Did Changing Sentiment Drive Mota-Engil SGPS's (ELI:EGL) Share Price Down By 35%?

Ideally, your overall portfolio should beat the market average. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term Mota-Engil, SGPS, S.A. (ELI:EGL) shareholders for doubting their decision to hold, with the stock down 35% over a half decade. The good news is that the stock is up 2.0% in the last week.

Check out our latest analysis for Mota-Engil SGPS

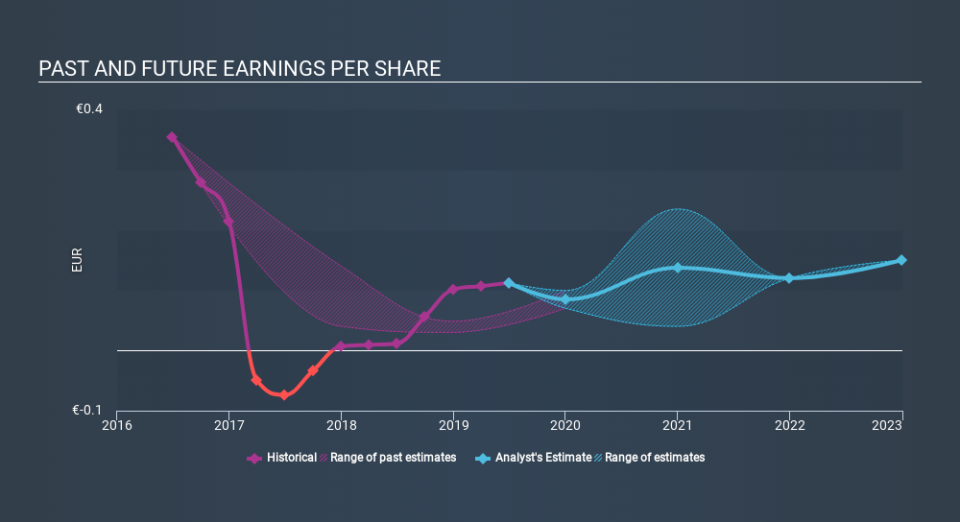

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years over which the share price declined, Mota-Engil SGPS's earnings per share (EPS) dropped by 18% each year. The share price decline of 8.1% per year isn't as bad as the EPS decline. So investors might expect EPS to bounce back -- or they may have previously foreseen the EPS decline.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Mota-Engil SGPS has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Mota-Engil SGPS the TSR over the last 5 years was -23%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Mota-Engil SGPS shareholders gained a total return of 11% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 5.0% endured over half a decade. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Mota-Engil SGPS better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with Mota-Engil SGPS (including 1 which is makes us a bit uncomfortable) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PT exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.