Did Changing Sentiment Drive China Nuclear Energy Technology's (HKG:611) Share Price Down A Painful 74%?

Every investor on earth makes bad calls sometimes. But you have a problem if you face massive losses more than once in a while. So take a moment to sympathize with the long term shareholders of China Nuclear Energy Technology Corporation Limited (HKG:611), who have seen the share price tank a massive 74% over a three year period. That would certainly shake our confidence in the decision to own the stock. And more recent buyers are having a tough time too, with a drop of 51% in the last year. Shareholders have had an even rougher run lately, with the share price down 22% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

See our latest analysis for China Nuclear Energy Technology

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Although the share price is down over three years, China Nuclear Energy Technology actually managed to grow EPS by 42% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We note that, in three years, revenue has actually grown at a 8.4% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating China Nuclear Energy Technology further; while we may be missing something on this analysis, there might also be an opportunity.

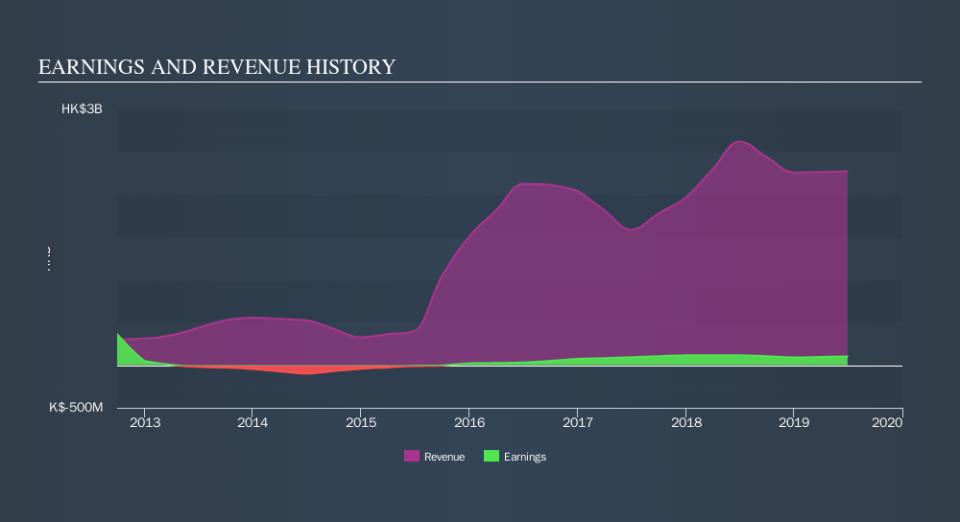

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on China Nuclear Energy Technology's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market lost about 5.3% in the twelve months, China Nuclear Energy Technology shareholders did even worse, losing 51%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 19% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You could get a better understanding of China Nuclear Energy Technology's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.