Des Moines metro developer, charity founder is claimed to owe $70 million, Watchdog finds

Daniel Pettit painted himself as a bold and adventurous developer, who appeared to have not only a Midas touch but a heart of gold.

A one-time mayoral candidate in Waukee, Pettit announced some of that city’s most ambitious projects before the pandemic hit – from a massive 40-acre, $101 million entertainment district called “The Quarter” to an 88,000-square-foot event and office space nearby.

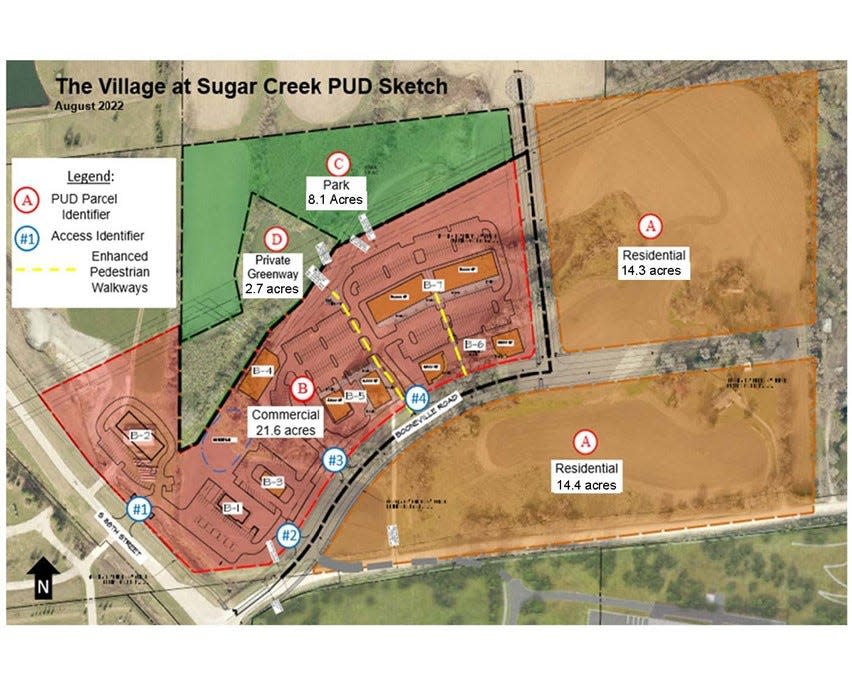

In 2021, Pettit convinced West Des Moines leaders and lenders to back two major commercial-residential projects, The Village at Sugar Creek and Banks Landing, on Booneville Road and South 88th St., north of Des Moines University’s new campus.

Along with his former wife, Rachael, the Drake University graduate founded a faith-based nonprofit called Trailhead International Builders, once enlisting former President George W. Bush to speak at Hy-Vee Hall to help raise money. Pettit said the organization built churches in some of the world's most impoverished countries, from Guatemala to Cuba, an effort that led him to be recognized as one of 10 Outstanding Young Americans by the Jaycees, now known as JCI USA.

But the 43-year-old also had an appetite for lavish things, buying a mansion worth at least $2.4 million with a nine-hole golf course and fishing pond in Johnston, a $1 million painting from pop artist Rob Prior in Miami, and a Bugatti Chiron Super Sport, a rare sports car, from Texas.

And as 2023 draws to a close, Pettit finds himself drowning in financial trouble, hounded by lenders and unhappy former investors and wanted by the law after being held in contempt of court in three civil court cases. On Nov. 30, a Polk County judge sentenced Pettit to six months behind bars for repeatedly ignoring court orders or failing to respond to subpoenas – but he failed to show up Friday morning to voluntarily begin his jail sentence for contempt, court documents show.

Among the willful conduct by Pettit this year that Judge Jeanie Vaudt noted in the sentencing: Pettit liquidated accounts this spring and summer, tried to write a check for a $275,000 Michael Jordan jersey, and transferred around $100,000 from a personal account to a joint account with a woman in Nevada, where he'd headed up a failed cannabis cultivation business. In August, Pettit also applied for life insurance with a $10 million death benefit to be awarded to his own revocable trust, the judge found.

"To put it plainly, it appears that defendent Daniel E. Pettit has consistently not been forthcoming to plaintiffs about his true financial condition and the kinds of results he could deliver to his investors," Vaudt's ruling said. "Many individuals and companies – big, medium and small – potentially have been economically damaged by (his) empty promises and lack of candor as to his true financial position... It is reasonable to assume that some of the money funding that lavish lifestyle came from defendant Daniel E. Pettit's investors."

In September, Pettit claimed in a financial statement submitted to the court to have cash assets of $2 million and total assets of $56 million. He listed his liabilities at $68,000, court documents show.

But documents reviewed by Watchdog in more than two dozen cases filed in Iowa courts show banks have foreclosed on properties he or his corporations purchased. Contractors from consulting to construction have filed mechanic's liens on his property. Investors from Illinois, Minnesota, New Jersey, Nevada, New York and Utah have obtained court judgments worth millions. Several former business partners have accused him of fraud while Pettit defaulted on tens of millions he borrowed.

