Detroit property tax lawsuit revived by appeals court

Detroit homeowners who sued the city over delayed property tax appeal notices will head back to court after the dismissal of their lawsuit was reversed in a ruling Monday.

The U.S. Circuit Court of Appeals for the 6th Circuit overturned a lower federal court's decision from last year that threw out the class action over the city's delayed delivery of more than 260,000 residential property tax notices in 2017.

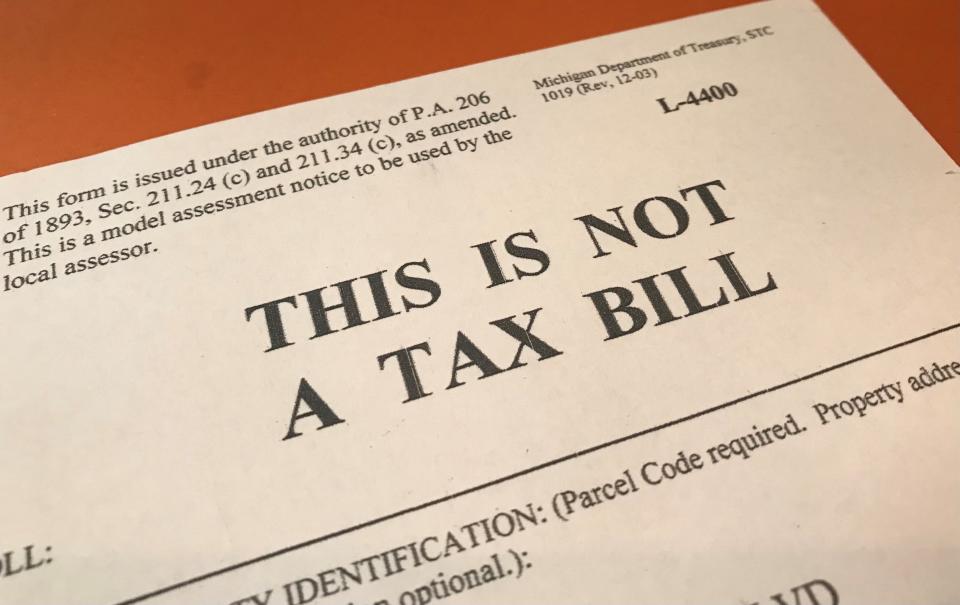

The notices inform residents of their property assessments — the values on which their tax bills are based — and how to appeal them. Detroit's overassessment of homes has been documented by researchers for years but city officials argue they have corrected the problem.

The homeowners who sued said their due process rights were violated because of the late delivery and that the city didn't do enough to communicate to residents that they later extended the deadline. The notices were mailed Feb. 14, noting that the appeals deadline was four days later on Feb. 18, according to court documents.

More: GM received $3.8 billion in tax credits from Michigan to keep jobs, automaker reveals

More: Buttigieg: White House will continue to push for gas-tax holiday to relieve fuel costs

The city extended the deadline to Feb. 28, publicized through public announcements and various news outlets. But the city did not do another mass mailing to homeowners of the new deadline.

"Detroit did not take reasonable steps to ensure this information would reach individual taxpayers," according to Monday's ruling written by Appeals Judge Julia Smith Gibbons.

The homeowners are asking to be paid damages of "an amount to be determined by trial" and the chance to appeal their 2017 assessments retroactively, among other demands, according to the lawsuit.

Last year, U.S. District Judge Nancy Edmunds dismissed the case, in part, because she said the federal court lacked jurisdiction within state tax systems and that the city extended the deadline.

The lawsuit, filed by the Chicago law firm Goldman Ismail Tomaselli Brennan & Baum, also named Mayor Mike Duggan, Deputy CFO/Assessor Alvin Horhn, Wayne County and state tax officials as defendants.

Detroit officials said they will continue to fight the case.

"We are disappointed in the ruling by the court of appeals and plan to vigorously defend our position in District Court," Deputy Corporation Counsel Chuck Raimi said in written statement.

Lawyers for the homeowners said they plan to pursue the case "vigorously."

"All Detroit homeowners deserve the opportunity to be heard," the lawyers said in a written statement. "The Circuit’s ruling confirms what this suit has said all along: The City of Detroit failed to give Detroit homeowners any clear path to appeal their property tax assessments in 2017."

Contact Christine MacDonald: cmacdonald@freepress.com or 313-418-2149.

This article originally appeared on Detroit Free Press: Detroit property tax lawsuit revived by appeals court