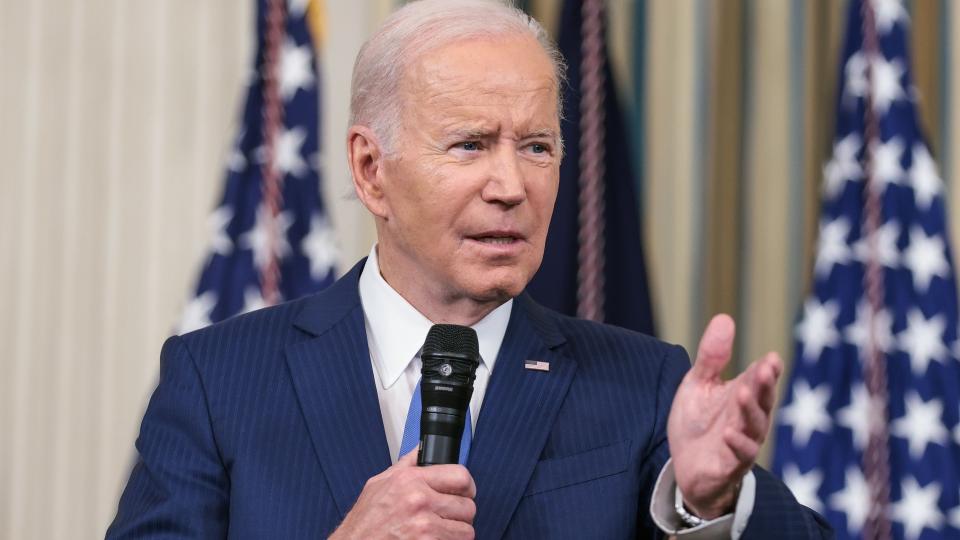

How Did Biden’s Second Year Impact Our Wallets?

From the peak of inflation in the summer to the depths of the crypto winter, 2022 was a year of financial highs and lows. President Joe Biden’s second year in office had a historical impact on budgets, bank accounts and wallets across the country. Like all that came before, Biden will get credit for things he didn’t do and blame for things he couldn’t help, but in the end, presidents are responsible for the economies they oversee.

Find Out: 6 Types of Retirement Income That Aren’t Taxable

See: States Whose Economies Are Failing vs. States Whose Economies Are Thriving

Here’s a look at how Biden’s second year impacted your wallet.

The Biggest Story Is the Recession That Wasn’t

Few things affect the wallets of more ordinary people than a recession — and the fact that the economy isn’t in one right now is the financial underdog story of the year.

According to the Dallas Fed, America’s GDP shrunk by 1.6% and 0.9% in the first and second quarters of the year — and that should have been the ball game.

Two consecutive quarters of negative economic production is a telltale sign of a recession, and with stocks in a bear market, a downturn felt like a foregone conclusion in June. But you can’t have a recession with full employment, and the jobless rate remained safely below 4% every month but January — closer to 3.5% most months.

The labor market’s defiance was truly historic.

According to economic journalist Ben Casselman, 1947 was the last and only time that two consecutive quarters of negative GDP brought gains in jobs, industrial production and consumer spending.

Take Our Poll: Do You Think Student Loan Debt Should Be Forgiven?

High Inflation and Interest Rates Defined the Year

Just like recessions, the president can’t directly control inflation or interest rates — but executive policy and legislative pursuits can indeed move the needle in one direction or the other.

Just About Everybody Paid More for Less in 2022

The highest inflation in 40 years directly impacted more wallets than any other financial storyline of 2022. Biden’s proponents might say that his Inflation Reduction Act prevented a recession while slowing worldwide price increases that the pandemic made inevitable. His detractors might say that Biden’s $1.9 trillion American Rescue Plan triggered the inflation crisis by pumping too much money into the economy too quickly.

No matter the macroeconomic perspective, the harsh realities on the ground didn’t change. American households had less buying power and few places to hide as prices rose fastest and highest in crucial categories like food, fuel, transportation, utilities and housing.

Rising Rates Made It Easier To Save but Harder To Borrow

The Federal Reserve, an independent body, sets interest rates — not the president — and the president can’t bar the Fed from raising them. But the president does appoint the Fed chair and other voting members and can use the power of his bully pulpit to influence strategy.

Biden consistently promoted Fed independence and mostly stepped aside as it aggressively raised interest rates at a historic pace.

His opponents called it classic buck-passing, but sincere or not, the impact on the ordinary household is the same. Money is more expensive to borrow than it has been in 20 years and credit card APRs are at a 30-year high — but your savings account yield is probably a whole lot prettier than it was last year, which means your savings will grow faster.

Real Wages Fell — But Not for Workers Who Risked a Change

A tight job market and high inflation positioned workers to demand higher wages. They often got them, but according to the Bureau of Labor Statistics, real average hourly wages declined by 2.3% between October 2021 and October 2022 — prices rose so quickly that income simply couldn’t keep up.

The one exception was the workers who rolled the dice and changed jobs despite the threat of an imminent recession. According to Pew, their gambles paid off. From April 2021 to March 2022, which is when quitting rates were at their high, most workers who left their jobs for another one saw gains in real wages.

College Borrowers Put Off 12 Payments

Biden was poised to directly impact the wallets of millions of Americans through his proposed student loan forgiveness program, but that policy now appears doomed for death by Supreme Court.

The president did, however, extend the pause on repayments through all of 2022. The extension gave borrowers the choice of continuing to pay down their debt or putting off payments without accruing interest or penalties.

According to the Federal Reserve, the average student loan payment is $393 for those who indicate that they currently are making payments on one or more loans for their own education. Over 12 months, that’s more than $4,700 of financial wiggle room for 43 million federal student debt holders.

When the courts blocked his loan forgiveness plan, Biden extended the repayment pause through part of 2023.

Biden Signed Future Healthcare Savings Into Law

The Inflation Reduction Act includes several provisions that the administration says will lower healthcare costs for millions of families, but many of them don’t phase in until 2024-27. However, Biden cemented three big changes for Medicare in 2023:

Drug companies will have to pay rebates to the federal government when their price increases outpace inflation for any drugs that Medicare recipients use.

Insulin cost-sharing will be capped at $35 per month for Medicare beneficiaries.

Cost-sharing will be eliminated for adult vaccines that Medicare Part D covers.

SNAP Benefits Were Highest in 2022

More than 41 million Americans rely on the Supplemental Nutrition Assistance Program (SNAP), and their average benefits were higher this year than they were last year or will be next year.

In late 2021, Biden’s USDA revised the program and added $36.24 to the average recipient’s monthly benefits. According to the Committee For a Responsible Federal Budget, the average payment for 2022 was $222, compared to $218 in 2021 and $173 projected for 2023. The $36.24 boost in 2022 replaced a 15% emergency increase that equaled only about $27 per month in 2021. The average monthly payment will drop next year because the pandemic-era emergency allocation will expire.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: How Did Biden’s Second Year Impact Our Wallets?