Did Changing Sentiment Drive Gujarat Pipavav Port's (NSE:GPPL) Share Price Down A Worrying 55%?

Investing in stocks inevitably means buying into some companies that perform poorly. But the long term shareholders of Gujarat Pipavav Port Limited (NSE:GPPL) have had an unfortunate run in the last three years. Unfortunately, they have held through a 55% decline in the share price in that time. There was little comfort for shareholders in the last week as the price declined a further 2.1%.

Check out our latest analysis for Gujarat Pipavav Port

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Although the share price is down over three years, Gujarat Pipavav Port actually managed to grow EPS by 1.3% per year in that time. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or else the company was over-hyped in the past, and so its growth has disappointed.

After considering the numbers, we'd posit that the the market had higher expectations of EPS growth, three years back. But it's possible a look at other metrics will be enlightening.

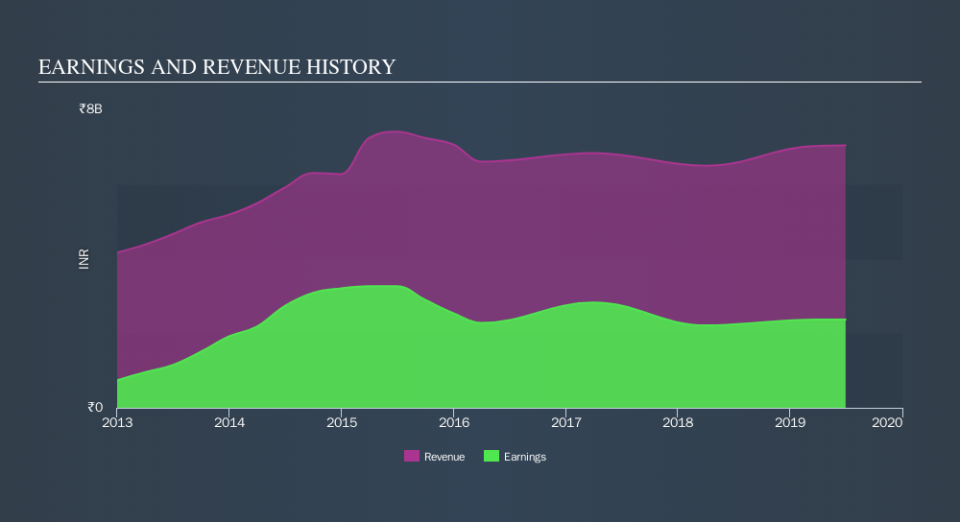

Given the healthiness of the dividend payments, we doubt that they've concerned the market. Revenue has been pretty flat over three years, so that isn't an obvious reason shareholders would sell. A closer look at revenue and profit trends might yield insights.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Gujarat Pipavav Port is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Gujarat Pipavav Port's TSR for the last 3 years was -50%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Investors in Gujarat Pipavav Port had a tough year, with a total loss of 19% (including dividends) , against a market gain of about 2.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Importantly, we haven't analysed Gujarat Pipavav Port's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

We will like Gujarat Pipavav Port better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.