Did Changing Sentiment Drive Hong Kong Food Investment Holdings's (HKG:60) Share Price Down By 31%?

For many investors, the main point of stock picking is to generate higher returns than the overall market. But the risk of stock picking is that you will likely buy under-performing companies. Unfortunately, that's been the case for longer term Hong Kong Food Investment Holdings Limited (HKG:60) shareholders, since the share price is down 31% in the last three years, falling well short of the market return of around -3.7%. The falls have accelerated recently, with the share price down 11% in the last three months. Of course, this share price action may well have been influenced by the 16% decline in the broader market, throughout the period.

Check out our latest analysis for Hong Kong Food Investment Holdings

Because Hong Kong Food Investment Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over three years, Hong Kong Food Investment Holdings grew revenue at 1.5% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. Indeed, the stock dropped 12% over the last three years. If revenue growth accelerates, we might see the share price bounce. But the real upside for shareholders will be if the company can start generating profits.

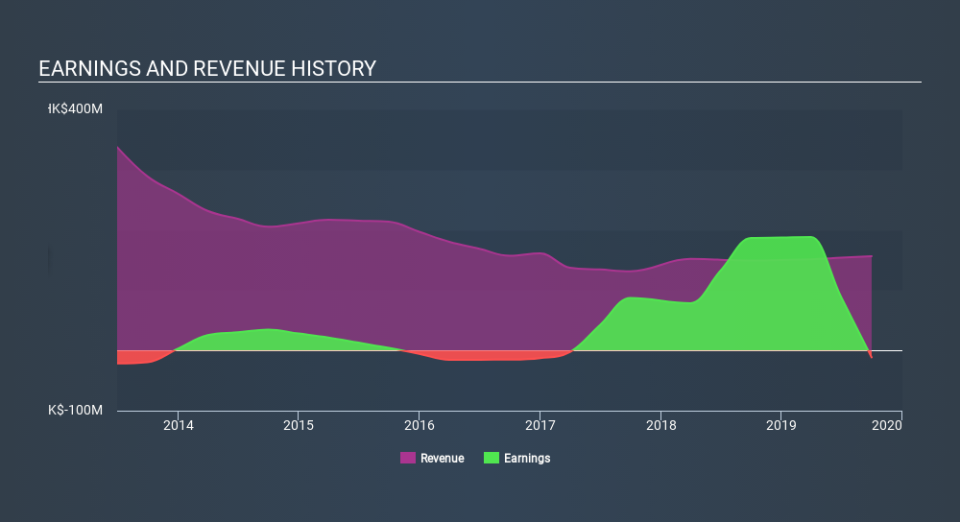

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Hong Kong Food Investment Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While it's certainly disappointing to see that Hong Kong Food Investment Holdings shares lost 12% throughout the year, that wasn't as bad as the market loss of 19%. Given the total loss of 5.8% per year over five years, it seems returns have deteriorated in the last twelve months. Whilst Baron Rothschild does tell the investor "buy when there's blood in the streets, even if the blood is your own", buyers would need to examine the data carefully to be comfortable that the business itself is sound. It's always interesting to track share price performance over the longer term. But to understand Hong Kong Food Investment Holdings better, we need to consider many other factors. Take risks, for example - Hong Kong Food Investment Holdings has 1 warning sign we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.