Did Changing Sentiment Drive Beijing Enterprises Environment Group's (HKG:154) Share Price Down A Painful 77%?

Long term investing works well, but it doesn't always work for each individual stock. We don't wish catastrophic capital loss on anyone. Imagine if you held Beijing Enterprises Environment Group Limited (HKG:154) for half a decade as the share price tanked 77%. Furthermore, it's down 11% in about a quarter. That's not much fun for holders.

See our latest analysis for Beijing Enterprises Environment Group

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

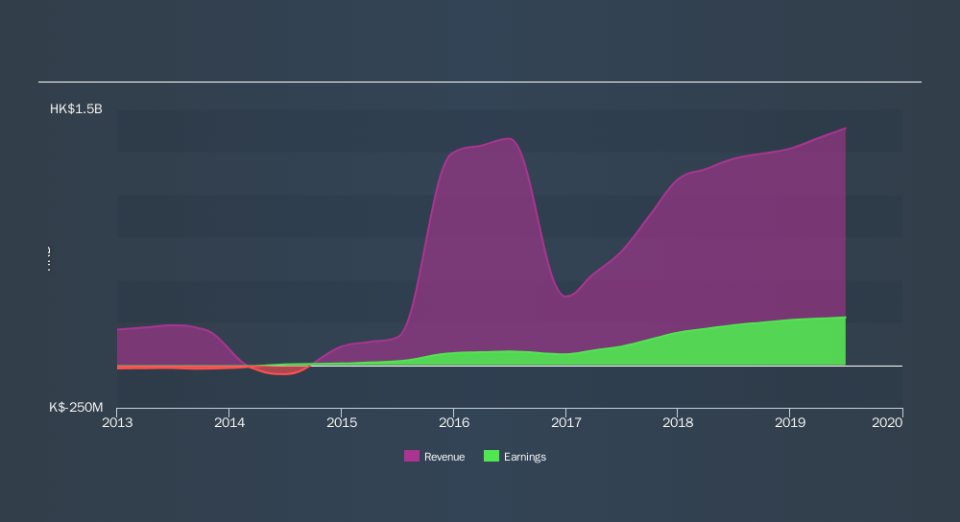

While the share price declined over five years, Beijing Enterprises Environment Group actually managed to increase EPS by an average of 106% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

Due to the lack of correlation between the EPS growth and the falling share price, it's worth taking a look at other metrics to try to understand the share price movement.

In contrast to the share price, revenue has actually increased by 29% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Beijing Enterprises Environment Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Beijing Enterprises Environment Group shareholders are down 4.5% for the year, but the market itself is up 4.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 26% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.