Did Bonesupport Holding's (STO:BONEX) Share Price Deserve to Gain 21%?

Passive investing in index funds can generate returns that roughly match the overall market. But investors can boost returns by picking market-beating companies to own shares in. To wit, the Bonesupport Holding AB (publ) (STO:BONEX) share price is 21% higher than it was a year ago, much better than the market return of around 1.7% (not including dividends) in the same period. That's a solid performance by our standards! We'll need to follow Bonesupport Holding for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

See our latest analysis for Bonesupport Holding

Because Bonesupport Holding is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Bonesupport Holding saw its revenue shrink by 9.7%. The stock is up 21% in that time, a fine performance given the revenue drop. To us that means that there isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

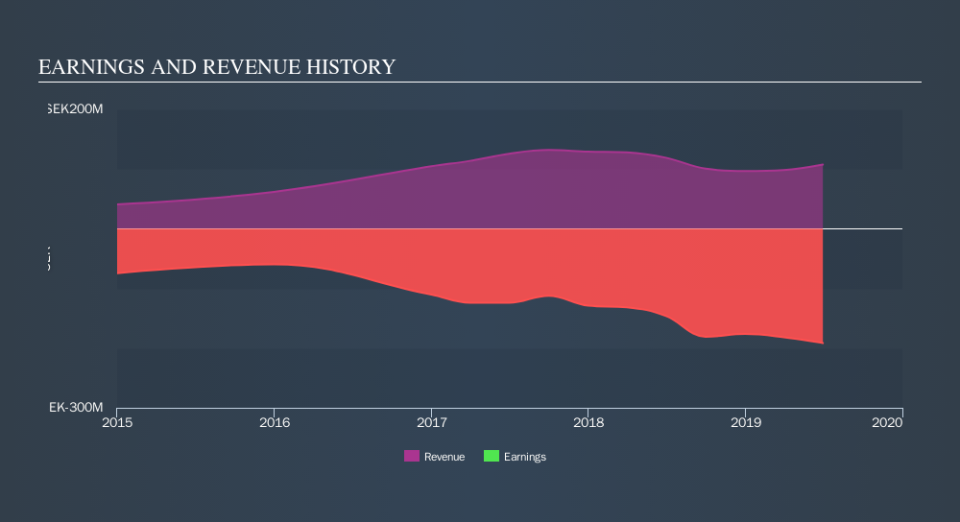

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Bonesupport Holding stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Bonesupport Holding shareholders have gained 21% over the last year. A substantial portion of that gain has come in the last three months, with the stock up 4.6% in that time. This suggests the company is continuing to win over new investors. If you would like to research Bonesupport Holding in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.