Did Changing Sentiment Drive B.A.G. Films and Media's (NSE:BAGFILMS) Share Price Down By 17%?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The simplest way to benefit from a rising market is to buy an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in B.A.G. Films and Media Limited (NSE:BAGFILMS) have tasted that bitter downside in the last year, as the share price dropped 17%. That contrasts poorly with the market return of 1.1%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 4.7% in three years. In the last ninety days we've seen the share price slide 21%. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

See our latest analysis for B.A.G. Films and Media

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

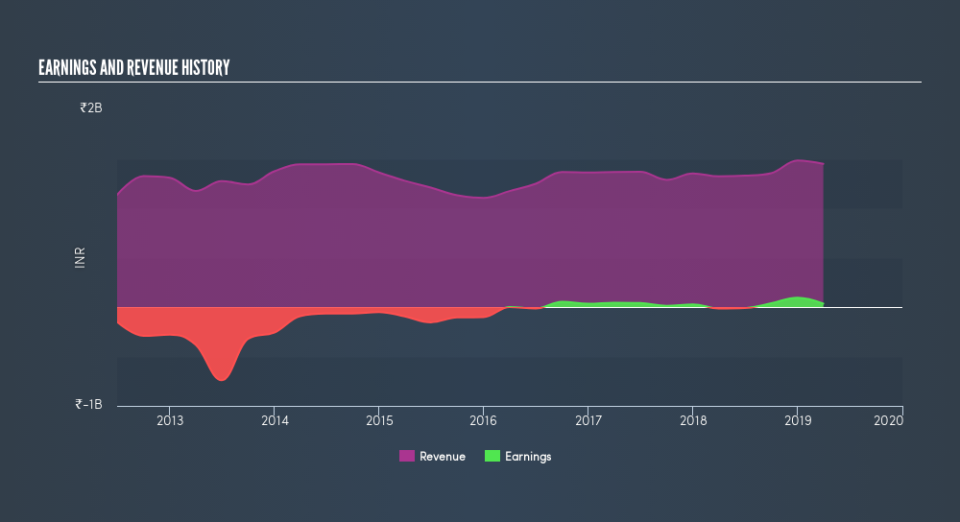

During the last year B.A.G. Films and Media grew its earnings per share, moving from a loss to a profit. When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action. But we may find different metrics more enlightening.

B.A.G. Films and Media's revenue is actually up 9.5% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

Take a more thorough look at B.A.G. Films and Media's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 1.1% in the last year, B.A.G. Films and Media shareholders lost 17%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 0.2% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Is B.A.G. Films and Media cheap compared to other companies? These 3 valuation measures might help you decide.

Of course B.A.G. Films and Media may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.