The Watchdog review revealed judgments and debts of nearly $70 million claimed against Pettit and limited liability corporations in which he is involved. Mechanic's liens taken out against his properties in West Des Moines by others owed money – some for a few thousand, others for almost $800,000 – add to that total.

Police question whether Daniel Pettit was involved in staging a holdup in his home

Pettit, who did not respond to an email and phone call seeking an interview, has no criminal record in Iowa.

But as his troubles mount, Pettit also finds himself at the center of a law enforcement investigation in Johnston, court documents show. Search warrant documents filed in Polk County District Court show Johnston police seized Pettit’s cellphone in late September to conduct a data search after he reported an armed robbery at his home on Sept. 10.

A search warrant application made after the robbery shows he reported the theft of three handguns, two Rolexes worth almost $100,000, about $25,000 worth of Cartier jewelry and a Bentley that he was driving but did not belong to him.

A preliminary search of Pettit's phone after the robbery showed he “promised and/or made payments” for sex and sexually explicit photographs, police allege. The officer involved in the investigation said he had probable cause to believe further evidence of prostitution would be found in the phone, according to search warrant documents filed in Polk County.

A report on the case by Johnston police obtained by Watchdog alleges that Pettit had communication with the robbery suspect and that police sought access to communications on his cell phone to determine "whether Daniel had involvement in the planning and/or staging the incident."

As he faces a barrage of legal trouble, Pettit has already placed the home he owned with his ex-wife on 26 acres in Johnston into a revocable trust under his name alone.

Rachael Pettit, the mother of his two minor children who divorced him earlier this year, has sought to distance herself from him legally and financially, court documents show. Reached Friday, she said she could not comment on the advice of her attorney.

Before Pettit's sentencing, Steven Katz, the head of a brokerage and advisory firm in New Jersey who recruited investors for Pettit and represented some plaintiffs in court cases, said Pettit belongs behind bars.

“Defendant Pettit needs to be confronted with the magnitude of these proceedings and the severity of his failures to comply with the legal process,” Katz said in the affidavit.

Katz told Watchdog Nov. 30 he would not comment on any of the legal action against Pettit, but said he was still in contact with Pettit and that Pettit owed him a lot of money.

David Bruck, a New Jersey attorney representing Sari Kramer, a psychologist who invested more than $500,000 through Katz with Pettit, said she is one of many people damaged by Pettit's failure to pay on loans. “As far as I can see, it was all a fraud,” Bruck said.

A pandemic, then unfulfilled promises, liens, foreclosures on Daniel Pettit developments

Pettit’s failed deals affect not only yet-to-be-constructed developments in West Des Moines but a wide swath of people, lenders and companies beyond Iowa. His ex-wife and his mother, who lives in his hometown of Cedar Rapids, are tangled up in court cases, as are investors in the legal cannabis operation in Nevada, and a venture capitalist in Miami Beach, Florida.

But when, in 2019, Pettit announced the development of a massive entertainment district once called “The Quarter” in Waukee, he was in good standing with city officials, according to city administrator Brad Deets. Others who invested included co-developers Matthew Jennings and Allen Stoye of Pan & Piper, a national firm that is still involved in the project.

Deets said Pettit previously had been involved in the successful Kettleview Development, a project in the Kettlestone development. However, he said, Pettit fell off early as a co-developer in the Waukee entertainment district, which is on the west side of Grand Prairie Parkway and Interstate 80. Now nearly complete, the $136.2 million entertainment complex, called KeeTown Loop, was developed instead by Pan & Piper along with Johnston Golf Development LLC.

By 2020, when the pandemic hit, Pettit's plans for a large event and office space inside what was to be called the Encompass Building – named after one of Pettit’s companies, Encompass Holdings – were never completed, Deets said.

“2020 happened and all those venues hit hard times,” Deets said.

The property was foreclosed upon, court documents show. By 2021, partners who loaned Pettit money for the Waukee entertainment district began accusing him of fraud, court documents show. Pettit later acknowledged in a court filing being in debt to Stoye and Jennings at Pan & Piper for $5.2 million.

“The parties had a dispute that resulted in fraud being alleged against Pettit and Pettit subsequently agreed he owed each of them $2.6 million,” the filing said.

Stoye and Jennings sued Pettit this year in Dallas County after he allegedly failed to repay them.

So did Anderson Four LLC, which loaned Pettit and two of his corporations, Ute Industrial and Encompass Holdings, $11.6 million for the land in Waukee. Anderson Four, managed by Anderson Properties CEO William Anderson of Urbandale, obtained a $5 million judgment this summer for damages and attorney fees.

Neither Stoye nor Jennings nor Anderson would comment for this story.

Struggling to pay debts, Daniel Pettit borrows more

In West Des Moines, Pettit created a limited liability corporation in 2021 to develop the apartments, townhomes and commercial space north of the Des Moines University campus.

The biggest lender to that corporation, called DB Booneville, was Lincoln Savings Bank. The bank loaned DB Booneville almost $10.3 million on a note that matured fast – in October 2022. DB Booneville defaulted, and Lincoln Savings moved to foreclose on the property, court records show.

