Delta: 3rd-Quarter Results Show Return to a Growth Industry

- By Margaret Moran

Before the markets opened on Oct. 13, Delta Air Lines (NYSE:DAL) reported earnings results for its third quarter of fiscal 2020, which ended on Sept. 30.

Total revenue for the quarter was $3.06 billion versus last year's $12.56 billion. The airline posted a GAAP loss per share of $8.47 compared to earnings per share of $2.31 in the prior-year quarter, while the non-GAAP loss per share came in at $3.30 compared to earnings of $2.33 in the same quarter of fiscal 2019. Earnings per share figures made a slight improvement from the loss per share of $9.01 in the second quarter of 2020. Analysts polled by Refinitiv had been expecting a non-GAAP loss per share of $3 on revenue of $3.1 billion.

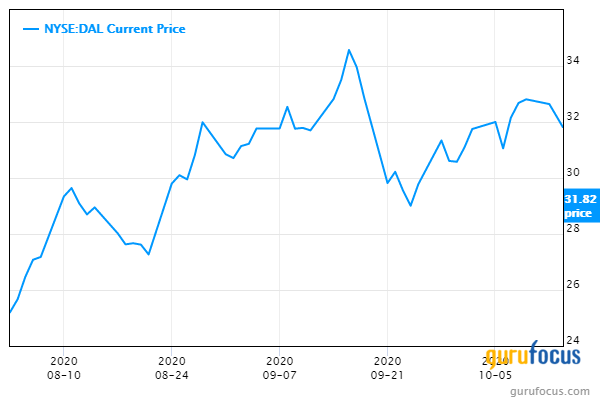

Following the news, shares of Delta fell more than 2% to around $31.82 in midday trading.

Earnings results

Year over year, revenue declined 79% on 63% lower capacity, which, as investors are already well aware, is almost entirely due to the pandemic and resulting decreased in travel (especially close-quarters air travel).

The extra 16% revenue drop that was not due to volume decreases can mostly be attributed to things such as the increased cost per passenger per flight, restructuring charges and early retirement plans for employees.

Normal operating expenses, excluding Covid-related charges, decreased 52% to $5.5 billion. Non-operating expenses for the quarter were $349 million higher compared to a year ago, primarily due to an additional $221 million in interest expenses from increased debt.

Delta ended the quarter with $40.217 billion in adjusted total debt, which consisted primarily of debt and finance lease obligations with an additional $2.8 billion added for 7 times the past year's aircraft rental fees.

Cash, cash equivalents and short-term investments stood at $21.525 billion and restricted cash was $1.68 billion, resulting in adjusted net debt of $17.012 billion. In comparison, adjusted net debt was $10.265 at the end of the prior-year quarter.

In terms of the benefits from the CARES Act, Delta recognized $1.315 billion of the $5.4 billion it received in emergency relief as a contra-expense for the quarter.

Looking forward

Delta has reduced its average daily cash burn by more than 70% since late March to around $24 million in September. The company estimates that it will be at least two years before the airline industry as a whole sees sustainable recovery. In the meantime, Delta expects to become cash flow positive by spring.

"While our September quarter results demonstrate the magnitude of the pandemic on our business, we have been encouraged as more customers travel and we are seeing a path of progressive improvement in our revenues, financial results and daily cash burn," CEO Ed Bastian said. "The actions we are taking now to take care of our people, simplify our fleet, improve the customer experience, and strengthen our brand will allow Delta to accelerate into a post-COVID recovery."

Valuation

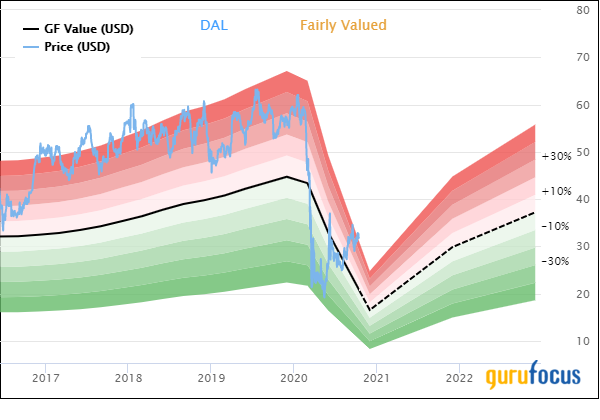

On Oct. 13, the GuruFocus Value chart rated Delta's stock as fairly valued. While the company's profits are expected to continue dropping through at least the end of 2020, once recovery gets underway in the next two to three years, analysts expect the value of the stock to catch up with the current price range.

There are two main reasons why analysts are more bullish on Delta's stock than that of most other major U.S. airlines. One is the company's relatively low debt; with a cash-debt ratio of 0.51, Delta is better off than two-thirds of transportation companies and most of its major competitors. The second and related factor is that due to its relative financial flexibility, Delta is able to focus more on expanding its customer base rather than simply trying to survive, potentially allowing it to snap up more market share as the airlines re-enter a growth phase in the next few years.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research and/or consult registered investment advisors before taking action in the stock market.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.