Did Changing Sentiment Drive Chengdu Expressway's (HKG:1785) Share Price Down By 12%?

It's easy to feel disappointed if you buy a stock that goes down. But sometimes a share price fall can have more to do with market conditions than the performance of the specific business. So while the Chengdu Expressway Co., Ltd. (HKG:1785) share price is down 12% in the last year, the total return to shareholders (which includes dividends) was -5.3%. And that total return actually beats the market return of -15%. Chengdu Expressway hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. The share price has dropped 12% in three months. However, one could argue that the price has been influenced by the general market, which is down 11% in the same timeframe.

View our latest analysis for Chengdu Expressway

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Even though the Chengdu Expressway share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past.

The divergence between the EPS and the share price is quite notable, during the year. But we might find some different metrics explain the share price movements better.

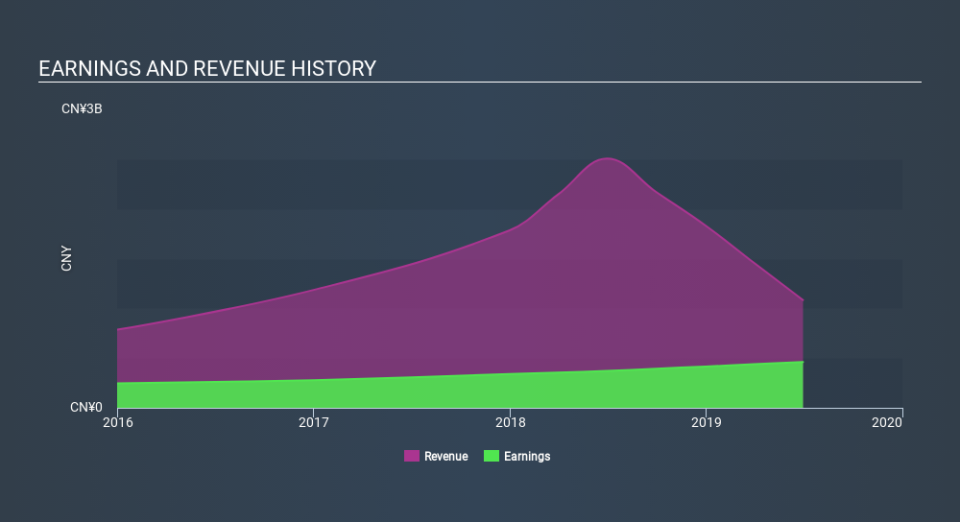

Chengdu Expressway's dividend seems healthy to us, so we doubt that the yield is a concern for the market. In fact, it seems more likely that the revenue fall of 57% in the last year is the worry. The market may be extrapolating the decline, leading to questions around the sustainability of the EPS.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Chengdu Expressway's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Chengdu Expressway, it has a TSR of -5.3% for the last year. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

While they no doubt would have preferred make a profit, at least Chengdu Expressway shareholders didn't do too badly in the last year. Their loss of 5.3% , including dividends, actually beat the broader market, which lost around 15%. Things weren't so bad until the last three months, when the stock dropped 12%. The recent drop implies that investors are increasingly averse to the stock -- quite possibly due to a deterioration of the business. In times of uncertainty we usually try to focus on the long term fundamental business metrics. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 4 warning signs for Chengdu Expressway that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.