Did Changing Sentiment Drive New Concepts Holdings's (HKG:2221) Share Price Down A Worrying 69%?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The nature of investing is that you win some, and you lose some. And unfortunately for New Concepts Holdings Limited (HKG:2221) shareholders, the stock is a lot lower today than it was a year ago. The share price is down a hefty 69% in that time. Notably, shareholders had a tough run over the longer term, too, with a drop of 53% in the last three years. The falls have accelerated recently, with the share price down 24% in the last three months. But this could be related to the weak market, which is down 10% in the same period.

Check out our latest analysis for New Concepts Holdings

New Concepts Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

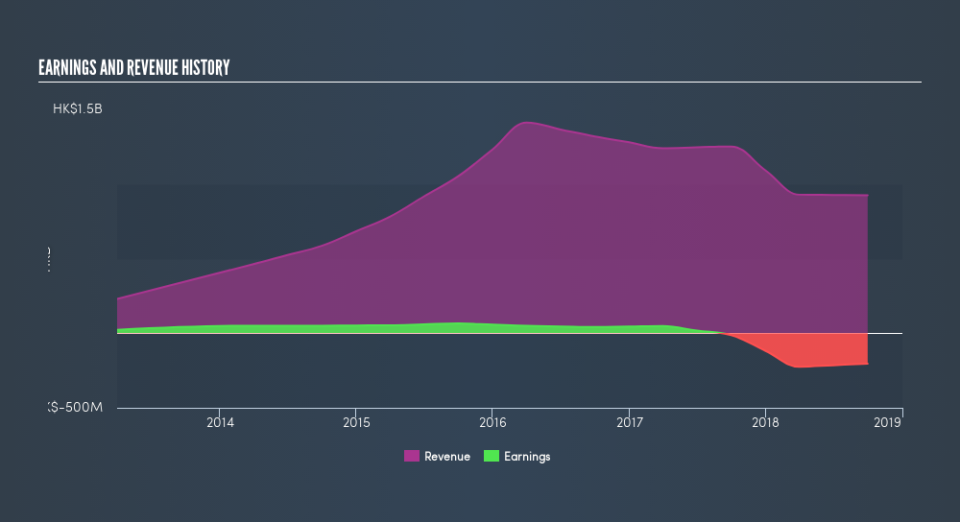

New Concepts Holdings's revenue didn't grow at all in the last year. In fact, it fell 26%. That's not what investors generally want to see. The share price drop of 69% is understandable given the company doesn't have profits to boast of. Fingers crossed this is the low ebb for the stock. We don't generally like to own companies with falling revenues and no profits, so we're pretty cautious of this one, at the moment.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. This free interactive report on New Concepts Holdings's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

The last twelve months weren't great for New Concepts Holdings shares, which performed worse than the market, costing holders 69%. The market shed around 13%, no doubt weighing on the stock price. Shareholders have lost 22% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Warren Buffett famously said he likes to 'buy when there is blood on the streets', he also focusses on high quality stocks with solid prospects. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

New Concepts Holdings is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.