company's state of incorporation.

The case against Delaware

Congress, in passing the act, did not define the terms of the statute, opening the window for both sides to argue how Congress four decades ago would have described MoneyGram checks. Thirty states led by Pennsylvania and Wisconsin said MoneyGram payments would count as a money order and therefore remit to the states where purchased, cutting Delaware off from making claims across the county. Delaware said they would be seen as an exempted "third-party bank check."

The court previously said that states should encourage companies to keep creditors' address information to solve the issue, but has found since that most do not as a business practice, rendering that solution moot.

The court ruled Tuesday that the MoneyGram products were close enough to a money order and fall within the 1974 act.

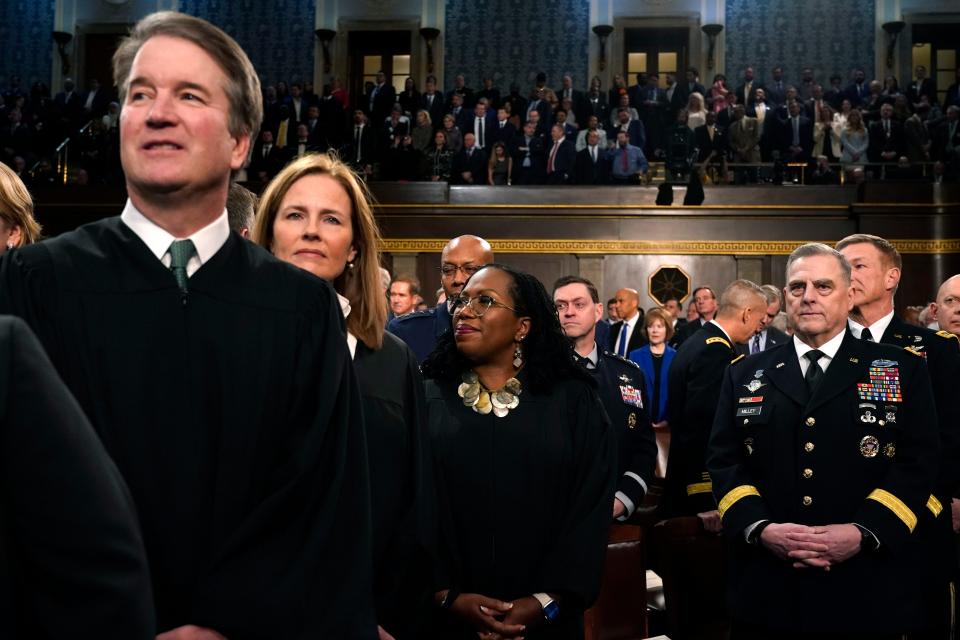

"Our common-law rules were permitting inequitable escheatment," Justice Ketanji Brown Jackson wrote in the majority opinion, her first as a Supreme Court justice.

What are the implications of the decision?

Pennsylvania Treasurer Stacy Garrity estimated in September that Delaware could owe as much as $400 million in escheated funds to other states, including $19 million to Pennsylvania.

Delaware can still collect significant escheat, but collections are already trending down and the MoneyGram loss could open up other appeals.

In 2015, Delaware made more than $500 million through unclaimed property. Last year, after returning $205 million to people who reclaimed their money, Delaware brought in about $350 million, according to the Delaware Economic and Financial Advisory Council.

Contact Brandon Holveck at bholveck@delawareonline.com. Follow him on Twitter @holveck_brandon.

This article originally appeared on Delaware News Journal: Delaware loses unclaimed property case at U.S. Supreme Court