Did Changing Sentiment Drive BCI Group Holdings's (HKG:8412) Share Price Down A Worrying 53%?

Taking the occasional loss comes part and parcel with investing on the stock market. And unfortunately for BCI Group Holdings Limited (HKG:8412) shareholders, the stock is a lot lower today than it was a year ago. To wit the share price is down 53% in that time. BCI Group Holdings may have better days ahead, of course; we've only looked at a one year period. Shareholders have had an even rougher run lately, with the share price down 28% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

See our latest analysis for BCI Group Holdings

BCI Group Holdings isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In just one year BCI Group Holdings saw its revenue fall by 14%. That's not what investors generally want to see. The share price drop of 53% is understandable given the company doesn't have profits to boast of. Having said that, if growth is coming in the future, the stock may have better days ahead. We don't generally like to own companies with falling revenues and no profits, so we're pretty cautious of this one, at the moment.

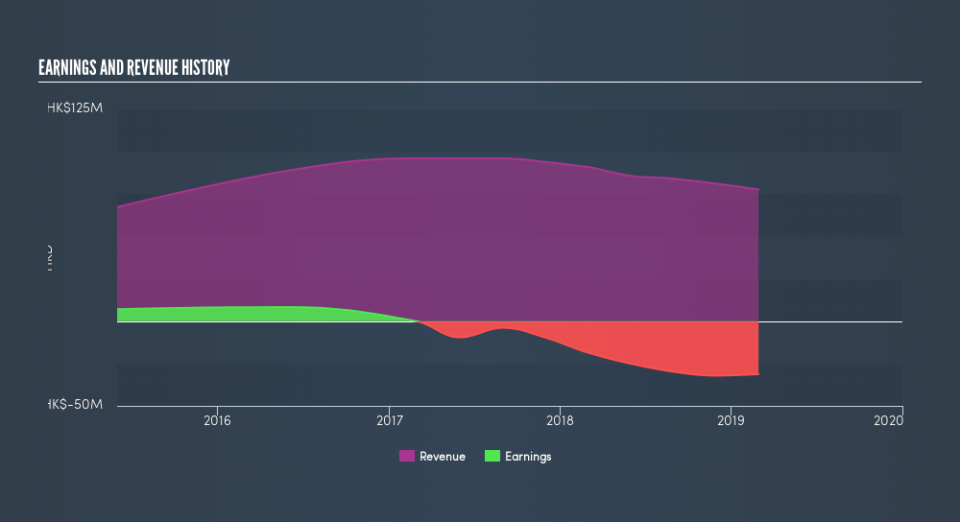

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

Balance sheet strength is crucual. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

BCI Group Holdings shareholders are down 53% for the year, even worse than the market loss of 3.1%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. The share price decline has continued throughout the most recent three months, down 28%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. You could get a better understanding of BCI Group Holdings's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

We will like BCI Group Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.