Despite Lacking Profits AVIC International Holding (HK) (HKG:232) Seems To Be On Top Of Its Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, AVIC International Holding (HK) Limited (HKG:232) does carry debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for AVIC International Holding (HK)

What Is AVIC International Holding (HK)'s Debt?

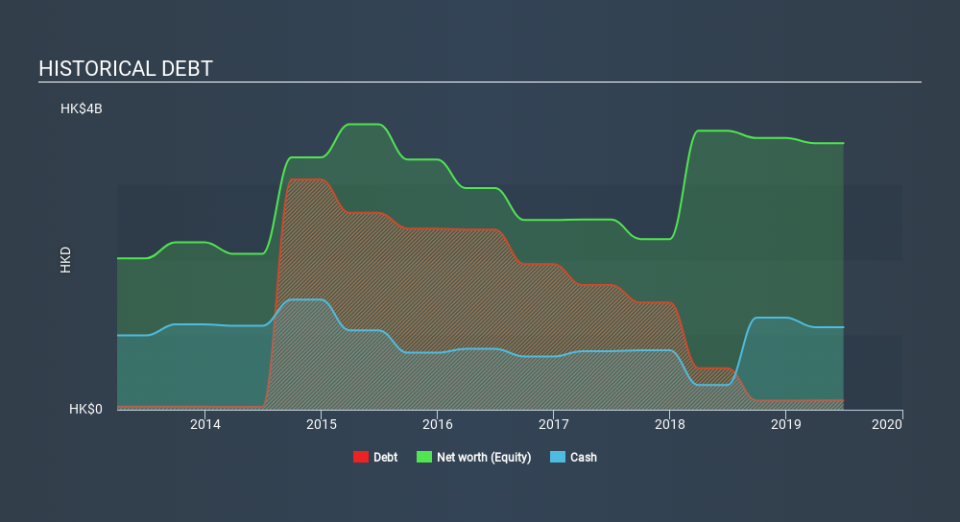

As you can see below, at the end of June 2019, AVIC International Holding (HK) had HK$124.4m of debt, up from HK$554 a year ago. Click the image for more detail. However, its balance sheet shows it holds HK$1.10b in cash, so it actually has HK$975.1m net cash.

How Strong Is AVIC International Holding (HK)'s Balance Sheet?

Zooming in on the latest balance sheet data, we can see that AVIC International Holding (HK) had liabilities of HK$575.7m due within 12 months and liabilities of HK$383.3m due beyond that. On the other hand, it had cash of HK$1.10b and HK$151.1m worth of receivables due within a year. So it actually has HK$291.6m more liquid assets than total liabilities.

It's good to see that AVIC International Holding (HK) has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Due to its strong net asset position, it is not likely to face issues with its lenders. Simply put, the fact that AVIC International Holding (HK) has more cash than debt is arguably a good indication that it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But it is AVIC International Holding (HK)'s earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year AVIC International Holding (HK) wasn't profitable at an EBIT level, but managed to grow its revenue by 146%, to HK$1.5b. So there's no doubt that shareholders are cheering for growth

So How Risky Is AVIC International Holding (HK)?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months AVIC International Holding (HK) lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of HK$116m and booked a HK$14m accounting loss. But the saving grace is the HK$975.1m on the balance sheet. That kitty means the company can keep spending for growth for at least two years, at current rates. The good news for shareholders is that AVIC International Holding (HK) has dazzling revenue growth, so there's a very good chance it can boost its free cash flow in the years to come. High growth pre-profit companies may well be risky, but they can also offer great rewards. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with AVIC International Holding (HK) (at least 1 which is significant) , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.