Delray Beach firm says it has 'innovative' plan, state calls it a scam

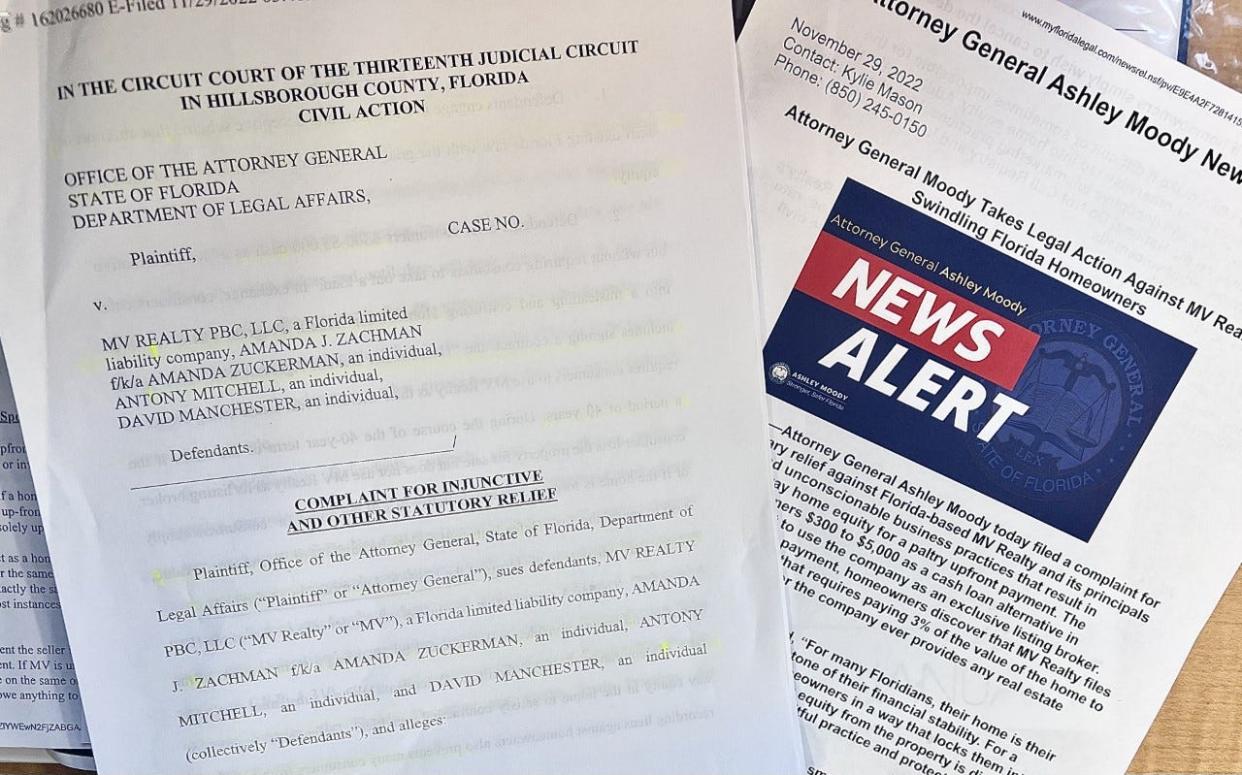

Thousands of Sunshine State homeowners were duped by a Delray Beach-based company into signing 40-year sales contracts that amount to liens on their properties with hefty repercussions for breaking the agreement, according to a Florida attorney general’s lawsuit.

An estimated 1,500 Palm Beach County homeowners and more than 9,000 statewide signed up with MV Realty PBC — a limited liability company whose initials stand for Mad Valorem, a play on ad valorem, the lawsuit says.

Filed in Hillsborough County, the suit accuses MV Realty executives Amanda Zuckerman, Antony Mitchell and David Manchester of using a “complex and deceptive scheme that attempts to skirt existing Florida law with the goal of swindling consumers out of their home equity.”

In exchange for one-time payouts of between $300 and $5,000 to the homeowner, the company gains the right to sell the home for four decades through a “Homeowner Benefit Agreement.”

Home sale slump:Palm Beach County home sales take steep dive in November

History on the move:West Palm Beach may move downtown historic homes for Related Cos. projects

Not so ancient history: Palm Beach County home prices top record; more homes listed

But if a homeowner wants to cancel the agreement, goes into foreclosure, lists to sell with a different agency, or dies and leaves it to heirs, MV Realty gets 3% of the property’s value as determined by MV Realty, according to court filings.

Officials: Agreement is interpreted as a lien

Also, state officials said because the agreement is recorded in official court records, it has been interpreted as a lien, which limits the homeowner’s ability to take out reverse mortgages and home equity lines of credit or to refinance.

MV Realty, which operates in 33 states, defended its practices and refutes any wrongdoing.

