Detroiters can appeal their property values next month: What to know

- Oops!Something went wrong.Please try again later.

Starting next month, Detroiters can begin the process to appeal the assessed value of their properties.

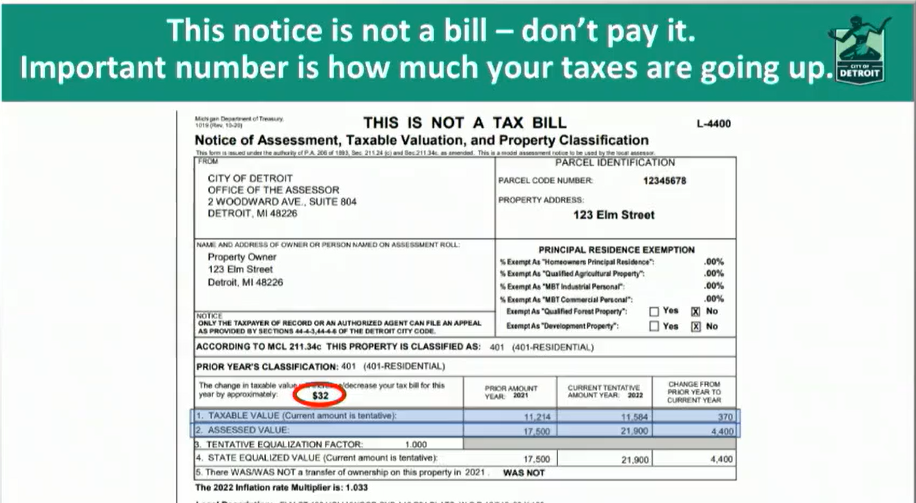

Assessment notices — which basically tell a homeowner how much their property is worth and how much of that is taxable — are being sent out this week and should hit mailboxes soon. Residents will have a roughly three-week period, known as the assessors review, from Feb. 1 through Feb. 22 to make their case and challenge their property assessment.

Last year, the average Detroit home value went up 31%, Mayor Mike Duggan said during a Tuesday news briefing. This continues a five-year growth trend. Some neighborhoods — East English Village, Chandler Park and Corktown — saw a 60% increase. The projections are based on a recent sales study and citywide property value analysis.

However, property taxes are going to go up only 3% because under Michigan law, property tax increases are capped at the rate of inflation as long as you stay in the house, Duggan said.

"We saw property values grow," he said. "And in this city our primary source of wealth, from generation to generation, has been in our homeownership. For most families, that is your wealth and a lot of families are far better off today than they were just a few years ago." .

The value of residential properties in the city is now tentatively $4.8 billion. In 2017, it was $2.8 billion, officials said.

More: Detroit overtaxed homeowners $600M. Years later, advocates still seeking reparations.

More: Nonprofit looks to help Detroiters get furnace repairs after summer flooding

Overassessments are a contentious issue in the city. A Detroit News investigation found that between 2010 and 2016, the city overtaxed homeowners by at least $600 million. More than 92% — of the 173,000 Detroit homes reviewed — were found to be overtaxed by an average of $3,800.

Last week, housing advocates — joined by U.S. Rep. Rashida Tlaib, D-Detroit, and Detroit City Council President Mary Sheffield — proposed a plan to compensate overtaxed Detroiters, including small business support, home repair grants and oversight measures.

"There is no question assessments were too high from 2011 to 2013. ... And I'm continuing to talk to council about a resolution, but any suggestion that taxes are illegally high today is just utter nonsense," Duggan said, adding that the taxes Detroiters are paying are below residential property values, which rose from 2015 to 2022.

In 2020, a federal class action was filed claiming that the city was late in delivering more than 260,000 residential property tax notices in 2017, leading to inflated property tax bills issued in recent years. The case was later dismissed.

Michigan law prohibits municipalities from assessing any property at more than 50% of its market value.

"I encourage everyone who owns property to take advantage of your right to question how your property is valued and to understand how wealth is generated and how the assessment process works," said Alvin Horhn, the city of Detroit's deputy chief financial officer and assessor.

The Property Tax Appeal Project — by the University of Michigan Law School and grassroots group Coalition for Property Tax Justice — is offering free legal help to eligible Detroiters who are interested in contesting their property value, said project director Marie Sheehan.

Here's a rundown of what to know:

The process and key dates

There are three opportunities for a taxpayer to appeal their property value: the local assessors review in February, another local review in March and then a tax tribunal at the state level.

First, a homeowner will receive an assessment notice. It indicates how much a property is worth (or the assessed value) based on real estate market conditions, how much is taxable and how to challenge the assessed value.

If a taxpayer wants to challenge the property value, they must first appeal to the assessors review, which is slated to take place between Feb. 1 and Feb. 22. That review can take into account structural defects, fire damage or demolition, according to the city.

"We will sit down with you, we will explain the process, we will answer any questions you have. If we need to go to your property, we will go to your property to assure you that we have valued your property according to law, according to market value," Horhn said.

As part of their appeal letter, homeowners should start looking for comparable properties and note the condition of a home and neighborhood, Sheehan said. They should take photos, get repair estimates and, if they are able to — a home appraisal.

"If you have a hole in your roof, if you have water damage, if you have mold, if you have any anything that might require ... extensive repairs, you want to include that," Sheehan said.

Residents who are not satisfied with the February decision may appeal again between March 8 and March 26 during what's called the March Board of Review. Taxpayers can appeal for a third time before the Michigan Tax Tribunal by July 31.

Assessment notices will be mailed out to more than 408,000 residential, commercial, industrial and personal property owners. These are not tax bills. Those will be mailed out at the end of June and in November, according to the city.

How to make an appeal

The assessors review process will take place remotely this year but people will have the option to meet via teleconference, according to the city.

Taxpayers can begin the process by emailing AssessorReview@detroitmi.gov or by mail at the "City of Detroit Office of the Assessor – ABOR," 2 Woodward Ave., Suite 804, Detroit, MI 48226.

They can also appeal online at www.detroitmi.gov/aborappeal2022, which will be available Feb. 1 through Feb 22.

According to Sheehan, a strong appeal letter includes:

A proposed assessed value.

Three to five nearby comparable properties that are selling for less than the market value of the home.

The condition of the home along with the surrounding neighborhood.

"How many vacant properties are on your block? Is there trash dumping on your block? Has there been any fires on your block? Are the sidewalks and streets and nearby lots well maintained?" she said.

Where to get help, more information

The Property Tax Appeal Project works with Detroit homeowners who wish to appeal their home's assessment. Homeowners who want to apply for help should fill out an interest form at https://bit.ly/PropertyTaxAppealProject before Feb. 15. The group can be reached at 313-438-8698 or by email at law-propertytax@umich.edu.

"Homeowners who connect with us and sign up for our services are paired with an advocate that will help them craft their appeal letter" and help them during the subsequent review process, Sheehan said.

Homeowners who live in their property as their primary residence and whose property is worth $100,000 or less are eligible for assistance through the Property Tax Appeal Project.

For more information about the city of Detroit's property assessment process, go to https://bit.ly/propertyassessmentappeal.

Nushrat Rahman covers issues related to economic mobility for the Detroit Free Press and Bridge Detroit as a corps member with Report for America, an initiative of The GroundTruth Project. Make a tax-deductible contribution to support her work at bit.ly/freepRFA.

Contact Nushrat: nrahman@freepress.com; 313-348-7558. Follow her on Twitter: @NushratR. Sign up for Bridge Detroit's newsletter. Become a Free Press subscriber.

This article originally appeared on Detroit Free Press: Detroiters can appeal their property value next month