Deliveroo picks London for £8bn stock market listing

Deliveroo has chosen London for its upcoming £8bn float in a major vote of confidence for the UK's planned changes to listing rules.

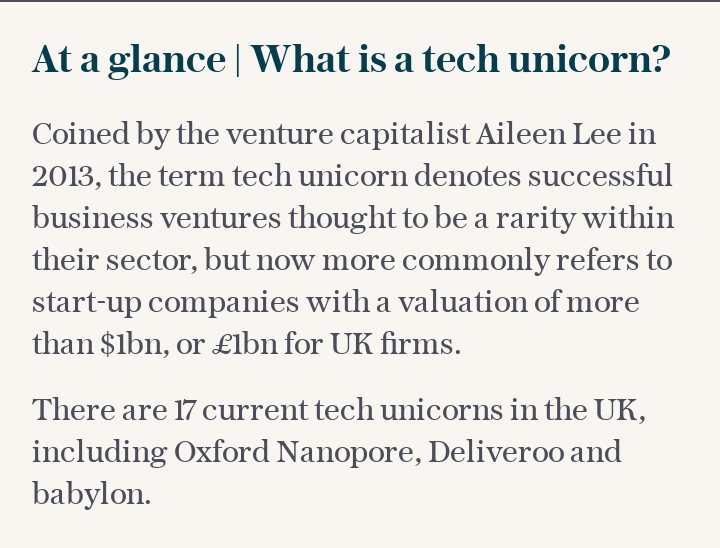

The takeaway app confirmed it had decided to list in London following months of speculation that the company, classed among Britain's best-known technology "unicorns", was planning to go public.

Deliveroo, which could land a valuation of as much as $11bn (£8bn) in the float, is expected to be the first in a flurry of blockbuster London tech listings, which include names such as Darktrace and Transferwise.

Charlotte Crosswell, chief executive of Innovate Finance, said there was an "incredible pipeline of tech and fintech companies that are getting ready to access the public markets". She said moves to overhaul the listing regime would help "ensure we attract these high growth companies to our public markets".

The takeaway app said it was "proud to be a British company, and the selection of London as its home for any future listing reflects Deliveroo’s continued commitment to the UK". It is understood to be kicking off the listing process within the next fortnight.

The listing will be one of London's largest this year and follows Rishi Sunak's backing of changes to the UK's listing regime, allowing founders more control of their start-ups after going public.

Deliveroo said it was planning to adopt a dual-class share structure as a public company - something Lord Hill suggested be allowed for companies on the premium segment of the London Stock Exchange in his UK Listing Review.

The recommendations of the review will need to go through consultation before they can be introduced. The Chancellor said on Wednesday he was "keen we move quickly to consult on its recommendations, cementing the UK’s reputation at the front of global financial services".

Deliveroo chair Claudia Arney said the time-limited dual class structure would provide Will Shu, the co-founder and chief executive of the takeaway app, and his team "with the certainty needed to execute against their ambitious growth plan to become the definitive online food company".

She said the company welcomed the Hill review recommendations to "support modernisation of the market and continued tech sector growth in the UK".

After three years, Deliveroo would move to a traditional single share-class structure.

The float is expected to net huge returns for some of its early backers, including Index Ventures which owned a 10pc stake before the company's latest funding round.

Boss Will Shu is also expected to be elevated into the ranks of Britain's richest entrepreneurs. Prior to the January funding round, he owned almost 6.8pc of Deliveroo, worth just over £540m at a £8bn valuation.

It comes amid a wave of technology floats in the city, with Denmark-based Trustpilot earlier this week revealing it too had picked the city to go public.

It marks a turnaround for London, following years of criticism that it was missing out on major tech floats that had been lured by less onerous listing rules on Nasdaq and the New York Stock Exchange.

Mr Sunak said: "The UK is one of the best places in the world to start, grow and list a business - and we're determined to build on this reputation now we've left the EU.

"That's why we are looking at reforms to encourage even more high growth, dynamic businesses to list in the UK. It's fantastic that Deliveroo has taken this decision to list on the London Stock Exchange."

David Schwimmer, chief executive of the London Stock Exchange Group, said: "Deliveroo's planned IPO on London Stock Exchange highlights the UK capital markets' ability to support leading global tech companies."

He said the LSE was an "increasingly attractive destination for high-growth founder-led businesses, enabling them to innovate, grow and create jobs".

The takeaway app has experienced a huge change in fortunes over the past 12 months, having warned it was at risk of collapse this time last year.

Deliveroo had told the Competition and Markets Authority that it "would fail financially and exit the market" without an investment by Amazon, which had been held up by the regulator.

Ultimately, the deal was allowed to complete. Months later, and thanks to a huge surge in demand for takeaways during the pandemic, Deliveroo revealed it had turned profitable.

The company said it was considering the listing "given the significant growth potential in the online food delivery sector".