Did Business Growth Power AnalytixInsight's (CVE:ALY) Share Price Gain of 156%?

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But if you buy shares in a really great company, you can more than double your money. For example, the AnalytixInsight Inc. (CVE:ALY) share price has soared 156% in the last three years. Most would be happy with that. Also pleasing for shareholders was the 35% gain in the last three months.

See our latest analysis for AnalytixInsight

AnalytixInsight wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last three years AnalytixInsight has grown its revenue at 40% annually. That's much better than most loss-making companies. Along the way, the share price gained 37% per year, a solid pop by our standards. This suggests the market has recognized the progress the business has made, at least to a significant degree. That's not to say we think the share price is too high. In fact, it might be worth keeping an eye on this one.

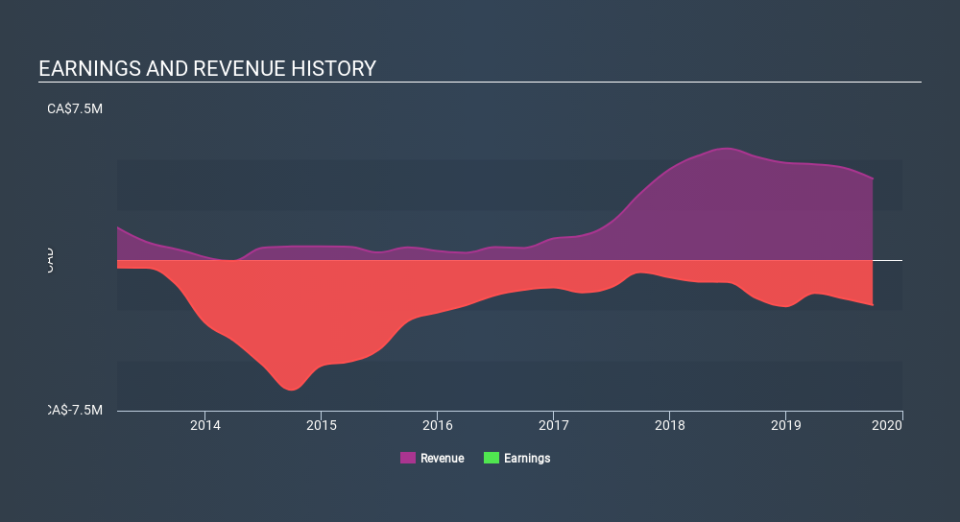

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on AnalytixInsight's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that AnalytixInsight shareholders have received a total shareholder return of 28% over one year. That gain is better than the annual TSR over five years, which is 14%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - AnalytixInsight has 6 warning signs (and 1 which is concerning) we think you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.