Did Changing Sentiment Drive China Chuanglian Education Financial Group's (HKG:2371) Share Price Down A Painful 80%?

While it may not be enough for some shareholders, we think it is good to see the China Chuanglian Education Financial Group Limited (HKG:2371) share price up 22% in a single quarter. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. Indeed, the share price is down a whopping 80% in that time. So we don't gain too much confidence from the recent recovery. The important question is if the business itself justifies a higher share price in the long term.

Check out our latest analysis for China Chuanglian Education Financial Group

China Chuanglian Education Financial Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over five years, China Chuanglian Education Financial Group grew its revenue at 13% per year. That's a pretty good rate for a long time period. So it is unexpected to see the stock down 27% per year in the last five years. The truth is that the growth might be below expectations, and investors are probably worried about the continual losses.

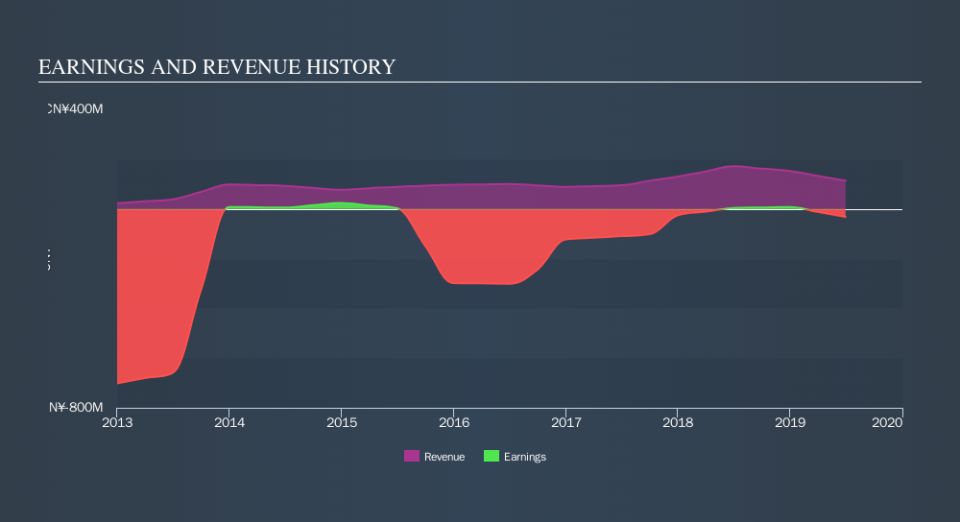

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

While the broader market gained around 4.2% in the last year, China Chuanglian Education Financial Group shareholders lost 27%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 27% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of China Chuanglian Education Financial Group by clicking this link.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.