Did Business Growth Power PharmAust's (ASX:PAA) Share Price Gain of 175%?

PharmAust Limited (ASX:PAA) shareholders have seen the share price descend 12% over the month. But that doesn't detract from the splendid returns of the last year. We're very pleased to report the share price shot up 175% in that time. So we think most shareholders won't be too upset about the recent fall. More important, going forward, is how the business itself is going.

Check out our latest analysis for PharmAust

PharmAust isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last twelve months, PharmAust's revenue grew by 33%. That's a fairly respectable growth rate. While that revenue growth is pretty good the share price performance outshone it, with a lift of 175% as mentioned above. Given that the business has made good progress on the top line, it would be worth taking a look at its path to profitability. But investors need to be wary of how the 'fear of missing out' could influence them to buy without doing thorough research.

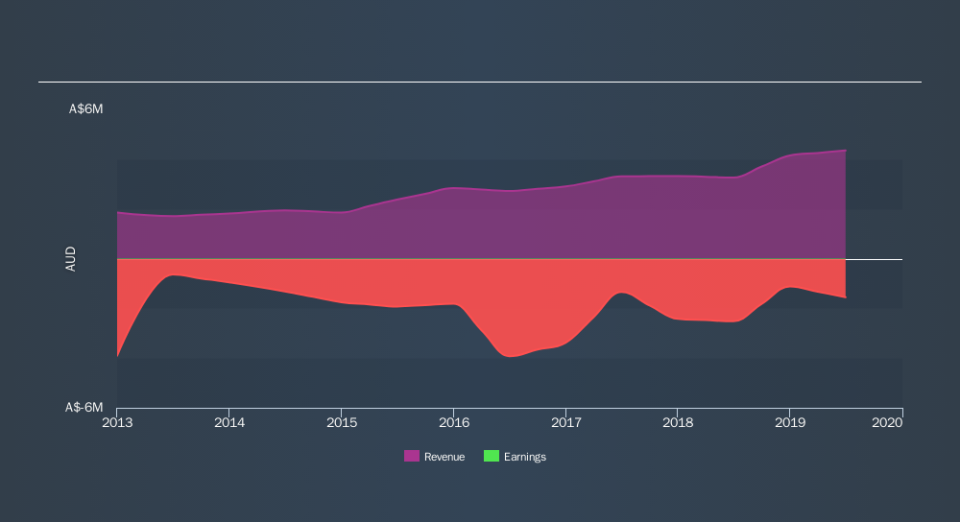

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on PharmAust's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between PharmAust's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. PharmAust hasn't been paying dividends, but its TSR of 203% exceeds its share price return of 175%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's nice to see that PharmAust shareholders have received a total shareholder return of 203% over the last year. There's no doubt those recent returns are much better than the TSR loss of 4.7% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.