Did Allegion's (NYSE:ALLE) Share Price Deserve to Gain 89%?

Stock pickers are generally looking for stocks that will outperform the broader market. Buying under-rated businesses is one path to excess returns. To wit, the Allegion share price has climbed 89% in five years, easily topping the market return of 47% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 12% in the last year, including dividends.

See our latest analysis for Allegion

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

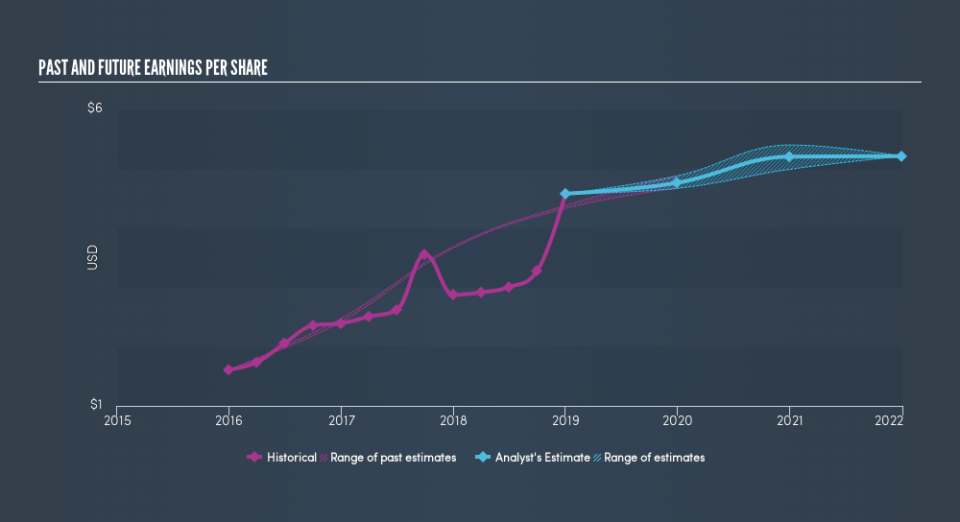

Over half a decade, Allegion managed to grow its earnings per share at 65% a year. The EPS growth is more impressive than the yearly share price gain of 14% over the same period. Therefore, it seems the market has become relatively pessimistic about the company.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Allegion has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Allegion stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Allegion's TSR for the last 5 years was 97%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's good to see that Allegion has rewarded shareholders with a total shareholder return of 12% in the last twelve months. That's including the dividend. However, that falls short of the 14% TSR per annum it has made for shareholders, each year, over five years. If you would like to research Allegion in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.