“New and innovative business models, like the Homeowner Benefit Agreement, can transform established industries and can sometimes draw questions from critics or outright hostility from those whose existing business model is threatened,” MV Realty said in a statement.

The company said it will work with attorneys general, policymakers and regulators to answer questions and discuss its program, which the company said has been used by more than 35,000 homeowners nationwide.

![Florida Attorney General Ashley Moody during a February 2019 visit to the AG's office in West Palm Beach. [GEORGE BENNETT/palmbeachpost.com]](https://s.yimg.com/ny/api/res/1.2/UlkOcdNuMcNikJnkO3cnmA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTk2MDtoPTY0MA--/https://media.zenfs.com/en/palm-beach-daily-news/befa82b7660cb68d0022d6e27c4582b4)

“We are confident after a full airing of the facts, these discussions will reinforce how MV Realty’s business transactions are legal and ethical and that our team operates in full compliance with state and federal laws,” the statement said.

Attorneys general in Massachusetts and Pennsylvania have also filed suits against the company, and at least one Palm Beach County attorney is wary of the operation.

“I find the entire concept unconscionable,” said Joseph Karp, a Palm Beach Gardens elder law attorney who stumbled on MV Realty in 2021 when working with an 82-year-old client suffering from dementia. “I don’t know how my client got contacted, or what she understood, but it just smelled wrong.”

Karp said his client didn’t need the $800 that MV Realty gave her for obtaining the exclusive rights to list her three-bedroom Port St. Lucie home for 40 years. It filed a “memorandum of homeowner benefit agreement” in official court records, which Karp said was effectively a 40-year lien.

More:$300K Florida real-estate scam saw woman sell 25 properties she didn't own, state says

Point of View: Homeowners need protection from property fraud scams

More:South Florida leads nation in mortgage fraud

“It would have been apparent to even a casual observer that my client was confused and not capable of understanding and signing a valid and enforceable contract,” said Karp, who contacted the attorney general’s office about his concerns.

The Florida lawsuit says “many” homeowners who signed contracts with MV Realty were vulnerable targets, including senior citizens with limited cognitive capacity or people who spoke English as a second language. Notaries often arrived at peoples' homes with only one copy of the agreement, which homeowners said they were not able to see or have explained to them, the suit claims.

Similar allegations are included in the Massachusetts lawsuit. Florida’s lawsuit was filed Nov. 29, followed by the ones in Massachusetts and Pennsylvania, which were both filed Dec. 14.

“We are suing to get homeowners out of these contracts, protect our residents from this scheme, and stop this predatory company from doing any more business here in Massachusetts,” said Maura Healey, then Massachusetts' attorney general and now its governor, in a December press release about the lawsuit.

Healey said MV Realty began doing business in Massachusetts in 2021 and has more than 500 contracts with homeowners who were given cash payments of between $500 and $5,000 to sign the Homeowner Benefit Agreement.

The company started in Florida in 2014 but didn’t offer the benefit agreement until 2018, which was at first called an “Optlisting Agreement.”

The Optlisting Agreement had terms that said the listing contract would automatically renew every three years unless a homeowner canceled it. A cancellation, however, required the homeowner to return back the one-time payout plus 1.5% of the market value of their home.

More:'Cruel' Lake Worth home-rental scam targeted 'perfect victims'

More:Desperate Florida renters are 'downsizing or downgrading' as price increases top the nation

More:Lack of affordable housing threatens Palm Beach County's economy, analysts say at forum

In 2019, the Optlisting Agreement became the Homeowner Benefit Agreement, which included the 40-year listing requirement and gave MV Realty 3% of the home’s market value if the agreement was broken.

Telemarketers are used to call or text homeowners with prerecorded messages about plans. One telemarketing company left 6.83 million voicemails marketing the Homeowner Benefits Agreement in 2021 and 2022. Millions of calls were also made to people on the National Do Not Call Registry, the Florida lawsuit claims.

Three counts of unlawful practices are levied against MV Realty in Florida’s suit, including violations of the Florida Deceptive and Unfair Trade Practices Act and the federal Telemarketing Sales Rule.

MV Realty continues to advertise its “Homeowner Benefit Program” on its website with some tweaks from its original format, including clarifying that the homeowner has three days to rescind the contract after signing it. It also says that while the listing agreement is for 40 years, if MV Realty doesn’t sell the house within six months of it going to market, the homeowner can use a different company without owing anything to MV Realty.

Kimberly Miller is a veteran journalist for The Palm Beach Post, part of the USA Today Network of Florida. She covers real estate and how growth affects South Florida's environment. If you have news tips, please send them to kmiller@pbpost.com. Help support our local journalism, subscribe today.

This article originally appeared on Palm Beach Post: MV Realty says new program is legitimate but Florida AG calls it bogus