Delek's (DK) Q4 Loss Wider Than Expected, Sales Beat Mark

Delek US Holdings, Inc.’s DK fourth-quarter 2020results recently reported an adjusted loss of $2.25 a share, wider than the Zacks Consensus Estimate of a loss of $1.84 as well as the year-ago quarterly loss of 11 cents. This underperformance was due to weak contribution from the refining segment.

Quarterly revenues of $1.88 billion compared unfavorably with the year-ago sales of $2.28 billion. However, the top line surpassed the Zacks Consensus Estimate of $1.42 billion. This better-than-expected report was driven by a strong contribution from the logistics segment and a tight leash on operating expenses.

Segmental Performance

Refining: The company reported a negative margin of $82 million for this segment against the positive $127.8 million in the year-ago quarter.Results were hurt by a lower crude differential environment and crack spreads resulting from coronavirus-induced reduced demand.

Logistics: This unit represents the company’s majority interest in Delek Logistics Partners, L.P. DKL, a publicly-traded master limited partnership that owns, operates, develops and acquires pipelines and other midstream assets. Margin from the Logistics unit was $62.2 million, up 46.4% from $42.5 million in the year-ago period, led by divesting the Big Spring Gathering business and Trucking Assets plus an elevated crude gathering and operating expense reductions.

Retail: Margin for the unit, formed from the acquisition of Alon USA Energy in 2017, declined 5% to $12.7 million from the year-earlier quarter’s level due to lower Retail fuel margin. Delek’s merchandise sales of $75.9 million with a margin of 30.1%, on average, compared favorably with $72.9 million sales carrying a margin of 30.6%, on average, in the prior year. Its retail fuel gallons sale totaled $41.5 million in the December quarter of 2020, the average margin being 33 cents per gallon. This compared unfavorably with $51.5 million sale, the average margin being 29 cents in fourth-quarter 2019.

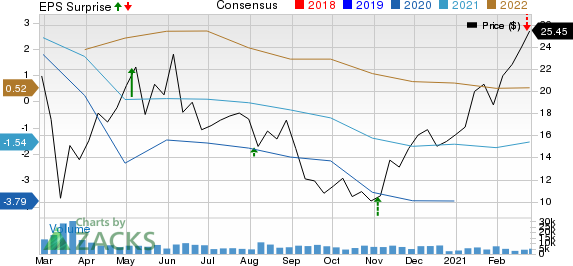

Delek US Holdings, Inc. Price, Consensus and EPS Surprise

Delek US Holdings, Inc. price-consensus-eps-surprise-chart | Delek US Holdings, Inc. Quote

Financials

Total operating expenses incurred in the quarter decreased 1.58% from the prior-year period to $2,196.1 million.

In the reported quarter, Delek spent $31.6 million on capital programs (64% on the Refining segment). As of Dec 30, 2020, the company had cash and cash equivalents worth $787.5 million and a long-term debt of $2,315 million with the total debt to total capital of 67.3%.

Guidance

Delek anticipates its 2021 capital expenses to be around $150-$160 million, comprising turnarounds. The capex estimate represents a decline of approximately $85 million from the prior-year levels.

Zacks Rank & Key Picks

Delek currently has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the energy space are Matador Resources Company MTDR and Denbury Inc. DEN, each presently flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.9% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delek US Holdings, Inc. (DK) : Free Stock Analysis Report

Denbury Inc. (DEN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research