Did Changing Sentiment Drive NSL's (SGX:N02) Share Price Down By 36%?

For many, the main point of investing is to generate higher returns than the overall market. But the main game is to find enough winners to more than offset the losers At this point some shareholders may be questioning their investment in NSL Ltd (SGX:N02), since the last five years saw the share price fall 36%. The good news is that the stock is up 1.9% in the last week.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for NSL

NSL isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

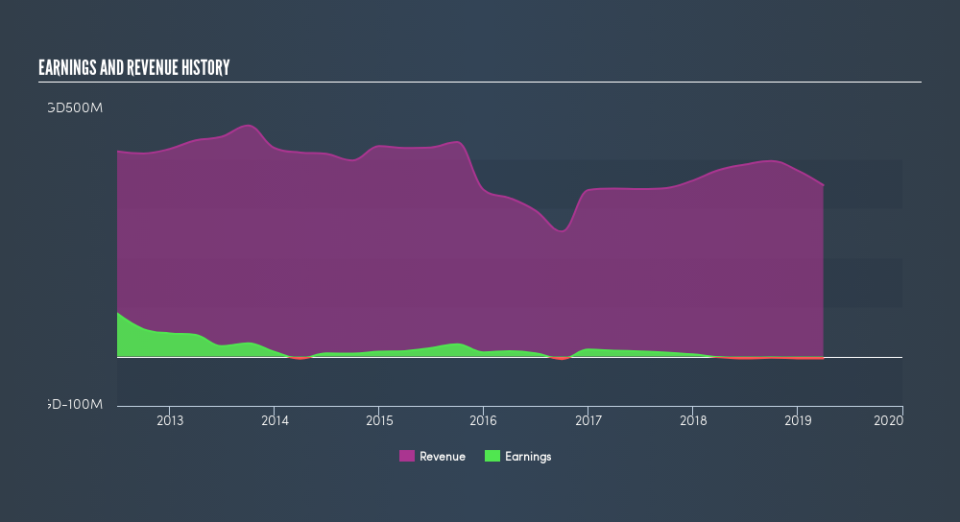

Over half a decade NSL reduced its trailing twelve month revenue by 3.0% for each year. While far from catastrophic that is not good. The share price decline at a rate of 8.6% per year is disappointing. Unfortunately, though, it makes sense given the lack of either profits or revenue growth. It might be worth watching for signs of a turnaround - buyers are probably expecting one.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

If you are thinking of buying or selling NSL stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of NSL, it has a TSR of -12% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We regret to report that NSL shareholders are down 12% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 5.2%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2.6% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before forming an opinion on NSL you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.