Airline CEOs warn coronavirus is cutting into reservations and are prepared for it to get worse

United Airlines (UAL) President and incoming CEO Scott Kirby warned on Tuesday that the airline’s move to cut overall capacity could hit 20% this May and grow by an equal or greater amount each month until ticket demand returns.

“Our current dire scenario planning option is for revenue to be down 70% in April,” Kirby told investors at the JP Morgan Industrials Conference in New York City. While he doesn’t expect the revenue hit to actually be that bad, he says United’s goal is to “raise liquidity, cut cap ex, and reduce capacity to position ourselves to bounce back when the crisis ends.”

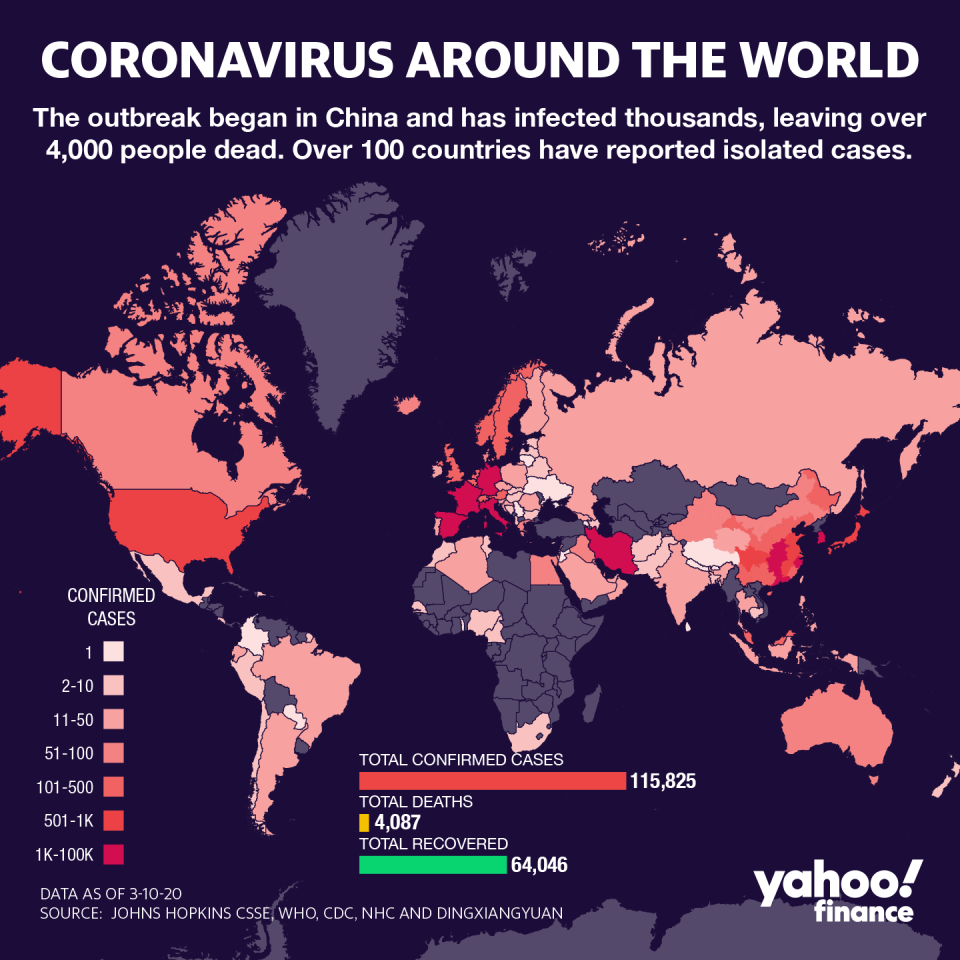

The warning from the United Airlines CEO comes as all of the major airlines face fallout from the new coronavirus outbreak, which has hit the travel industry particularly hard. CEOs from Delta and American Airlines also said at Tuesday’s conference that they were cutting capacity as the coronavirus reduces demand for tickets.

Delta (DAL) CEO Ed Bastian is piloting his airline down a similar path to United since the virus spread outside of China. “Since then we have seen a 25 to 30% decline in net bookings and are prepared for it to get worse,” Bastian told investors at the conference.

Delta is taking aggressive actions to maintain its financial position, which includes reducing international capacity by 20% to 25% and domestic capacity by 10% to 15%. Delta is also targeting $1.8 billion in cost reductions, which include a company-wide hiring freeze, voluntary leave options, parking aircraft and retiring older planes. But, he noted, “This demand destruction like all others is temporary.”

American Airlines (AAL) is also cutting its schedule, suspending service from some U.S. airports to Rome, Milan, Venice, and other cities in Europe. Chairman and CEO Doug Parker told the JP Morgan conference it’s cutting domestic capacity by 7.5% in April. American is “aggressively readjusting our flight schedule ... which will result in a 10% reduction in our international summer capacity versus our current schedule,” he said.

Parker says that includes a current 55% reduction in trans-pacific capacity. “These reductions are based entirely on customer demand, not safety concerns,” Parker said.

Investors rewarded the airline leaders’ transparency, driving their stocks up during Tuesday’s trading session. But 2020 has been rough for the airlines: Shares of Delta are off roughly 22% year to date, and United and American are down about 40%. But American’s Parker says, “The U.S. airline industry will manage through this and American Airlines will lead the way.”

Bastian echoed that sentiment, pointing out the airlines are in better cash positions than after previous crises like the 2001 terror attacks that led to several big airline bankruptcies. “Over the last 10 years, we’ve transformed Delta by strengthening the balance sheet,” Bastian said.

But all three admit the coronavirus outbreak and the challenges it poses to their businesses continue to change. It’s one reason Delta suspended its full-year guidance and Kirby said United would suspend its guidance for the first quarter. “Let me be blunt, speaking for United, hope is not a strategy,” Kirby said. “Our strategy is to act quickly.”

Adam Shapiro is co-anchor of Yahoo Finance’s “On the Move.”

Virgin Galactic has a plan to grow its business beyond space tourism

Former Trump official: 'Markets would prefer a Joe Biden' over other Democrats

Delta CEO to Boeing: 'Don't lose sight of the future' following 737 Max problems

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit