Democratic presidential candidates are waiting on the states when it comes to private retirement reform

Lack of access to work retirement plans is possibly a more pressing problem than the coming shortfall of Social Security.

A study by the Stanford Center on Longevity found that only “half of American workers are participating in a retirement plan at work.” Another report, by the National Institute on Retirement Security, found that two-thirds of working millennials have nothing saved for retirement.

Access to plans would help. Seventy-five percent of Americans without a workplace retirement plan said they would be likely to participate if given the option in a recent survey.

Yet a survey of presidential campaigns by Yahoo Finance and the Bipartisan Policy Center’s Funding our Future campaign found only a smattering of concrete plans among Democratic candidates to address the issue.

Many are instead looking to the states. Senator Cory Booker (D-NJ) told Yahoo Finance he “supports states stepping up and doing what they can to improve retirement savings for workers.” Senator Michael Bennet (D-CO) commented, “We should work to facilitate [state] efforts, rather than block them.” And former U.S. congressman Beto O’Rourke added “states have played a critical role in stepping up where the federal government has not.”

Few expect dramatic action at the federal level anytime soon and that might just be fine from a state’s perspective. A few states have already begun implementing their own programs to improve access, with Oregon among the leaders.

"What's at the heart of what we're trying to do in Oregon is the recognition that there's a market failure" Oregon Treasurer Tobias Read told Yahoo Finance in an interview. Read is in the middle of implementing OregonSaves, a program he helped create in 2017 that offers a retirement savings program (through a personal IRA) to workers who don't have access to a qualified retirement plan at their jobs.

Read seems in no rush to have the federal government join the party. He noted that Oregon, California, and Illinois are leading the charge in this arena. "You might well see, eventually, the federal government use some of those lessons and describe how they might take it on," he says, adding, “I think ideally the notion is to create some kind of a floor, so that everybody has access and in some part but I think we're still early.”

A smattering of plans from certain candidates

To be sure, there are candidates with plans. Senator Amy Klobuchar (D-MN) is a leading voice in Washington on the issue. In the survey, her campaign said that a Klobuchar administration "would work with Congress to create innovative, portable personal savings accounts called Up Accounts — modeled after landmark legislation she has introduced with Senator [Chris] Coons — that can be used for retirement and emergencies by establishing a minimum employer contribution to a savings plan."

The goal of Klobuchar's Senate plan is for employers to set aside at least 50 cents per hour worked, "helping a worker build more than $600,000 in wealth over the course of a career."

Michael Bennet has a similar plan, but without an employer mandate to contribute. He would “expand workplace-based retirement savings options and create portable savings options, such as the ‘401(k) in the sky,’ so workers have the flexibility they need to thrive.” Jason Grumet, founder and president of the Bipartisan Policy Center, likes the idea it’s “a little bit of a Beatles metaphor there” he says adding “it's those kinds of ideas which will make the system more secure but at the same time not necessarily raise the overall cost that is probably a sweet spot."

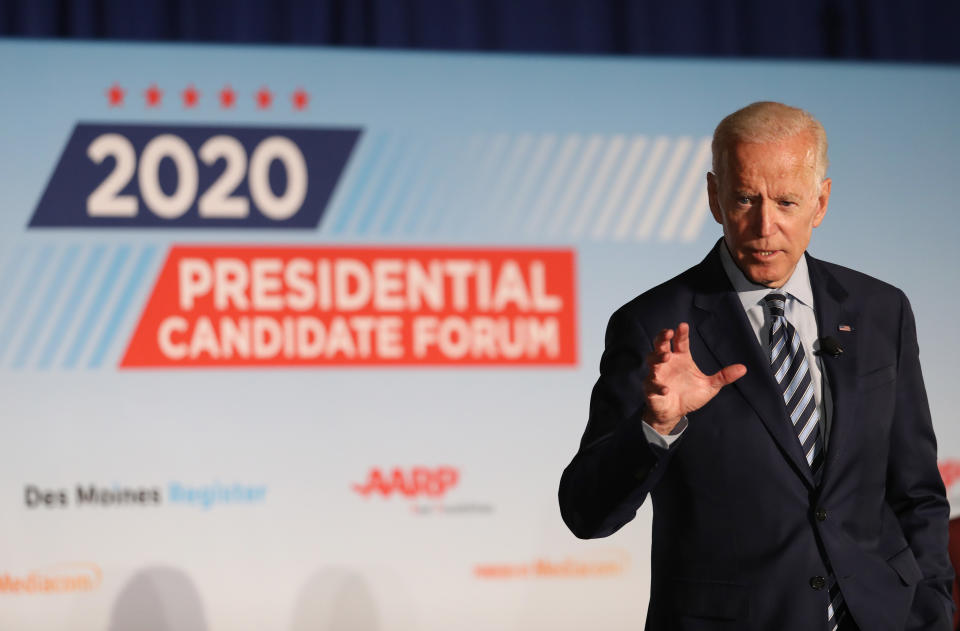

Former Vice President Joe Biden has a section in his Plan for Older Americans where he states that a Biden administration would “call for widespread adoption of workplace savings plans and offer tax credits to small businesses to offset much of the costs.” His campaign, in a statement to Yahoo Finance, said that more details are forthcoming: "Biden for President is dedicated to making a secure retirement possible for all Americans and will be releasing related plans in the coming months."

Andrew Yang has a brief page about the issue proposing “opt-in retirement accounts that have defined contributions that automatically increase with people’s incomes.”

Other candidates have discussed national plans that might require an employer contribution.

Two candidates (John Delaney and Steve Bullock) endorsed the concept of a Guaranteed Retirement Account (GRA) in their responses. Delaney’s GRA would be opened at birth and employers and the individual would be required to make annual contributions equal to a certain percentage of pre-tax income. Both campaigns emphasize that a GRA would still allow states to create their own retirement policies “as a supplement to the federal GRA."

Pete Buttigieg has also talked a bit about guaranteed retirement accounts on the campaign trail. "The basic premise is that employers need to contribute to retirement for everybody and it needs to be pro-rated or portable," he said at an event in June, adding, "Pretty soon, we’ll be talking more about what we think it would take for guaranteed retirement accounts to be established." The mayor's campaign declined to participate in the survey and has yet to offer more detailed plans on the issue.

Portability is a key area where Grumet think’s there might be a chance of action at the federal level.”The gig economy, part time work requires a different imagination for retirement” he says adding that plans that “recognize modernity” are “probably where legislation can move forward.”

Other candidates have offered support for broad outlines of reform. “Beto supports creating a portable retirement account that is accessible to all Americans” said O’Rourke’s campaign; and Marianne Williamson, in her responses, endorsed the idea of “a national minimum coverage standard on retirement plans.”

Silence from some corners of the field

Other campaigns have offered little to no focus on private retirement reform in the campaign so far.

Bernie Sanders (I-VT) has a detailed page on "The Right to a Secure Retirement" with sections on health care, drug prices, Social Security and more — but no mention of private accounts. As a senator, Sanders has highlighted the problem of insufficient retirement savings as a way to argue for his plan to expand Social Security.

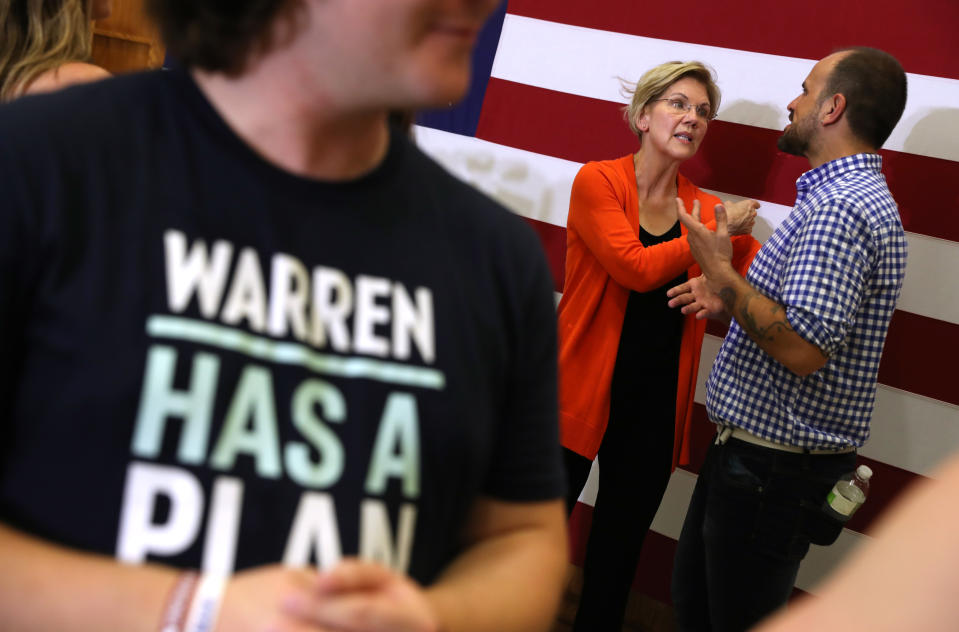

Elizabeth Warren's (D-MA) position page on Social Security notes that Americans aren't saving enough personally and then focuses on expanding Social Security as the way to solve it. Before she ran for president, Warren criticized private retirement accounts. "Employers have replaced guaranteed retirement income with savings plans, like 401(k) plans, that leave the retiree at the mercy of a market that rises and falls, and, sometimes at the mercy of dangerous investment products," she said on the floor of the U.S. Senate in 2013, adding, "These plans often fall short of what retirees need, and nearly half of all American workers don’t even have access to those limited plans."

Kamala Harris (D-CA) has co-sponsored legislation in the Senate to reform Social Security but does not have an issues section on her website focused on retirement issues.

All three of these campaigns declined repeated invitations by Yahoo Finance to provide more details on their plans.

The next steps

President Trump, like his Democratic rivals, hasn’t made private retirement reform a front-burner issue. His administration ended an Obama-era program called myRA that was intended to provide a retirement savings option for lower income workers. When it announced the decision, the Treasury Department said, “Unfortunately, there has been very little demand for the program, and the cost to taxpayers cannot be justified by the assets in the program.”

On Capitol Hill, the SECURE act is a bill designed to help increase access to retirement savings plans by allowing more part-time workers to save for retirement and also making it easier for small businesses provide 401(k)s to their workers. There is bipartisan support for the bill — but also bipartisan agreement that it’s only a first step toward solving the problem. The House of Representatives overwhelmingly passed the bill this spring by a vote of 417-3. The bill is currently languishing in the Senate but there is hope that it will be passed later this year.

Either way, Oregon Treasurer Read expects that the action will remain primarily at the state level for the time being. He says he gets calls from all around the country from states looking to do something similar to OregonSaves.

"Some [states] are really close, some are just kind of getting into it, and they're not always the states that you would expect,” he said. "Sometimes they're very red and conservative states to use as appeals on the basis of an opportunity to be more autonomous and independent to individual people."

OregonSaves requires Oregon businesses to participate in the program if they don’t offer their own retirement plans. However, it does not require employers to contribute to the plan (in fact, it forbids it).

Read’s advice from his work in Oregon: “Go slow [in order] to go far.”

Ben Werschkul is a producer for Yahoo Finance in Washington, DC.

Read more:

A plan that could save Social Security and boost the economy — with one big catch

Americans aren't saving enough for emergencies. Here's a plan to help

Why Social Security might be a loser of the recent budget deal

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.