Delek's (DK) Q1 Loss Wider Than Expected, Sales Beat Mark

Delek US Holdings, Inc.’s DK stock has been stable since the company’s first-quarter 2021 earnings announcement on May 4. While this industry player disappointed on the bottom line front, it gave an impressive revenue performance.

Behind the Earnings Headlines

Delek’s first-quarter 2021 results recently reported an adjusted loss of $1.69 a share, wider than the Zacks Consensus Estimate of a loss of $1.38 as well as the year-ago quarterly loss of 30 cents. This underperformance was due to weak contribution from the refining segment.

However, quarterly revenues of $2.39 billion compared favorably with the year-ago sales of $1.82 billion and also surpassed the Zacks Consensus Estimate of $1.64 billion. This better-than-expected report was driven by a strong contribution from the logistics segment and a rigid operating expense management.

Segmental Performances

Refining: The company reported a negative margin of $21.2 million for this segment, narrower than the negative $290.4 million in the year-ago quarter. However, adjusted margins of -$56.8 million worsened from -$23.1 million in the year-ago period. Results were hurt by the Winter Storm Uri, which weakened throughput and flared up energy costs.

Logistics: This unit represents the company’s majority interest in Delek Logistics Partners, L.P. DKL, a publicly-traded master limited partnership that owns, operates, develops and acquires pipelines and other midstream assets. Margin from the Logistics unit was $57.7 million, up 22% from $47.3 million in the year-ago period, led by divesting the Big Spring Gathering business and Trucking Assets.

Retail: Margin for the unit, formed from the acquisition of Alon USA Energy in 2017, rose37.4% to $16.9 million from the year-earlier quarter’s level of $12.3 million on higher Retail fuel margin. Delek’s merchandise sales of $74.6 million with a margin of 32.7%, on average, compared favorably with $71.7 million sales carrying a margin of 31.6%, on average, in the prior year.

Its retail fuel gallons sale totaled $39.8 million in the March quarter of 2021, the average margin being 35 cents per gallon. This compared unfavorably with $48 million sale, the average margin being 31 cents per gallon in first-quarter 2020.

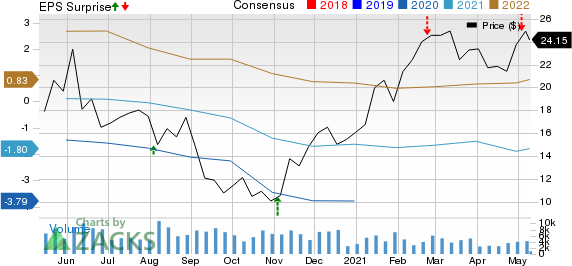

Delek US Holdings, Inc. Price, Consensus and EPS Surprise

Delek US Holdings, Inc. price-consensus-eps-surprise-chart | Delek US Holdings, Inc. Quote

Financials

Total operating expenses incurred in the quarter decreased 13.3% from the prior-year period to $2,472.3 million.

In the reported quarter, Delek spent $67 million on capital programs (86.3% on the Refining segment). As of Mar 31, 2021, the company had cash and cash equivalents worth $793.5 million and a long-term debt of $2,354.4 million with the total debt to total capital of 69.6%.

Guidance

Delek projects its second-quarter 2021 total operating expenses in the 140-$150 million band while total crude throughput is estimated in the 270,000-280,000 barrels per day range.

The company anticipates its 2021 capital expenses to be around $175-$185 million, comprising turnarounds.

Zacks Rank & Key Picks

Delek currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the energy space are Matador Resources Co. MTDR and Continental Resources, Inc. CLR, each presently flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Continental Resources, Inc. (CLR) : Free Stock Analysis Report

Delek US Holdings, Inc. (DK) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

Delek Logistics Partners, L.P. (DKL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research