Pettit and his ex-wife also signed a promissory note to a Delaware limited liability corporation called DMU, Iowa Land, LLC for $5.5 million. That entity was managed by a venture capitalist named Lowell Kraff of Miami Beach, records from Iowa’s secretary of state show. Kraff is executive chairman of a company called Trivergance LLC.

That loan also went into default, leaving not only the city but other investors and lenders in the lurch, court document show. Chris Costa, Knapp Properties’ president and CEO, was appointed receiver in that case in May this year.

West Des Moines city officials did not respond to multiple requests for an interview.

One of the complicating factors in resolving the case, Costa said, is that an infrastructure bond was already in place to install public improvements at the site. The city of West Des Moines, he said, is dealing with an insurance company to ensure the infrastructure is built.

“Pettit will continue to have the opportunity to pay off the lending entities and retain his ownership in the ground, but he’s had that opportunity for some time and he hasn’t been able to come up with the funds,” Costa said.

In June, Farmers State Bank in Waterloo foreclosed on Pettit, his ex-wife, Encompass Holdings, Kettleview LLC, 2565 SE Encompass Investment Group LLC as well as Kurt Brewer, Bernard Feldman, the city of Waukee and CT Corporation, as representative.

The bank had given Black Oak, one of the limited liability corporations involving Pettit, a construction and development loan for $3.3 million in September 2021.

Black Oak still owed more than $3.14 million this year, but it failed to sell the property as of January in accordance with a forbearance agreement. The Shops at Kettlestone was subsequently cleared for sale in September for $11.9 million, court documents show.

Feldman, an investor, also obtained a judgment against Pettit for almost $9.3 million in Polk County. Part of the investment was supposed to be for two projects called Ashworth and Southbranch, but Pettit never bought the real estate, according to court documents. Part was to invest in property in the Banks Landing development north of Des Moines University that was later placed in foreclosure. And $1.1 million was for the Encompass Building property in Waukee, which was sold in lieu of foreclosure, Feldman's case shows.

Feldman declined to comment through his attorney.

Judgments are filed against Daniel Pettit in Iowa from other states

Court documents show Pettit and his limited liability corporations have been the subject of numerous court actions this year involving debts allegedly owed lenders or investors, many from out of state. They show:

In May, Pettit and his ex-wife, as well as corporations he started or was involved with, were ordered to pay an almost $1 million court judgment from Utah in favor of Libertas Funding LLC, a Connecticut company acting for Webbank, a national issuer of consumer and small business credit.

In June, a Minnesota judgment of almost $4.5 million was filed in Iowa against Pettit, his ex-wife and two corporations, Matchbox Investments and LasBox Holdings, after the default of a $4.5 million loan to VH II, another limited liability corporation. Later, a Minnesota judge ordered the local sheriff to seize property there and sell it, court documents show.

In August this year, The Avanza Group LLC of Staten Island notified Pettit and two of his corporations, Encompass Development and Encompass Holdings, of a judgment against them in New York totaling $344,163. When Encompass did not pay, Avanza sought to garnish its account at First Interstate Bank in Clive.

Praesumo Capital LLC, an Illinois company, also filed notice that month of a judgment against Pettit and Black Oak Real Estate Companies LLC for $1.4 million.

In October, Pettit and Encompass Holdings were notified of two default judgments worth $505,195 against them by Kramer, the New Jersey psychologist.

A limited liability corporation called SBBPJV21 LLC also obtained a judgment for $3.4 million against two limited liability corporations tied to Pettit, South Branch Investment Group LLC and Encompass Holdings.

At the end of the month, a judge issued another judgment against Pettit, Encompass Farm LLC (based in Nevada) and Encompass Holdings LLC for $6.45 million and interest of more than $1,500 a day. The judgment, on behalf of Farm Credit Services of America, based in Omaha, related to two loans in default that were made in 2022. Farm Credit Services also put a lien against a property in the Michael’s Landing development in West Des Moines.

This month, a man who heads a family trust in Austin, Texas, who sold Pettit his Bugatti sports car – and later accused him in court documents of fraud and breach of contract – obtained yet another judgment against Pettit for more than $6.13 million after Pettit allegedly bounced checks for payments. In his court filings, trustee Brett Jacobson also sued several of Pettit's corporations and the nonprofits he created, including Advance Sports Local in West Des Moines, Life Local and Trailhead International Builders, the nonprofit Pettit started with his former wife in 2015. That nonprofit showed less than $1 million in revenue for years until Pettit left as president last year. Since then, its revenues have grown to over $4 million. Officials from Trailhead International did not return phone calls seeking comment.

Lee Rood's Reader's Watchdog column helps Iowans get answers and accountability from public officials, the justice system, businesses and nonprofits. Reach her at lrood@registermedia.com, at 515-284-8549, on Twitter at @leerood or on Facebook at Facebook.com/readerswatchdog.

This article originally appeared on Des Moines Register: Iowa developer, charity founder Daniel Pettit accused of owing $70M