Did Business Growth Power Control4's (NASDAQ:CTRL) Share Price Gain of 138%?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you buy shares in a really great company, you can more than double your money. For instance the Control4 Corporation (NASDAQ:CTRL) share price is 138% higher than it was three years ago. How nice for those who held the stock! It's down 2.2% in the last seven days.

View our latest analysis for Control4

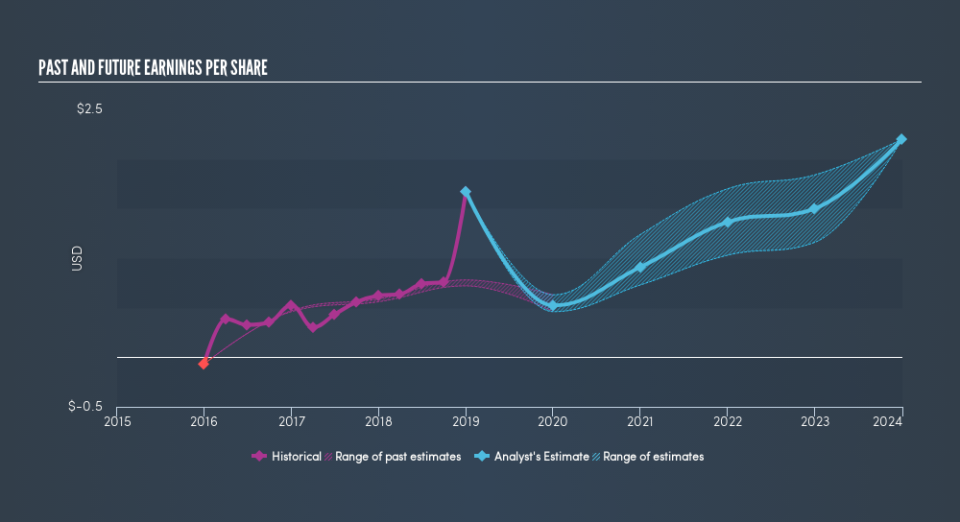

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Control4 became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Control4 has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling Control4 stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market gained around 8.6% in the last year, Control4 shareholders lost 19%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.6% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before forming an opinion on Control4 you might want to consider these 3 valuation metrics.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.