Did Changing Sentiment Drive Costa Group Holdings's (ASX:CGC) Share Price Down A Worrying 60%?

Taking the occasional loss comes part and parcel with investing on the stock market. And there's no doubt that Costa Group Holdings Limited (ASX:CGC) stock has had a really bad year. The share price has slid 60% in that time. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 15% in three years. Shareholders have had an even rougher run lately, with the share price down 23% in the last 90 days.

View our latest analysis for Costa Group Holdings

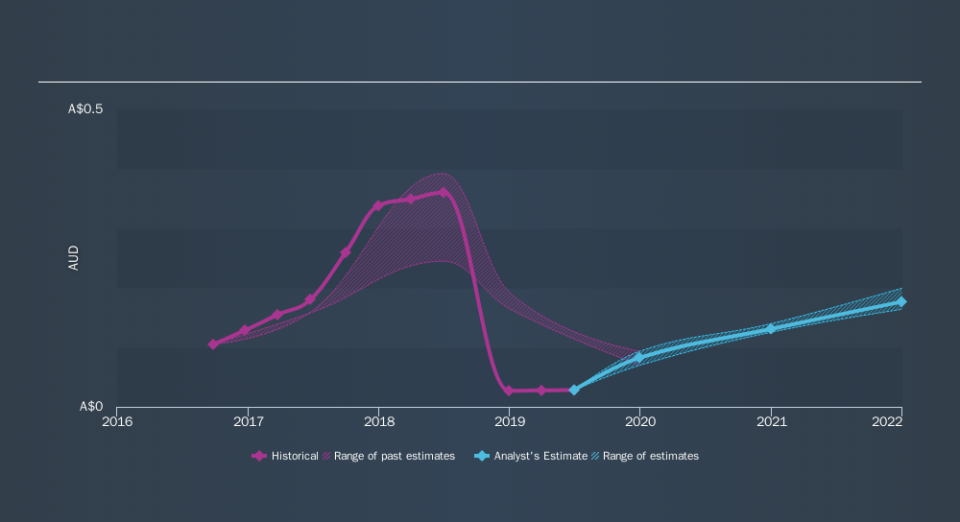

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Unhappily, Costa Group Holdings had to report a 92% decline in EPS over the last year. This fall in the EPS is significantly worse than the 60% the share price fall. So the market may not be too worried about the EPS figure, at the moment -- or it may have expected earnings to drop faster. Indeed, with a P/E ratio of 97.21 there is obviously some real optimism that earnings will bounce back.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. It might be well worthwhile taking a look at our free report on Costa Group Holdings's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Costa Group Holdings's TSR for the last year was -58%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

The last twelve months weren't great for Costa Group Holdings shares, which cost holders 58% , including dividends , while the market was up about 23%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 2.0% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.